Rio Tinto flags Simandou plans, backs improving markets and dividend

Rio Tinto signals plans to push on with the development of the giant ‘Pilbara-killer’ Simandou deposit in Guinea.

Rio Tinto has signalled plans to push on with the development of the giant “Pilbara-killer” Simandou deposit in Guinea, flagging moves to update the 2015 feasibility study on the massive iron ore project.

Amid surging iron ore prices that have again topped $US110 a tonne, and a strong performance from its Pilbara iron ore operations, Rio’s quarterly production report flagged new work with its “partners” to update earlier studies on the 650km rail line and port infrastructure needed to bring the two billion tonne iron ore deposit to production.

“A scope of work has been prepared to enable selected China-based design institutes to update the infrastructure elements of the project including the design of its designated trans-Guinean rail line and to assess shipping methods,” the company said.

Rio’s existing partners in the deposit are China’s Chinalco and the government of Guinea — but the company did not name its partners and unconfirmed media reports from China last month tipped steelmaking giant Baowu to lead another consortium of Chinese state-owned majors, including Shougang Group and China Minmetals Corp, to take over Chinalco’s stake and help push ahead with its development.

The second half of Simandou is controlled by a second China-backed consortium including Shandong Weiqiao (China’s largest aluminium producer), Yantai Port Group, UMS (a French and Guinean logistics company) and Singapore’s Winning International Group.

The Guinean government has said the rail and port infrastructure built to service Simandou will be open to third-party use, indicating that only one line will be built — although it is not yet clear whether Rio and its partners, or the SBM Winning Consortium will eventually carry the burden of building the infrastructure.

Rio completed its bankable feasibility study into its half of the deposit in late 2015, and delivered it to the Guinea government in May 2016. It did not release a price on the project’s total development costs, but the SMB consortium has forecast total costs of about $US14bn ($20bn) for its side of the development, including port and rail.

Improving conditions

The commentary on Simandou came as Rio flagged improving conditions for its markets in the second half of the year, saying China’s economy appears to be stabilising after the impact of the coronavirus, with conditions for trade in the US and Europe improving in the second half of the year.

But the company warned a second wave of COVID-19 is a key risk for advanced economies, despite strong prices for its flagship Pilbara iron ore products putting it on track to deliver a strong first-half dividend.

“In China, conditions have improved through the second quarter and appear to be stabilising. While employment and trade uncertainties remain, the construction and infrastructure sectors are performing well; house prices and stock markets are also recovering, lending support to consumer confidence,” Rio said on Friday.

“The US and Europe have started to re-open and recover. A second wave of infections remains a key threat for advanced economies. China’s demand for iron ore continues while the recovery in Japan and Europe is yet to begin meaningfully and is likely to be subdued when it does.”

Rio’s Pilbara operations delivered an improved performance in the first half of the year, despite the impact of cyclones in the first quarter, finishing the year in a rush.

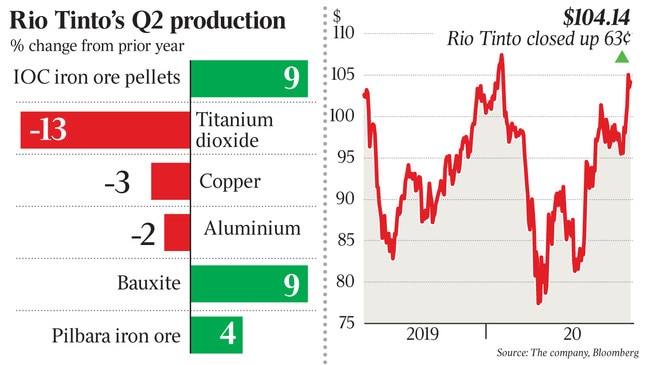

Rio’s mines produced 161.1 million tonnes in the first half, and shipped 159.6mt, up 3 per cent on the first half of 2019. In the June quarter its mines produced 83.2mt, and shipped 86.7mt as Rio ran down stockpiles a 20 per cent lift on a weather-affected first quarter of the year.

Rio has said its pricing remained strong, with realised prices of $US78.50 a wet metric tonne the equivalent of the first half of 2019, putting the company on track to deliver a strong first-half dividend — a move likely to be welcomed by a market starved for dividend yield amid the coronavirus crisis.

Rio paid an ordinary dividend of $US1.51 a share on the back of similar pricing in 2019, and declared a $US61c a share special dividend.

The company said its iron ore costs remained within previous guidance of $US14 to $US15 a tonne, despite an estimated US50c a tonne impact from measures to reduce the risk of coronavirus impacting its mines.

Rio chief executive Jean Sebastien Jacques said the company’s operations performed well in the first half of the year, particularly its iron ore and bauxite divisions.

“Our iron ore assets are performing well in a strong pricing environment and we are on track to meet our 2020 iron ore guidance,” he said.

“Our focus is to maintain a business as usual approach with many safeguards at a very unusual time. Our operational teams are continuing to run our assets safely so we can continue to contribute to local and national economies and serve our customers. We remain even more committed to our relationship with communities, following the Juukan Gorge events in the Pilbara, and we are engaging extensively with Traditional Owners around our operations and across Australia.”

Rio shares closed up 0.6 per cent, or 63c each on Friday, at $104.14.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout