Copper a highlight as Rio Tinto sets sights on production record

Rio’s chief says the miner’s ‘value over volume’ mantra is still intact, even as the giant sets its sights on a production record.

Rio Tinto chief executive Jean-Sebastien Jacques says the miner’s “value over volume” mantra is still intact, even as the mining giant sets its sights on a new production record from its Pilbara iron ore operations.

The miner yesterday said it expected to ship between 338 million and 350 million tonnes of iron ore this calendar year, which if achieved would represent an annual production record.

Mr Jacques’ advocacy for a focus on margins and profitability over increased production has been a marked point of difference to his predecessors, yet Rio’s world-leading iron ore operations have continued to lift their output under his watch.

Rio’s latest quarterly production report confirmed that the wildly profitable Pilbara iron ore business had produced 338 million tonnes last year, at the upper end of the guidance of between 330 million and 340 million tonnes and 2 per cent higher than a year earlier.

The ongoing increase in output is being driven by Rio’s driverless rail network, which was finally delivered last year, and the ongoing ramp-up of its new Pilbara mines.

In a statement accompanying the results, Mr Jacques said the company had delivered a “solid” operational performance.

“With a firm ‘value over volume’ focus and disciplined allocation of capital, we will continue to progress our strategic objectives and to deliver superior returns to shareholders in the short, medium and long term,” he said.

A better than expected performance from Rio’s copper division was the highlight of an otherwise solid quarter from the mining giant.

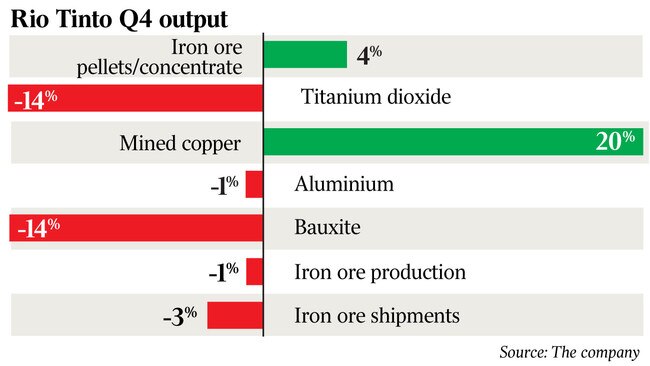

The December quarterly report released by the company on Friday showed a 33 per cent jump in copper production for 2018, due to what it said was strong production from its Escondida and Kennecott operations.

The higher than expected copper output for the December was the only big surprise in today’s release, which also saw the company forecast an increase in its iron output this year.

The copper output for December of 178,000 tonnes was 21 per cent higher than forecast by analysts at JPMorgan and was 5-6 per cent higher than predicted by Bank of America Merrill Lynch.

But the increased levels are only likely to be temporary, with much of the quarterly increase due to higher output from the Grasberg mine in Indonesia. Rio finalised the sale of its stake in Grasberg late last year for $US3.5 billion.

CLSA analyst Kaan Peker said the company’s copper and iron ore divisions had recorded strong results for the quarter.

“The key standout was for fourth quarter was the copper division,” Mr Peker said.

“While all assets performed well over the quarter, the beat came from Rio’s recently sold Grasberg asset.”

JPMorgan analyst Lyndon Fagan, meanwhile, said he expected a muted market reaction to the release, given the latest production figures and 2019 production guidance was largely in line with expectations.

The mining giant released fresh production guidance for 2019, tipping a lift in iron ore output from 338 million tonnes in 2018 to between 338 million and 350 million tonnes.

It confirmed that the fire at its Cape Lambert port in the Pilbara last week would have a limited disruption of its shipments this year.

The 338.2 million tonnes of iron ore shipped by the company in 2018 was up 2 per cent from the previous year and were in line with its forecast last October of shipments at the upper end of a 330-340 million tonne range.

Rio Tinto’s iron ore production was aided by an ongoing productivity drive, good weather conditions and rising production from its new Silvergrass mine, where it began operations in 2017. It did face some disruptions during the third quarter from maintenance work and the death of a truck operator at one of the company’s pits.

The company will next year start construction of a $US2.6 billion iron ore mine that will be the miner’s most high-tech operation to date and buoy future production as older pits are depleted.

Rio Tinto has spent billions of dollars expanding its vast iron ore mining network in a bet on continued strong demand for the steel making commodity in Asia. To fatten profits from its biggest division, the Anglo-Australian miner has also sought to make existing mines more productive, including through the use of autonomous equipment.

Rio Tinto typically earns a margin of more than 60 per cent from its iron ore business.

Rio Tinto on Tuesday also reported a 1 per cent year-on-year fall in output of bauxite, the raw ingredient in aluminium, despite recent measures implemented to reduce bottlenecks at its Gove operations.

Aluminium production fell by 3 per cent on a year ago, while mined copper output surged 33 per cent.

Shares in Rio closed at $80.65, up 0.3 per cent.

With Dow Jones Newswires

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout