South32 set to walk away from Eagle Downs coal project

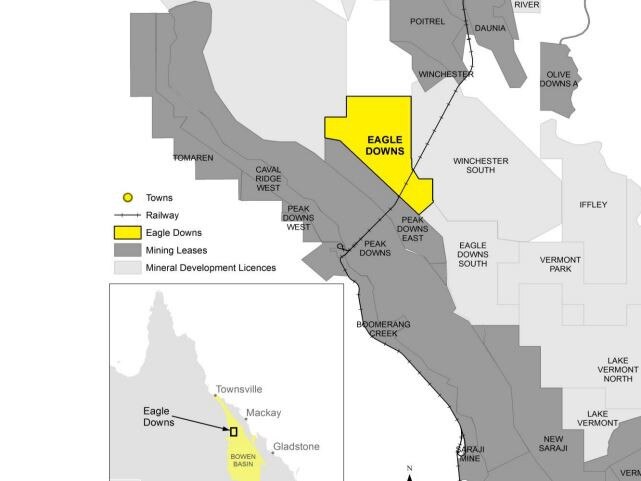

South32 is set to walk away from the Eagle Downs coal project in Queensland, but it’s understood its Chinese partner is still keen.

South32 is set to walk away from its half-owned Eagle Downs metallurgical coal project in Queensland as the mining major edges further away from the coal business.

South32 bought half of the Eagle Downs coking coal project from Brazil’s Vale in 2018, paying $US106m ($148m) upfront and agreeing to deferred payments worth another $US27m.

At the time South32 chief executive Graham Kerr said the mine – already fully permitted and partially built by its previous owners, but mothballed in 2015 when coal prices fell and a major contractor went bust – was an “attractive development option” to add to South32’s coking coal operations.

But it is understood South32 is set to announce it will not pursue development of the $1.5bn project, after considering the results of a feasibility study delivered last year. It is now believed to be considering options for the sale of its share of the project.

The other half of Eagle Downs is owned by Chinese steelmaking giant Baowu, which acquired its stake through the $1.4bn takeover of Aquila Resources in 2014. At the time of the takeover Aquila said it would cost about $1.5bn to complete development of the mine.

Mr Kerr had previously flagged South32’s diminishing interest in the project, telling analysts after the company’s annual financial results that he was not “super excited” about the likely returns from building a new metallurgical coal mine in Queensland’s Bowen Basin, but the company would make a final decision after feasibility studies were delivered in early 2021.

“To date I haven’t seen enough financial attractiveness to say we’d want to invest in it, but the study is not finished,” he said.

“My indication was that in the short term the met coal price is under some pressure, some other projects are getting built, the returns I’ve initially seen don’t super-excite us – but there’s still time for that to be finalised. I’m slightly pessimistic but if the team can demonstrate it generates the kind of returns we’re looking for, we’ll look at it.”

The metallurgical coal price has since plunged on the back of China’s bans on the import of Australian coal, although short-term pricing is not believed to have played a major role in South32’s final decision.

It is believed Baowu is still keen on the project, although it is not clear whether the Chinese steelmaker would seek to buy South32’s share and go it alone.

Baowu’s project website says the Eagle Downs feasibility study pointed to a low cost operation producing high quality coal. It tips average production of 5.2 million tonnes of low volatile hard coking coal from an underground mine, at an average operating cost of about $71 a tonne – which the company says would put it in the lowest quartile of coking coal mines on a cost basis.

South32’s decision is likely to leave Baowu in a tricky position with regards to Eagle Downs, with the Chinese steel giant still believed to be exposed to take or pay contracts that require it to pay for rail and port capacity in Queensland regardless of whether it is shipping coking coal.

Mr Kerr told reporters in August South32 had structured its acquisition of its half of Eagle Downs in such a way it was not exposed to paying for a project if it did not decide to invest further in the mine.

South32’s decision comes as it awaits approval from the NSW Independent Planning Commission to extend its Dendrobium mine at its Illawarra metallurgical coal hub.

The extension would take the mine further beneath Sydney’s water catchment zone and has been stiffly opposed by both environmental groups and by the state’s water authority, which submitted a stinging criticism of South32’s proposal to the IPC in mid-December, accusing the company of consistently underestimating the volume of water losses through the catchment due to the operations of the underground mine.

Although South32 has offered to fund more than $100m in water catchment offsets, to be spent on water conservation measures or capital works to improve Sydney’s overall water supply, WaterNSW said even South32’s estimate of 3.3 gigalitres worth of water losses a year would be “unacceptable”, and that actual losses could be even greater.

“WaterNSW considers that it is possible that surface water losses could be up to double those that have been assessed, in the order of 6-7 GL/year. This would clearly have major implications for the proposed compensation package,” its submission said.

A spokesman for South32 said the company took its “environmental responsibilities seriously and we understand the sensitivities of working within the Metropolitan Special Area”.

“The Dendrobium Mine Extension Project has been designed to minimise impacts on the local environment and we are committed to long-term detailed monitoring and mitigation measures before, during and after mining,” he said.

“We will not mine beneath dams, named watercourses or key stream features. South32 will also contribute to works that have a positive impact on catchment water quality, including fire management, road maintenance and restricting unauthorised access to catchment land.”

South32 shares closed up 2c, or 1.2 per cent, to $2.59 on Monday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout