Rio Tinto returns cash bonanza as iron ore drives huge profit jump

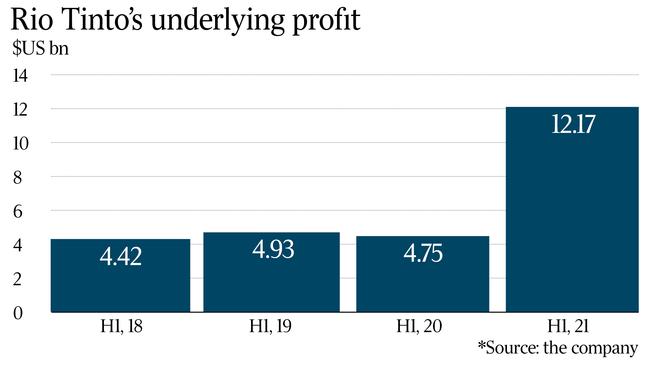

Rio Tinto will pay a bumper dividend as the resource giant jumped to a $US12.2bn underlying profit for the first half of the year.

Rio Tinto will pay out $12.4bn in half-year dividends after the iron price boosted its profits into record territory and the mining giant found itself in a net cash position for the first time in more than a decade.

Rio declared a $US5.61 ($7.63) a share interim dividend on Wednesday as the company jumped to a $US12.2bn underlying profit for the first half of the year, up more than 150 per cent from the first half of 2020.

The extraordinary result comes on the back of strong commodity prices as Chinese demand for raw materials surged in the half

But Rio boss Jakob Stausholm warned on Wednesday that appetite could slow through the remainder of the year, even though the long term outlook still looked strong.

“China is very capable of managing their economy and they clearly restarted it very well after Covid. But they’re trying to avoid the negative impact of too much expansion,” he told reporters.

“The long term potential for China is still intact, but we probably have seen non-sustainable high levels of industrial development in some of the months in the first half of this year.”

Rio delivered its half year financial results on Wednesday, saying it would return 75 per cent of its underlying half year earnings to shareholders through a $US6.1bn ordinary dividend and a $US3bn special dividend.

The return tops the $US5bn returned to shareholders after the first half of 2020 and kicks off what is expected to be a bumper earnings season for mining investors.

Rio generally pays out about half of its underlying earnings at its half-year results.

But Mr Stausholm said the rivers of cash flowing from Rio’s Pilbara operations had put the company in a net cash position by the end of June, likely for the first time since its disastrous $US38bn takeover offer for Alcan in 2007.

Given the strength of Rio’s balance sheet, Mr Stausholm said its board had elected to declare a special dividend.

“It‘s of course a little bit beyond our policy, a little bit beyond our practise,” he said.

“The $US6.1bn, 50 per cent, payout is kind of our normal practise at the half year. But the fact that we suddenly ended up having net cash on the balance sheet meant that we were a little bit more generous.”

Rio booked an after-tax profit of $US12.3bn for the first half, on free cash flow of $US10.2bn from its global operations.

Mr Stausholm said the result was a first-half record for the company, and was driven by stimulus packages launched by governments around the world as they looked to rebuild their economies from the initial impact of the coronavirus pandemic.

“This enabled us, despite operational challenges, to deliver record financial results with free cash flow of $US10.2 billion and underlying earnings of $US12.2 billion, after taxes and government royalties of $US7.3 billion,” he said in a statement.

The result, as always, was led by its iron ore division which booked underlying earnings of $US10.2bn on earnings before interest, tax, depreciation and amortisation of $US16bn.

Underlying earnings from its aluminium division rose 377 per cent to $US921m as prices recovered from long term lows at the height of 2020s pandemic, with underlying copper up 700 per cent as the price of the industrial metal surged in the first half.

The result is in line with analyst consensus, which had tipped EBITDA of $US16bn from Rio’s dominant iron ore division, and underlying earnings of $US10.3bn.

Consensus estimates had tipped $US12bn in underlying earnings across the group.

The first half returns come despite Rio’s iron ore division struggling to take advantage of record iron ore prices in the first half of the year.

Rio’s first half iron ore shipments were down 3 per cent to 154.1 million tonnes compared to the first half of 2020, with unit cash costs up $US3.40 a tonne to $US17.90.

Rio cited labour shortages, the need to tie in new mines to its port and rail system, and the need to revise mine plans around Pilbara heritage sites for the shortfall, which forced a fresh revision of the company’s cost guidance for 2021.

In its June quarter production report, released on June 16, the mining major lifted 2021 iron ore cost guidance to $US18 to $US18.50 a tonne, from earlier expectations of $US16.70 to $US17.70 a tonne.

Rio is the first of Australia’s iron ore majors to report financial figures after the commodity’s sterling run in the first half of the year.

But, although Rio says the benchmark iron ore price averaged $US172.60 a tonne in the first half of the year, excluding shipping costs, lingering issues at its Pilbara operations meant Australia’s biggest iron ore producer struggled to take full advantage of high prices.

Rio received an average price of $US154.90 a wet metric tonne in the first half of the year, equivalent to $US168.40 a dry metric tonne, $US4.20 a tonne below the average benchmark price.

Mr Stausholm admitted Rio’s operational performance was well below where he wanted to be, telling reporters it would take some time to address issues across its operations.

“In the first half, we experienced too much operational instability. We are addressing this in a systemic manner and will sharpen the consistency of our performance. Today‘s results clearly demonstrate the underlying quality of our asset base, but our operational performance clearly isn’t where it has been in the past, or where we want it to be,” he said.

But Mr Stausholm said he was cautious about how long it would take to restore Rio’s reputation as the best operator in the business.

“There‘s a lot to be done. And first of all I think we have to remind ourselves how profitable we are, what a great set of financial results,” he said.

“It‘s not going to happen immediately. It’s going to be a gradual improvement, half-year on half-year, on half-year. I’m trying to avoid being too short term focused in demonstrating effects very quickly, because the risk is to become too short term. We’re building this in a very structural way.”

Mr Stausholm said the long term outlook for Rio’s business was bright, particularly in light of its approval of the development of the $US2.4bn Jadar lithium project in Serbia, which will deliver Rio a significant stepping stone to enter the battery minerals sector if it is approved by local authorities.

Rio shares closed down 25c, or 0.2 per cent, to $132.20 on Wednesday. Rio’s London listed shares were down 0.4 per cent in early trade.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout