South32 shuffles management as share buybacks resume

South32 has reinstated its share buyback program as it continues its senior management reshuffle.

South32 has reinstated its share buyback program in a sign it believes its core markets as stabilising, as the company continues its reshuffle among the ranks of senior management.

South32 suspended its on-market buyback program in march as global markets tumbled as the coronavirus crisis hit, and chief executive Graham Kerr has said the company would not resume the program until it was confident it had built enough cash on its balance sheet to withstand any further market hiccups.

The company released its September quarter production report on Monday, saying it had built its net cash position by $US70m through the quarter, to $US368m at the end of September, despite the effects of the coronavirus pandemic on its markets.

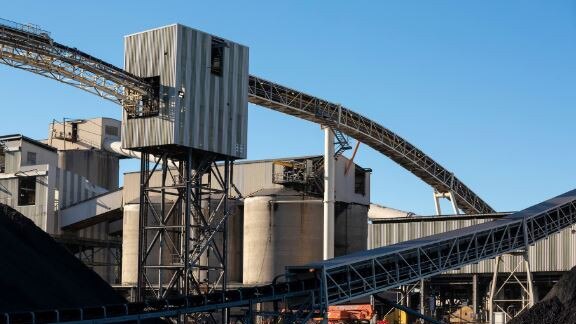

South32 said the return of its South African manganese operations from pandemic movement restrictions helped lift manganese ore output by 19 per cent compared to the June quarter, to $1.46 million tonnes, with both metallurgical and thermal coal production both up by 20 per cent.

Mr Kerr said South32 expected to resume the remaining $US121m portion of its share buyback shortly.

“With another quarter of strong operating performance behind us and the further strengthening of our financial position, we have lifted the suspension of our on-market share buyback. Our capital management program has $US121 million remaining and recommencing or buybacks will deliver immediate value to our shareholders,” he said.

Mr Kerr also continued the reshuffle of his senior management team, following the departure of joint chief operating officer Paul Harvey in June.

Chief technical officer Vanessa Torres will also take control of the company’s health, safety and environmental responsibilities, with chief commercial officer Brendan Harris taking charge of human resources.

South32 will also promote corporate affairs vice president Kelly O’Rourke to its leadership team in the newly created role of chief external affairs officer.

As part of what Mr Kerr described as the “continued simplification of the group’s functional structures”, chief sustainability officer Rowena Smith and chief people and legal officer Nicole Duncan will depart the company.

South32 said it would also be downsizing its London and Singapore offices as it searches for another $US50m in ongoing savings across its operations.

The company maintained production guidance across all of its global operations, Mr Kerr said,

South32 shares closed up 4.3 per cent at $2.20.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout