South32 lifts cost outlook amid fuel price pressures

South32 has joined a growing list of major miners warning of rising cost pressures.

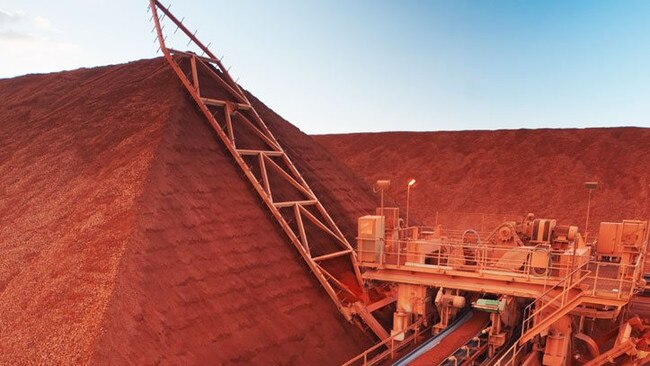

Cost pressures have hit mining major South32, with the miner lifting cost guidance across a range of its global operations, citing the weakening US dollar and rising freight and fuel costs.

South32 released its March quarter production report on Tuesday, saying output had lifted across a number of key assets in the forest nine months of the financial year, with production up 6 per cent at its Cannington base metals mine in Queensland, and nickel output up 33 per cent at its Cerro Matoso mine.

The company’s Illawara metallurgical coal mines produced 42 per cent more in the March quarter, despite the impact of wet weather and Covid-19 in NSW.

But South32 joined other mining majors in expressing concerns about cost pressures saying freight and fuel costs, as well as a weaker US dollar, would send its costs up 3 per cent to 15 per cent compared to its previous guidance – with higher received prices also playing a part as they flow through to royalties paid to the governments of the countries in which South32 operates.

South32 said expected costs at its Worsley alumina operations would now likely come in at an average $US265 a tonne, compared to earlier guidance of $US257 a tonne – although the company said annual output at Worsley is now likely to come it ahead of nameplate capacity for the full financial year at about 3.97 million tonnes.

Costs at its Brazilian aluminium operations are expected to rise 5 per cent compared to the previous financial year, with its costs in South Africa and Mozambique likely to 10 to 15 per cent.

Similarly, costs will likely rise at Cannington, Illawarra and South African manganese operations.

Like other major commodity producers, South32 said it was struggling with supply chain issues and tight freight markets, with the company having to find new ways to ensure delivery of its products to customers.

“Working capital remains elevated across the business, due to higher prices and the ongoing impact of logistics congestion on our supply chains, slowing the movement of inventory at a number of operations,” the company said.

“In our aluminium value chain, where this is most acute, we have responded by establishing alternative shipping solutions and points of dispatch to move inventory closer to our customers. While we expect the build in working capital to partially unwind once port congestion and freight market tightness alleviates, and we realise the full benefit of initiatives implemented across our business, we continue to observe volatility in supply chains.”

South32 shares closed down 38c, or 7.9 per cent, at $4.46 on Tuesday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout