Resolute Mining buys Toro Gold

Resolute Mining’s rising share price has helped it finally snare Toro Gold, owner of the Mako mine in Senegal, for $440 million.

A strong surge in Resolute Mining’s share price has helped it finally snare the African asset it has long been hunting for.

The company late yesterday announced it had bought Toro Gold, the unlisted, private equity-backed owner of the Mako mine in Senegal, for $440 million.

The deal, as first revealed by The Australian’s DataRoom column yesterday, will see Resolute snare Toro in exchange for $US130m ($188m) in cash and 142 million of its shares.

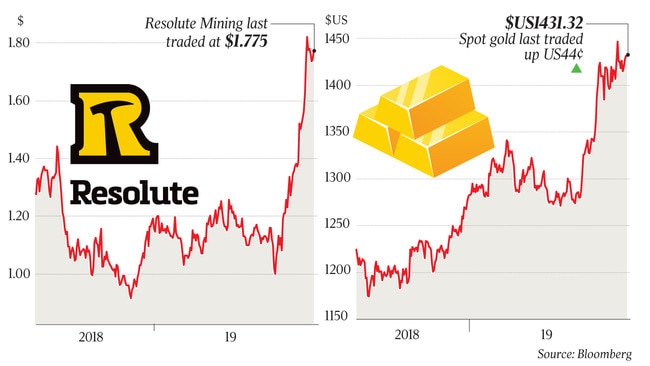

Shares in Resolute have surged from $1 in mid-June to $1.78 before it entered a trading halt yesterday. Managing director John Welborn told The Australian that the run had helped it secure a project that he had previously feared could be out of reach.

He said the company had been looking at Toro for two years, and noted there had been a “very competitive” process in recent months to find a buyer.

“My understanding is it was the upward momentum in the Resolute share price and the quality of the company, rather than price, that won us this deal,” Mr Welborn said. “We certainly didn’t compete on price, we haven’t paid up for this asset.”

Mr Welborn has made no secret of his desire to acquire more African goldmines that would complement its mainstay Syama mine in Mali. The company last month added a listing on the London Stock Exchange in an effort to access a shareholder base with a greater understanding of and comfort in investing in Africa.

Mako entered production in early 2018, and is expected to produce about 140,000 ounces of gold a year over a seven-year mine life. It produced 156,926 ounces at an all-in sustaining cost of $US655 an ounce.

The mine made $US70m in cashflow last year and Mr Welborn said he expected it to continue with that sort of performance.

“I’ve been joking with our management team for years that we should do an easy asset for a change and this one has been very well developed and very well run,” he said.

“Resolute in the past has bought things cheaply with a view of rolling our sleeves up and fixing them. We are really good at that but it is hard work.

“This asset is not hard work, it is generating really good cash and we expect it will continue to do so under our ownership.”

The cash component of the acquisition will be funded through a 12-month, $US130m debt facility with Taurus Funds Management.

Resolute will also pick up a broader African exploration portfolio within Toro.

“There hasn’t been a budget for exploration, so we are looking forward at getting on the ground and looking at what the tenement package has in terms of exploration potential and mine life extension,” Mr Welborn said.

The buyout represents a solid payday for Toro’s private equity owners, including Resource Capital Fund, QG Africa Mining and Tembo Capital.

Toro was led until last year by Perth-based Mark Connelly who had plenty of experience in Africa, who stood down as its chair after production began, having led the firm from an explorer in 2014.