Santos’ Kevin Gallagher seeks bipartisan political support for a decade-long energy plan

Santos managing director Kevin Gallagher says a concerted climate plan looking 10 years ahead is needed, as he announced a significant dividend increase.

An end to the “climate wars” needs bipartisan agreement on an energy plan stretching more than a decade into the future, with gas a crucial component of that, Santos managing director Kevin Gallagher says.

In contrast, Australia faces a situation where investors are unable to invest or have price certainty, potentially indefinitely, given the government’s flagged intention to intervene in the market beyond the $12 per gigajoule emergency price cap implemented late last year, he said.

While unveiling a record profit result and a 78 per cent spike in the final dividend payment to Santos shareholders, Mr Gallagher said Australia, and the world, would need “more, not less” gas in coming years.

But he told The Australian that international investors were wary, given the amount of “noise” around issues such as the flagged proposal to develop a “reasonable pricing framework” for domestic gas, to be administered by the Australian Competition and Consumer Commission.

“All that noise is causing investors to really hold back and consider investing in other environments,’’ Mr Gallagher said.

“The quicker we can settle everything down, resolve all the different interventions for lack of a better term, resolve them and get back to a stable fiscal, operating and regulatory environment the better.’’

Mr Gallagher said a central price setting regimen would remove the ability for international investors to generate models based on commodity price forecasts, which the industry was used to relying on.

“Now we’ve got this black hole of the ACCC which is going to set the price based on what they determine to be a reasonable rate of return,’’ he said.

“If you’re an investor you say ‘well what does that look like? How can I invest in this project when I don’t know what price you’re going to get for your product?’’’

Mr Gallagher said energy projects, which were high risk, could not be priced, or funded, like low-return infrastructure projects.

Mr Gallagher, who in December characterised the federal government’s intervention in energy market pricing as “Soviet-style policy’’, said on Wednesday he believed policymakers were starting to come to their senses.

“What I am pleased about is hearing the PM say recently that we need to recognise the role of gas and AEMO saying in their report over the last few days that gas is critical as part of the energy mix for a stable energy grid going forward and for the transition,’’ Mr Gallagher said.

“I’m hearing the right signals that people are starting to get it, their eyes have been opened.

“But if you want to end the climate wars you can only do that by having a bipartisan energy policy which goes beyond the next decade and I’m saying with confidence it will include gas.

“It has to include gas otherwise you’re not transitioning.’’

Mr Gallagher told an earlier investor call that the need for more gas was a global theme.

“People still need to have access to affordable energy, which requires more gas supply, not less,’’ he said.

“LNG demand is at record levels with under-investment driving significant price increases, as we have seen in Europe, and limiting access to energy for those who can least afford it.

“Asia Pacific LNG demand is expected to double by 2040 according to McKinsey.’’

On the operational front, Santos delivered an “outstanding’’ result, Mr Gallagher told the investor call, with the company boosting its final dividend by 78 per cent after a more than tripling in full year net profit to $US2.1bn.

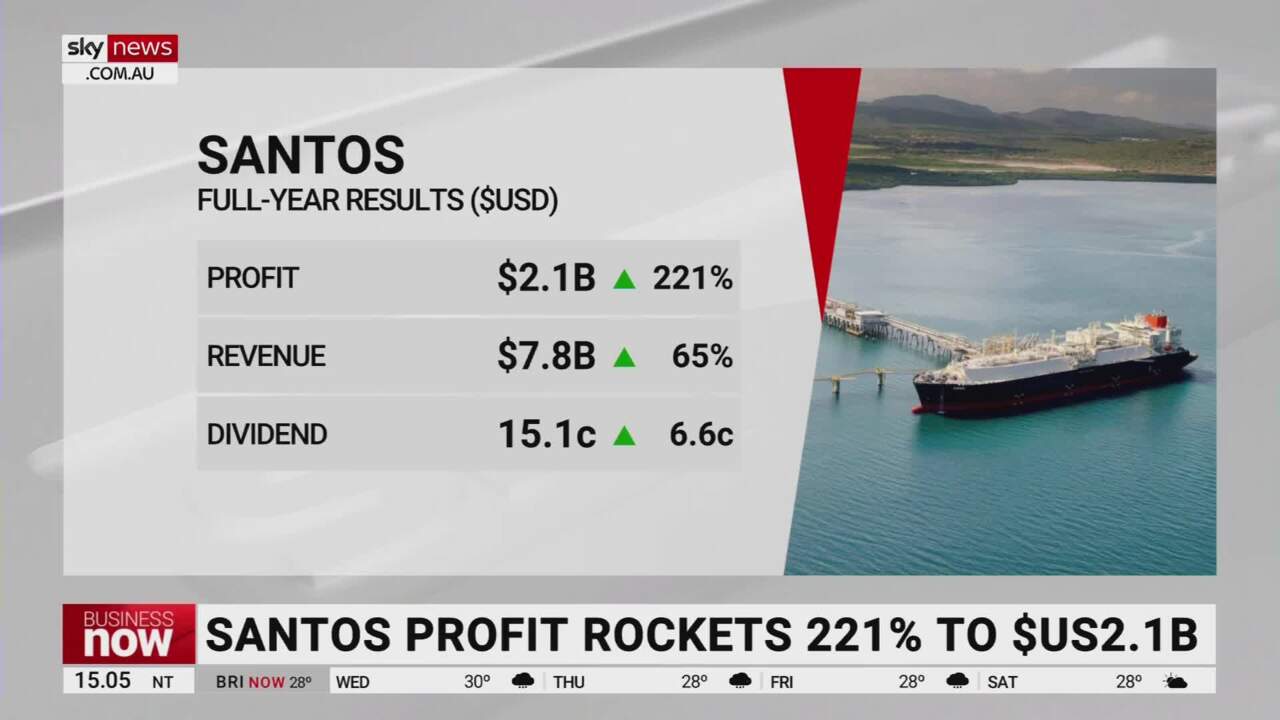

Santos on Wednesday posted an underlying profit of $US2.46bn, up 160 per cent, while the net profit attributable to shareholders was $US2.1bn, up 221 per cent.

The company said it was benefiting from “significantly higher oil and LNG prices” due to stronger global energy demand and a higher interest in PNG LNG following Santos’s merger with Oil Search in late 2021.

Mr Gallagher said the company delivered record production, free cash flow and underlying earnings in 2022.

“Today’s results demonstrate the strength of Santos, with strong diversified cashflows and

capacity to provide sustainable shareholder returns, fund new developments and the transition

to a lower carbon future,” Mr Gallagher said.

“Strong free cash flows mean we are in a position to deliver higher shareholder returns through an increase in the final dividend and previously announced increase in the on-market buyback, consistent with our disciplined capital management framework.

“Demand for our products has remained strong in both Australia and internationally, due to

increased demand and shortages of supply from producing nations because of global

under-investment in new supply sources.

“Our critical fuels not only play a key role in the energy security of Australia and Asia, but they also provide affordable and reliable alternatives to switch from higher emitting fuels.

“We are focused on backfill projects to sustain production of these critical fuels in our core

assets.’’

Santos will pay an unfranked final dividend of US15.1c per share, up from US11.8c per share for the previous corresponding period.

This brings total dividends paid for the full year to US22.7c, or $US755m, up from US14c in 2021 and US7.1c in 2020.

Santos also has an ongoing $US700m share buyback in operation and said $US384m of this had been used by the end of 2022.

The company incurred previously-announced impairment charges of $US224m after tax, losses on commodity hedging and one off costs associated with acquisitions and disposals.

Santos’s average realised oil price was $US110.10 per barrel compared with $US76.1 the previous year and $US47.70 in 2020.

Net debt was reduced by $US1.7bn to $US3.45bn with gearing at 18.9 per cent.

Broker UBS said overall it was a “soft” result.

“The outlook suggests further cost out in the core business is challenged by the high cost environment,’’ UBS said.

“That said, Santos is still a low cost business with a $US34 per barrel free cash flow break-even oil price and every $US10 per barrel in oil lifts free cash flow by about $US400m suggesting strong dividends remain.’’

RBC Capital Markets said the earnings results were a “slight miss’’ on consensus estimates while the final dividend payout was above expectations.

Mr Gallagher’s realised remuneration for 2022 was $7.06m, down from $7.21m, reflecting a lower performance against the company’s incentive scorecard.

Santos, which received a 25.3 per cent first strike vote against its remuneration report at its annual meeting last year, said in its annual report also released on Wednesday that it had engaged widely with shareholders as a result and said it was committed to transparency around executive remuneration.

It also said the board had carefully selected performance targets linked to both the delivery of major projects and emission reduction initiatives.

Santos shares closed 3.1 per cent higher at $7.02.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout