Sanjeev Gupta’s Australian operations a vital national asset

I set out yesterday how the “Frydenberg boom” is impacting Australia.

Given local construction steel trading conditions are so good, there is a real opportunity for the nation’s capital markets to properly finance a new company to acquire the Australian Gupta-Greensill operation and realise its potential to be an industrial powerhouse.

I would like to see a public company own these vital national assets rather than a private equity exercise where it will be hyped up and eventually sold to the public at inflated prices.

The Australian Gupta operation has two parts. The first is now called “InfraBuild” and it comprises a whole series of successful businesses that were prominent in Australia in previous decades but got lumped into the old OneSteel operation and became infected by serious management mistakes at the Whyalla steelworks. In addition, when OneSteel was spun out of BHP, it was given too much debt.

InfraBuild buys about one third of its steel from the Whyalla steel mill and the remainder is produced by InfraBuild’s electric arc furnaces in Melbourne and Sydney---the former Smorgon steel operation.

InfraBuild is Australia’s largest maker of steel mesh for concrete slabs and encompasses the formerly listed ARC business that was sold to Humes and then purchased by Smorgons.

Then there is the old Tubemakers steel pipe business which was once an associate of BHP. InfraBuild also has one of the biggest steel distribution operators in the land. In a past rationalisation InfraBuild also ended up with the old Savage River iron ore mines in Tasmania and the Tasmanian Electro Metallurgical Company (TEMCO), which is Australia’s only manganese alloy smelter supplying more than 50 companies around the world. BHP built the plant in the early 1960s.

This InfraBuild business is separate from Whyalla and has no finance from Greensill. It seems that JP Morgan provides around $600m in loans to the company which has turnover above $4 billion and generates an EBITA that covers all debt obligations. Debt coverage is rising on the back of the infrastructure and building booms.

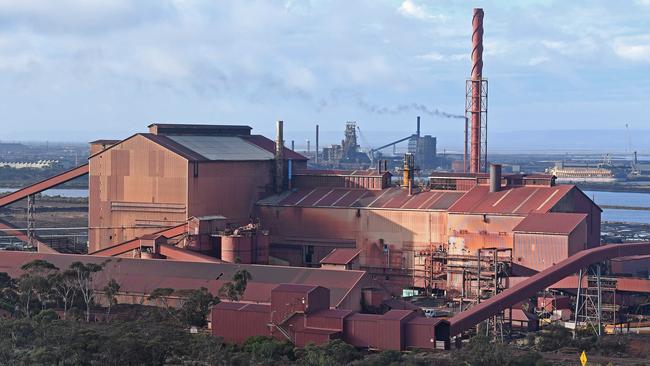

The Whyalla operation is separate but InfraBuild is a key steel customer. You may remember that Whyalla got into desperate trouble because foolish managers signed a “labour agreement from hell” that passed management control to the unions and made the plant unworkable.

Paradoxically similar crazy union agreements infiltrated the motor manufacturing industry and were the main cause of its demise. Whyalla could have gone the same way but was rescued by Gupta — something the nation should not forget.

There were two bidders for the Whyalla steel plant ---the Koreans and the Gupta group. The AWU backed Gupta because they feared that the Koreans would shut Whyalla down and supply the steel from Korea. The union was almost certainly correct.

It looks like part of the arrangement with Gupta was that the “enterprise agreement from hell” would be renegotiated to enable the steel maker to run properly.

Whyalla produces steel construction beams and rail track which are both in desperate need at the moment because of the difficulty of trading with China. Australia simply can’t afford Whyalla to shut and, indeed, we are fortunate it survived the tough times. Whyalla also has the Middleback ranges iron ore deposits which supply its furnaces but the ore is also exported.

It’s ironic that back in the 1950s the Australian government and BHP believed that the Middleback ranges were our only major source of iron ore. Accordingly iron ore exports were banned until the discovery of iron ore in the Pilbara.

Currently, thanks to the current prices, the Middleback iron ore operations are having a ball.

BHP spun off OneSteel which had both Whyalla and InfraBuild assets under the OneSteel banner. Its high debt almost sent it into receivership in its first year but it survived. It was always a weak company that could not operate under a bad enterprise agreement.

The total enterprise should probably be remerged again, properly financed and sold off as a public company.

At the moment of course the sharks are circling the Whyalla operation, looking to undertake high interest rate loans and exploitive deals in so-called “rescue operations”.

But the simple fact is that if Whyalla-InfraBuild shed the Greensill-Gupta morass we would have a strong industrial company that is a vital part of the nation. We cannot rely on Chinese steel in the future and, given there is an incredible amount of infrastructure and corporate structures to be built, these two operations are essential parts of Australia’s forward thrust.

The potential of the old OneSteel assets has never been realised but right now they stand to be a major Australian beneficiary from the China trade war.

Naturally private equity will want to buy the assets but if due diligence confirms the picture I have painted above, then it is an ideal opportunity for our industry and retail superannuation funds, plus our self-managed funds, to share the benefits of the prosperity ahead.

The jewel in the Gupta-Greensill morass is the Australian operations which are profitable and are benefiting from the “Frydenberg Boom” and the difficulty of gaining steel from China.