Santos to buy ConocoPhillips LNG assets for $US1.4bn

Santos says it will buy ConocoPhillips’s stakes in assets in northern Australia for $US1.4bn.

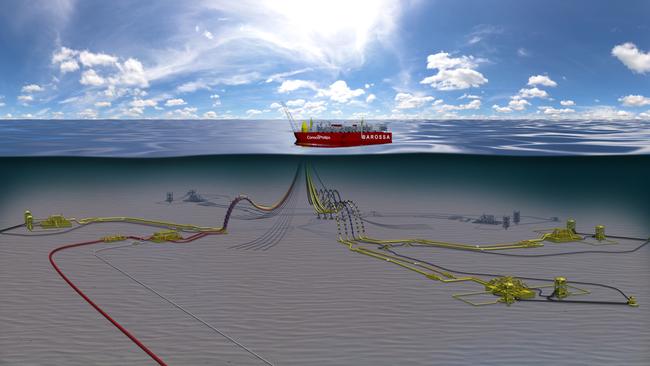

Santos says it will buy ConocoPhillips’s stakes in assets in northern Australia for $US1.39 billion, plus a further $US75 million contingent on a final investment decision being taken on the Barossa natural gas project.

ConocoPhillips is selling the operations as it seeks to shift capital to other projects it believes will generate the highest longer term value.

The assets being bought by Santos include ConocoPhillips’s controlling stake in the Darwin LNG gas-export project and cover production of about 50,000 barrels of oil equivalent a day and proved reserves of about 39 million barrels as of the end of 2018.

The deal with Santos covers ConocoPhillips’s 56.9 per cent interest in the Darwin liquefied natural gas facility and the Bayu-Undan field that feeds it, a 37.5 per cent stake in the Barossa gas project, its 40 per cent in the Poseidon field and 50 per cent in the Athena field.

ConocoPhillips said it will hold on to its 37.5 per cent stake in the Australia Pacific LNG project on Australia’s east coast, and will remain the operator of the project’s LNG facility.

Proceeds from the sale to Santos, which may include an additional US$75 million contingent on a final investment decision being taken on the Barossa project, will be used for general corporate purposes, ConocoPhillips said.

For Santos, one of Australia’s largest independent oil and gas producers, the assets it is picking up will lift its earnings per share by about 16 per cent in 2020 and increase pro-forma production by about 25 per cent, it said.

Santos already is a partner of ConocoPhillips in the north, and has an 11.5 per cent stake in the Darwin LNG project’s infrastructure and a 25 per cent interest in the Barossa development that is set to supply the LNG operation in the future.

Santos said it expects a final investment decision on the roughly $US4.7 billion Barossa project early next year, with first LNG anticipated in 2024. The gas from the Barossa field is expected to extend the life of the Darwin LNG operation by more than 20 years.

The Australian reported in August that Santos was eyeing the ConocoPhillips stakes.

Santos CEO Kevin Gallagher said buying the assets “fully aligns with Santos’ growth strategy to build on existing infrastructure positions while advancing our aim to be a leading regional LNG supplier”.

“This acquisition delivers operatorship and control of strategic LNG infrastructure at Darwin, with approvals in place supporting expansion to 10 mtpa, and the low cost, long life Barossa

gas project.

“These assets are well known to Santos. It also continues to strengthen our offshore operating and development expertise and capabilities to drive growth in offshore northern and Western Australia.”

“Santos is also committed to be Australia’s leading domestic gas supplier and we will be pursuing domestic gas opportunities in the Northern Territory from our broader northern Australia gas portfolio where we have significant resource potential both onshore and offshore.”

The deal adds to other asset-exits agreed by ConocoPhillips in recent months, including an agreement in April to sell two subsidiaries focused on production in the UK’s North Sea for about $US2.68 billion in cash.

Also in April, the company closed the sale of its 30 per cent interest in the Greater Sunrise gas-fields to the government of East Timor for $US350 million.

ConocoPhillips has been divesting some of resources and focusing in part on projects in Alaska and Louisiana, as well as in Canada and Asia. Asia Pacific and the Middle East together are the second-largest segment in ConocoPhillips portfolio by production, and include the assets in Australia as well as producing fields in China, Indonesia, Malaysia and Qatar.

Dow Jones Newswires

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout