Russian coal set to replace Australian exports to China

Russian president Vladimir Putin is targeting Australian coal markets in China.

Russia is gearing up to take advantage of Canberra’s poor relationship with China to expand its coal exports, analysts say, as Chinese authorities allow some of the millions of tonnes of Australian coal stranded off its coast on dozens of ships to be offloaded.

Russian President Vladimir Putin last week met industry executives and government officials to plan ways to increase Russian coal exports to Asia by up to 30 per cent over the next three years, suggesting an increase to output of 34 million tonnes a year by 2024, according to a recent Wood Mackenzie report.

WoodMac analysts said Mr Putin ordered officials to draw up plans for the expansion of rail routes to carry coal to ports that export from Russia’s main coal district in Kuzbass to Asia, suggesting government funding could be available for a rethink of its export strategy.

“Until the meeting on March 2, the consensus in the industry was that eastbound coal exports from Kuzbass will remain flat in 2021 and then grow very little, if at all, until 2024,” WoodMac said.

“The President’s announcement on March 2 suggests a major departure from the current status quo. A 30 per cent increase would mean Kuzbass’s eastbound coal exports would grow from 53 million tonnes in 2020 to 69 million tonnes in 2024. If extra quotas are made available in 2021, we could see a 4 million tonne increase each year through 2024 of just Kuzbass eastbound coal exports.”

Other Russian coal hubs were planning to lift production, WoodMac said, pointing to a lift of about 34 million tonnes a year of coal exports to Asia over the next three years.

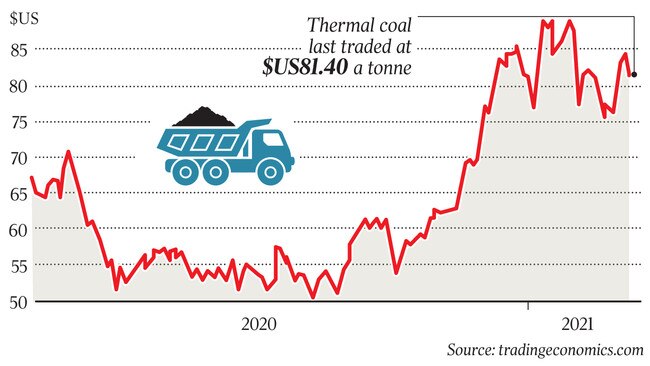

Prices for Australian thermal and coking coal have both risen in recent months as global trade flows around China’s bans on Australian output, with the US lifting shipments to China and Australian cargoes heading to South Korea, Vietnam, Japan and other parts of world.

But the Russian move suggests President Putin is planning a longer-term push into the Chinese market to replace Australian coal amid ongoing tensions between Canberra and Beijing.

Russia’s shift in strategy comes as Chinese authorities appear to be allowing some of the stranded Australian coal sitting off its coast to land to allow crew changes on bulk cargo vessels, but it could be months until the flotilla is dispersed unless Chinese coal buyers abandon attempts to get it in the country and resell it elsewhere.

Late last month Beijing began to allow a few ships to offload their cargo without clearing the coal through customs.

Wood Mackenzie principal analyst of Asia Pacific coal research Rory Simington said this would allow ship crew — some of whom have been stranded offshore since last June — to return home without having to break the boycott.

“A number of Australian cargoes have been unloaded in the last month or so. However, we understand none of these has been cleared by customs,” he said.

“That means the cargoes have been unloaded onto stockpiles in Chinese ports. This means the vessels and their crews are no longer stuck but the coal is still unavailable to the buyer until it is cleared.”

Mineral Councils of Australia CEO Tania Constable said the ships would be prioritised, based on how long they had been waiting off the coast.

‘We have discussed this issue with Chinese officials and were pleased to learn that the Chinese government has since allowed a small number of vessels to unload in February, prioritised by the length of time that vessel crews have been at anchor,” she said.

“We understand that this orderly offloading will continue each month.”

The Australian understands that between five and 10 vessels were permitted to offload their cargo in the past month and at least another five will be waved through in March, with about 48 ships still anchored off Chinese ports as of February 26, according to freight analysts Braemar ACM.

At the peak of the blockade 75 ships were stranded outside Chinese ports. But the industry isn’t optimistic the flotilla will be cleared soon because under “free on board” sale arrangements the coal belongs to the Chinese buyer once it leaves Australian ports, limiting the ability of Australian companies to intervene.

“If it was actually up to the buyers these cargoes would have been offloaded,” Mr Simington said. “It is the Chinese government via Chinese customs that are preventing the cargoes from being unloaded or processed through customs.”

Last week, Coronado Global Resources chief financial officer Gerhard Ziems said the Chinese owners of the coal were unlikely to attempt selling the commodity in another country due to a degradation in the quality.

“I don’t believe the Chinese are selling these cargoes to anyone else and now it’s too late because the coal deteriorates over time. So I don’t think they will find a lot of buyers,” he said.

“It loses a lot of qualities and moisture starts to set in and you really risk buying a cargo there that you can’t use.”

Commonwealth Bank mining and energy commodities research director Vivek Dhar said it was likely some of the coal could be salvaged, but at a cost.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout