Senex shares hit multi-year high after third, $815m, bid from steel giant POSCO International

The oil and gas producer’s shares hit record highs on POSCO’s new $815m offer, but it’s looking for even more.

Senex shares surged almost 15 per cent to seven-year highs on Monday after South Korean steelmaker POSCO’s international arm upped its bid for the local oil and gas player to $815m.

Following previous takeover offers of $4 and $4.20 per share, Senex told the ASX that the $3.2bn POSCO International had secured an extended period of exclusive due diligence with a new $4.40 offer — and indicated that it will hold out for more.

“Following further discussions between the parties, Senex has now agreed to extend POSCO International’s exclusivity period to November 5, 2021, in order to provide POSCO International with additional time to assess a further revised proposal at a price higher than $4.40 per share,” Senex said.

“The Senex board believes it is in the best interests of its shareholders to continue to engage with POSCO International and will assess any proposal received on its merits.”

The news sent shares in Senex, which operates in Queensland’s Surat Basin and South Australia’s Cooper Basin up by 14.9 per cent to $4.39, a price not seen since October of 2014.

It came after Senex shares hit a daily high of $4.41, in excess of the revised offer price.

Wood Mackenzie analyst Michael Song said the bid could become Australia’s largest upstream takeover since the $US2.1bn Santos-Quadrant tie-up in 2018.

“An acquisition of Senex provides POSCO with exposure to Australia’s east coast gas market at an opportune time,” he said. “The Australian east coast supply demand outlook is precariously balanced, and a lack of new supply sources is expected to lead to rising prices.”

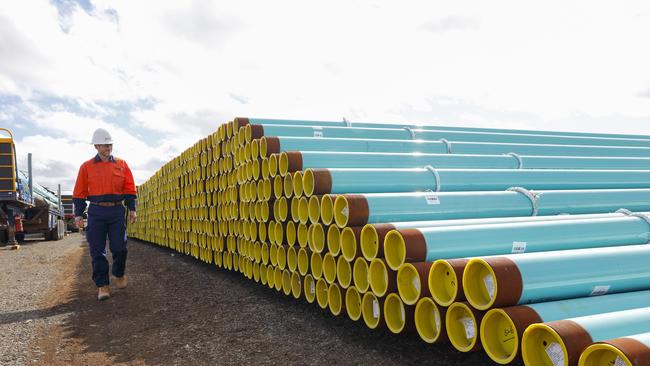

Senex’s production focus is on gas from Queensland’s Surat Basin, where it is expecting a rapid growth in output and revenue as production ramps up from its Roma North and Atlas gas projects.

Its share price has lifted more than 20 per cent since POSCA made its first approach at the end of July, outpacing the S&P/ASX200’s energy index 14 per cent gain and a 11 per cent increase in the price of brent crude oil.

Senex said the revised offer represented a 19 per cent premium to its 30 day volume-weighted average price as of October 15.

POSCO International has indicated that if a deal occurs, it would be implemented through an off-market takeover which would be subject to a 50.1 per cent minimum acceptance condition and the assent of the Foreign Investment Review Board.

JP Morgan analyst Mark Busuttil said the offer price looked “fair” but “not full,” with a chance another interested party could come to the table.

“We believe there could be other domestic or international parties potentially interested in the assets,” he wrote in a client note.

“Beach (Energy) has distanced itself from Queensland CSG assets but could be an interested party, while the large LNG exporters may also be interested in increasing reserves through Senex.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout