Snowy Hydro pushes gas plant to bridge looming coal gap

Snowy Hydro has released a long-awaited business case for its NSW facility which aims to start firing gas into the market by the end of 2023.

Snowy Hydro says its controversial $600m gas plant can cover renewable “droughts” and turn a profit when coal plants close, providing an insurance policy for the market and avoiding a repeat of price spikes when big generators exit the power grid.

The government-owned power player, also developing a major expansion of its Snowy hydro scheme, has released a long-awaited business case for its facility which aims to start firing gas into the market by the end of 2023, offsetting the closure of AGL’s Liddell coal power station.

Its critics have railed against the facility, concerned by Commonwealth intervention in energy markets, questions over its commercial viability – given it may only run for 2 per cent of the time – and debate over the size of a supply gap once Liddell closes, after the government insisted an extra 1000 megawatt injection was needed.

AGL this week also blamed Snowy’s gas plant as a key reason for not pushing ahead with its own planned gas station, also in Newcastle.

However, Snowy expects an internal rate of return of 12.3 per cent under its base case scenario, factoring in transmission synergies and capacity deals that provide buyers with hedges against volatile electricity prices.

The lowest return expected would be 8.3 per cent, depending on market pricing and the potential for any cost overrun in building the $600m project.

Snowy said the 660MW project was aimed at boosting intermittent solar and wind supplies and filling in a market gap once Liddell exits in the 2022-23 summer.

“If there’s a big drought across the eastern seaboard and there’s low wind and low solar, that plant is going to run like the clappers,” Snowy chief commercial officer Gordon Wymer said.

A $32bn plan by the NSW government to underwrite investment in 12GW of renewables, released after the business case was compiled, will also boost the economics of the plant, according to Snowy.

“This initiative, to whatever extent it is eventually implemented, would put a further premium on firm, flexible, dispatchable capacity.

“This would produce a material value uplift for the project and for any other proponents of open cycle gas turbine plants in the national electricity market,” Snowy said in its business case.

Snowy said it was still mindful of the abrupt closure of the Hazelwood brown coal-fired power plant in Victoria in 2017, which caused turmoil in the national electricity market.

“The shutdown of Liddell has the potential to create a repeat of the effects of the Hazelwood closure,” it said.

“A new gas plant, built by Snowy Hydro, represents an insurance policy for safeguarding system security and managing the national electricity market supply and demand balance.”

Sending first gas into the grid by late 2023, Snowy is expected to be the first to market, ahead of a rival gas plant being planned by billionaire Andrew Forrest in NSW’s Port Kembla – which is also backed by the Morrison government through $30m in budget funding.

“We’ve gone through this forensically so we would guess we would be in front, but you never know,” Snowy chief executive Paul Broad said.

Scott Morrison told companies to commit 1000MW of new supply by the April 30 deadline or it would build its own 650MW plant via Snowy at Kurri Kurri in NSW’s Hunter Valley.

EnergyAustralia subsequently committed to expand its existing Tallawarra gas power plant in NSW’s Illawarra with a 350MW facility even as debate swirled over how much extra supply was warranted once the 1680MW Liddell exited.

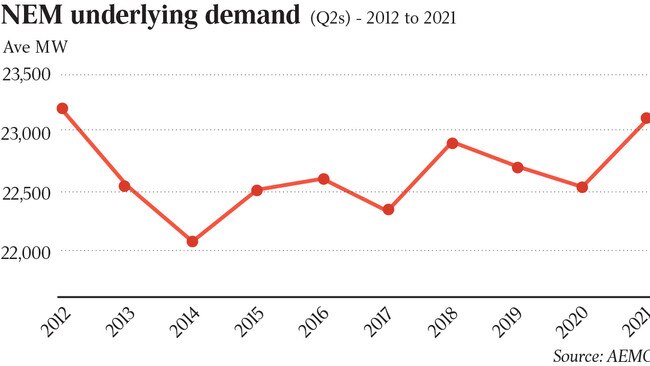

Official forecasts by the Australian Energy Market Operator only indicate a shortfall of less than 200MW.

Still, the government’s Liddell Taskforce found closing the AGL plant without the required dispatchable replacement capacity risked prices rising by around 30 per cent over two years, or $20 per megawatt hour to $80 in 2024 and up to $105 per megawatt hour by 2030.

An increasing number of experts also now predict more coal plants will exit the grid ahead of planned retirement dates as the power stations struggle to compete with renewables.

NSW electricity grid owner TransGrid this week crunched six scenarios for the nation’s energy sector out to 2050, and found coal plants could be forced out of the grid up to 16 years early despite accounting for 70 per cent of supply currently.

Snowy said a renewables-based system backed up by gas and pumped hydro could ultimately meet demand and emissions reduction goals and more gas plants would be needed in the transition away from coal.

“Wind and solar, firmed by open cycle gas turbines, storage hydro and batteries, promises to solve the trilemma of least-cost, least-CO2, reliable energy production in the national electricity market,” Snowy said in its business case.

“The project is considered by Snowy Hydro as a meaningful step in that direction, noting that many more gas plants will need to be built in the market to underpin the decarbonisation trajectory that is now a clear goal of governments, commercial and industrial customers, and mums and dads end users.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout