Rio Tinto bows to green pressure

The mining giant has matched moves by its major rivals to outline goals to reduce the carbon emissions of its customers.

Rio Tinto has bowed to investor pressure and matched moves by its major rivals to outline goals to reduce the carbon emissionsof its customers, as the company declared a record $US6.5bn ($8.38bn) dividend on the back of the iron ore price boom.

The company will also match Glencore’s promise to put its climate goals to a shareholder vote.

Rio has for years resisted pressure to set goals for scope-three emissions — those attributable to the use of its productsby customers — with chairman Simon Thompson having previously told shareholders the push was “unworkable”, arguing the companyhad little control of how its customers ran their businesses.

But the mining major backflipped on Wednesday, adopting similar plans outlined by BHP boss Mike Henry last year to work withits steel mill customers to find ways to limit the carbon emissions from the global steel industry.

New chief executive Jakob Stausholm late on Wednesday told The Australian the world had changed since Rio’s last annual shareholdermeeting, when almost 37 per cent of votes backed a resolution calling on the company to match promises made by its major competitorson scope-three emissions, even though the Rio board rejected the motion and Mr Thompson told shareholders the push was “notviable”.

“It’s easy to start off saying we’ll be [carbon] neutral in 2050, but when you really start working backwards and seeing theimplication of it you realise what a massive challenge the whole world has got. And Rio is at the heart of this, we have abig carbon footprint, but we have an even bigger indirect carbon footprint, the scope three,” Mr Stausholm said.

“I think it’s absolutely right what we did. We started off being transparent, very transparent in our climate change report,and we set scope one and two targets for reductions in medium term and long term. And we set money aside for it, and we arefocusing on that.”

Rio announced on Wednesday it would seek to find ways to reduce the carbon intensity of its steel mill customers by 30 percent by 2030, mirroring the target set by BHP in September last year.

The company said it would bake in carbon emissions goals into bonus plans for key executives, and said it would find waysto reduce the carbon intensity of the shipping fleet that moves its products across the globe by 40 per cent by 2030.

Rio also promised to find partners to help develop “breakthrough technologies” with the potential to deliver carbon-neutralsteelmaking by 2050, and advance at least one project to industrial pilot scale by 2025.

Mr Stausholm admitted Rio’s new scope-three goals were more “an intention” than a hard target, given the technology neededto turn its goals into reality does not yet exist at commercial scale.

He said Rio’s change of views were also informed by the rush in China and other major customers to set harder targets on climateemissions, after China pledged carbon neutrality by 2060 last September.

“I think what we have learned is that we just need to buy into how we can help other parties — a lot has changed there aswell,” he said. “The world was very misaligned on climate change, and it is actually becoming more aligned. And you’ve seen,China is moving with the speed of light on climate change and their commitment to be neutral in 2060 will require a significanteffort, and therefore we have a lot of pick-up from our customers as well on that front.

“But it’s more than anything an intention, because it’s not that we have all the solutions yet, but at least putting our forcebehind and putting money behind it, that will drive actions.”

While a significant step forward for the mining giant, the moves are unlikely to satisfy pressure by climate-minded investorsand activist groups to reduce its total carbon footprint, given BHP’s goals were criticised for a lack of ambition.

But while Rio’s climate goals may not satisfy activist groups, its full-year return to shareholders is unlikely to generatemuch quibbling, after the company declared a dividend of $US4.02 ($5.15) a share — a $US3.09 final dividend on the back ofthe result, as well as a US93c special dividend — returning $US6.5bn to shareholders.

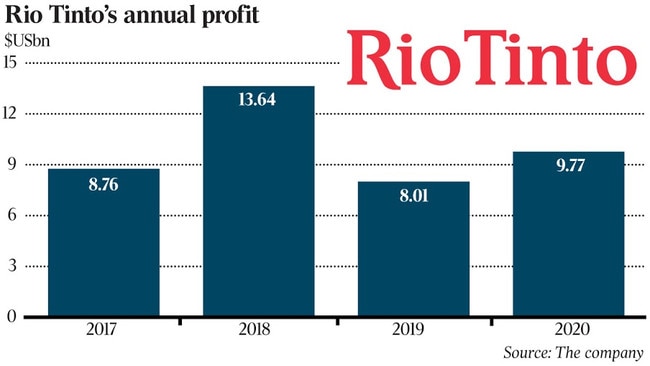

The payout comes on the back of a $US9.77bn annual profit, up 22 per cent to close out an otherwise horrific year for theminer.

It declared an underlying profit before interest, tax, depreciation and amortisation of $US23.9bn, up 13 per cent on 2019.

Rio’s result was dominated by its iron ore division, which delivered underlying EBITDA of $US11.4bn.

Analysts’ consensus tipped Rio’s underlying iron ore earnings, before interest and tax, at $US11.47bn, or about 90 per centof its total earnings for the year.

While iron ore delivered a stellar result, the company is still smarting from the loss of its crown as the Pilbara’s cheapestoperator, and Rio again lifted its cost guidance for its flagship Pilbara iron ore operations, blaming the rising dollarfor the increase.

It cost Rio about $US15.40 to export each tonne or iron ore in 2020, with the company flagging average costs of $US16.70-$US17.70this year.

“This mainly reflects a forecast 12 per cent strengthening of the Australian dollar (US77c in 2021 versus US69c in 2020),given that a significant majority of our Pilbara costs are Australian-dollar denominated (excluding freight and royalties),” Rio said.

“In 2021, we expect to incur commissioning costs associated with tying in 90 million tonnes of replacement mine capacity andstart-up costs for Gudai-Darri, with production ramping up in 2022.

“We also anticipate additional study costs for the next wave of replacement mines. There are no COVID-19 costs in our 2021guidance compared with US60c per tonne in 2020.”

The extraordinary profit closes out a horror year for Rio, in which it shed chief executive Jean-Sebastien Jacques, iron oreboss Chris Salisbury and corporate affairs head Simone Niven over the decision to blast 46,000-year-old rock shelters atthe company’s Brockman mine in order to access higher-grade ore zones.

Rio shares closed up $4.42 to $127.47 on Wednesday.