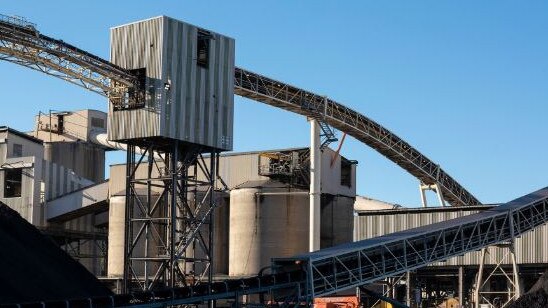

South32 slashes the value of Illawarra coal mines after IPC rejects extension plans

South32 has cut the value its Illawarra coal assets after failing to win approval for a major extension of the NSW mine, putting thousands of jobs at risk.

South32 has slashed the value of its Illawarra coal assets in half, cutting $1bn from the book value after failing to win approval for a major extension of a mine earlier this year.

The company has said more than 2000 jobs are in jeopardy if it does not win the right to extend the life of the Dendrobium mine, and on Wednesday it flagged a $US728m ($1bn) writedown on the value of the operations as it considers its options for their future.

Its full-year accounts, released in August last year, put the value of the net operating assets at Illawarra at $US1.36bn.

South32 said it had scaled back work on the Dendrobium expansion project as it considered alternatives to its original plans, after the NSW Independent Planning Commission knocked back its application to extend the life of the mine in early February, putting more than 200 jobs in jeopardy, according to the company.

South32 applied for a judicial review of the IPC decision with the NSW Land and Environment Court in March, and on Wednesday said it was still considering whether to submit alternative mine plans to the NSW planning minister for review as a project of state significance.

The company said it expected to have clarity on the future of the assets by the end of the year, but the uncertainty created by the IPC decision had forced it to review the assets’ carrying value.

“This charge reflects the increased approval uncertainty created by the NSW Independent Planning Commission’s decision to refuse our application for the Dendrobium Next Domain life extension project and the resultant potential impact on the economics of the broader IMC complex,” the company said.

South32 has previously said the rejection of its mine life extension plans risks the future of about 2000 jobs in the Illawara region if an alternative is not found.

The extension would take the life of the operations out to about 2048, and allow the extraction of another 78 million tonnes of coking coal.

The writedown comes as South32 reported a strong quarter of production across its global mining operations, according to chief executive Graham Kerr.

“During the year we achieved production records at Worsley Alumina, Brazil Alumina and Australia Manganese,” he said.

“At South Africa Manganese volumes increased by 21 per cent, following COVID-19-related impacts in the prior year. Our base metals operations, Cannington and Cerro Matoso, both finished the year strongly, achieving 20 per cent and 54 per cent increases in zinc equivalent and nickel production volumes respectively during the June quarter.”

Coal sales from Illawara lifted 9 per cent for the year, to 7.65 million tonnes, although the company said the production of coking coal fell sharply in the June quarter, down 15 per cent to 1.77 million tonnes, as it hit geological challenges at the operations.

South32’s revenue line was hit by China’s bans on Australian coal, with average received prices for its coking coal off 21 per cent for the year to an average $US115 a tonne.

But South32 benefited from rising base metals prices, with average nickel prices up 12 per cent for the year to $US6.68 a pound, lead up 13 per cent to $US1862 a tonne, and zinc up 66 per cent to an average $US2357 a tonne.

South32 shares closed up 3c to $2.84 on Wednesday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout