Santos getting its mojo back: CEO Gallagher

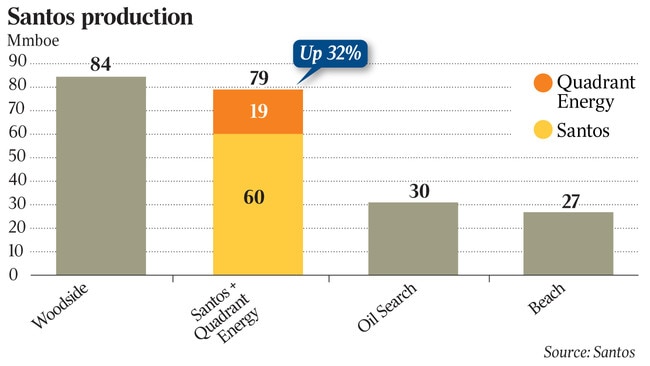

Santos investors have warmed to the Quadrant buyout and the company’s decision to resume dividend payments.

When Kevin Gallagher took the reins as Santos boss in early 2016, he faced the biggest challenge of his career.

With oil trading near record lows at just $US30 a barrel and Santos requiring a price of $US48 a barrel just to break even, the South Australian energy producer was losing more than $US2 million every day.

His first act as chief executive underlined the scale of the turnaround task.

Just three weeks after starting he told shareholders the company had suffered an embarrassing annual net loss of $2.7 billion. The Scottish executive immediately focused on a company-wide reset with investors furious about the loss and a 80 per cent share price rout in the previous 18 months.

“I knew before I came in it was going to be a challenging position,” Mr Gallagher told The Australian. “And it has been. It’s been a tough two years. We’ve all had to take a hard look at the way we did things at the company, some people left the organisation and we’ve had to reshape our business model.”

The decision to sell assets, cut costs and simplify the company into five core areas has dovetailed with the oil price more than doubling under Mr Gallagher’s watch. The scale of the turnaround job sparked a $14bn takeover approach from US-based Harbour Energy three months ago.

While Santos’s decision to reject the well-priced bid put some investors offside, the board had another deal on its mind. The decision last week to splash up to $2.9bn buying Western Australia’s Quadrant Energy may turn out to be its best form of defence, boosting its domestic gas cashflows and giving it a hedge against its oil-linked LNG business.

Santos operates the GLNG export plant in Queensland and owns a 13.5 per cent stake in the Papua New Guinea LNG project.

The boss Mr Gallagher replaced when Santos was struggling under rock bottom oil prices — former chief David Knox — said the company had struck the Quadrant deal at the right time.

“Quadrant has been something that has been long thought of and has now been well conceived and well delivered,” said Mr Knox. “It has given them more muscle and I think that’s very important for the future.”

Santos shares briefly touched $7 on Friday — their highest level under Mr Gallagher’s watch — as investors warmed to the Quadrant buyout and the company’s decision to resume its interim dividend after a three-year freeze.

For Mr Gallagher, it’s proof his strategy is working with the energy producer set to lower its break-even oil price to under $US32 a barrel as a result of the Quadrant deal, from $US35 a barrel previously. Brent oil was trading at about $US75 a barrel on Friday.

“If there’s one thing that I’ve learned over the last few years is that it’s very difficult to be a successful liquefied natural gas exporter if you don’t look after the domestic markets at the same time,” said Mr Gallagher.

“We’ll have a business now that can continue to perform all of its sustaining activities through the cycle even at the low end of the cycle and be cash positive.”

The decision last week to resume dividends has also been weighing on the Santos chief’s mind after he made the tough decision to axe the payout after the oil price crash.

“I was the CEO who turned it off in 2016 while we focused on debt reduction,” said Mr Gallagher. “That was something that I know was disappointing to shareholders, but I know it was the right thing to do at the time. It’s great to be in a position less than two years later where we can turn it back on.” To be sure, Australia’s third largest oil and gas operator wants to let shareholders know it’s not job done.

The “Santos journey”, as Mr Gallagher puts it, still has several years to play out. “As I said when Harbour came back with its bid in February, I took it as a compliment of where Santos had been that they were willing to come and pay what they offered to buy the company,” he said.

“But we’re still early in the journey. I don’t want to talk like we have finished because we still have a way to go.”

For Mr Knox, Santos is finally reaping the benefits of rising demand within Australia and Asia for gas — along with a spike in the oil price — after a tough spell under the latter part of his reign three years ago.

“I’m pleased to see the company getting its mojo back,” said Mr Knox. “As the oil price rises, all boats rise and Santos is benefiting from that which is great to see.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout