Santos takes $US139m hit from lower reserves

Santos has been hit by a further writedown in a blow that takes its total annual impairments to $1.15bn.

Santos has been hit by a further writedown in a blow that takes its total annual impairments to $US895m ($1.15bn), after lowering the size of a gas field in Western Australia.

The $US139m writedown was triggered due to lower levels of gas reserves at its Reindeer gas field in WA and Juha field in Papua New Guinea.

The Adelaide-based energy producer said it would take a $US98m impairment of goodwill after lowering Reindeer reserves by 27m barrels of oil equivalent after water started to be produced earlier than expected.

A further $US41m per-tax charge has also been taken on unnamed late-life, exploration and evaluation assets.

After previously flagging a $US756m hit last August due to lower oil prices, Santos will take a pre-tax impairment of $US895m at its annual results this Thursday, or $US653m after tax.

“The expected impairment charges will be excluded from underlying earnings and are subject to finalisation of the full-year accounts, auditor processes and board approval,” Santos noted.

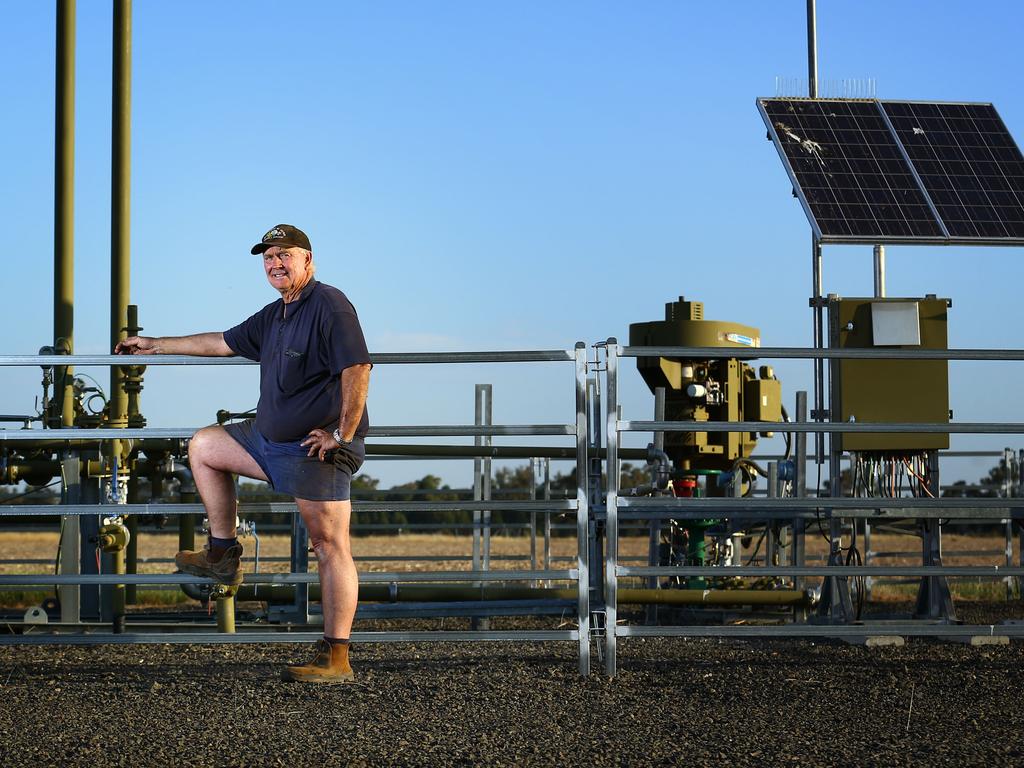

Santos gained its hold on the Reindeer field through the blockbuster Quadrant deal in 2018.

Overall, Santos reported 933m boe of proved plus probable reserves at the end of 2020, an increase of 34m boe before production.

Santos confirmed a final investment decision will be made on its Barossa project in Northern Australia in the first half of 2021, which would see 380m boe commercialised to proven and probable reserves, known as 2P in the industry.

The producer hit the top end of upgraded guidance in January, delivering record annual production of 89 million barrels of oil equivalent, up 18 per cent on 2019.

Quarterly production was up 1 per cent on the prior quarter, while guidance for the current calendar year is for production of 84-91m boe and sales of 98-105m boe.

Santos came out ahead of its upcoming annual meeting to say it won’t be getting out of oil and gas any time soon, despite a request from a tiny group of activist shareholders.

Its shares rose 1.3 per cent to $6.90.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout