Renewables targets ‘to fall short’

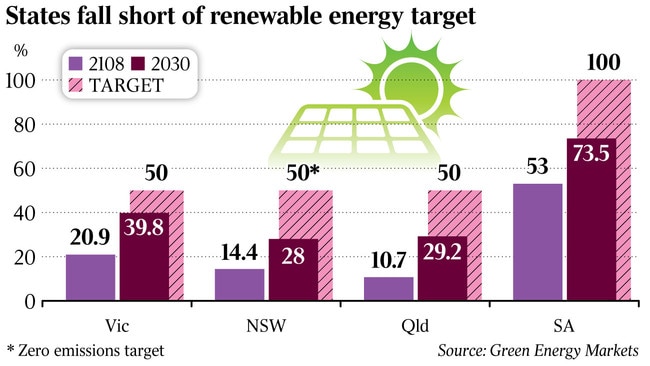

NSW, Victoria, Queensland and South Australia may fail to meet ambitious renewable energy targets in the next decade.

NSW, Victoria, Queensland and South Australia may fail to meet ambitious renewable targets in the next decade, as uncertainty over solar and wind investment threatens to derail a planned transition to a cleaner power supply.

New forecasts by consultancy Green Energy Markets underline the challenge of moving an electricity grid dominated by coal generation to solar and wind backed up by hydro, batteries and gas in the coming years, and raise concern that high power prices may remain locked in should investment slide.

Australia’s largest economy, NSW, will produce just 28 per cent of its electricity from renewables by 2030, the outlook shows.

While double last year’s level, it remains well short of the 46 per cent required at that stage to reach its ultimate goal of zero emissions by 2050.

Victoria — where the Andrews government yesterday kicked off a $1.3 billion solar program — will be roughly in line with its 40 per cent target by 2025 but will stall near that level in the following five years, falling short of its 50 per cent target.

Queensland Premier Annastacia Palaszczuk will achieve just 29 per cent renewables by 2030 compared with its 50 per cent target, while South Australia’s Liberal government will reach 73.5 per cent against its ambitious 100 per cent objective by the end of the next decade.

In the short term, spending on renewables will fall in the absence of a more ambitious federal emissions target, the consultancy says.

Investment in large-scale wind and solar projects may fall from about 4000MW a year on average to less than 1000MW in 2020 if no new state government initiatives are put in place.

“The boom is likely to be followed by a bust without new policy,” Green Energy Markets director of analysis and advisory Tristan Edis told The Australian.

“We anticipate a collapse in investment in large-scale wind and solar farms by next year.

“While wind and solar costs have declined to quite low levels, we don’t yet see new investments as being attractive at the short-run operating cost of most coal plants.”

To address the problem, states may need to consider banding together and implementing the emissions component of the dumped National Energy Guarantee to provide a clearer investment signal to stimulate more renewables into the system, according to Green Energy Markets.

“The states don’t have to wait for the federal government because the constitution rests power for regulating the power sector with the states,” Mr Edis said.

“Back in 2006 the states looked at pursuing an emissions trading scheme for the electricity sector without the involvement of the federal government and were provided with legal advice indicating they could implement such a scheme.”

New renewables capacity could also be underwritten by states through long-term contracts, mirroring the Victorian government’s reverse auction scheme which guarantees a price for project developers through 15-year deals.

If NSW and Queensland followed Victoria’s lead, the move could provide a useful counterweight to Canberra’s hefty investment in Snowy 2.0.

“You could see state governments’ underwriting new wind and solar as being complementary to the federal government’s support for pumped hydro,” Mr Edis said.

“The states induce the wind and solar that provides the large-scale bulk low cost energy that allows economical pumping of water uphill.

“Then the pumped hydro delivers the dispatchable capacity that ensures energy is available exactly when we need it.”

While Australia has undergone a clean energy boom over the last few years and holds 100,000MW of yet to be developed capacity in the pipeline, according to Rystad Energy, there is uncertainty over how much will ultimately be delivered to market.

While some experts say investors will continue to plough on regardless of federal policy, others say the federal government’s underwriting program and financial backing of Snowy loom as risks to prospective renewable developers. Similarly, the Queensland government-owned CleanCo may also distort the market for private developers.

In turn, congestion in solar projects along with tighter regulations and a more modest rate of return is challenging the outlook for growth in the sector, compounded by different targets across the states and commonwealth.

“All of the states within the National Electricity Market appear to recognise that we need a legal framework setting out how our electricity system will steadily reduce emissions in line with our international commitments. Without this, investors are stuck in a no man’s land,” Mr Edis said. “They know fossil fuel plants lack a long-term future, but at the same time investment in renewables is constrained by concerns about oversupply until more coal plant exits.”

Snowy Hydro is already working on fast-tracking a solution to the quagmire. It has lobbed a proposal to Victorian Premier Daniel Andrews to urgently address the state’s fragile power grid, requesting his backing for a major new power line that can deliver huge slabs of electricity to Melbourne from the Snowy scheme.

The government-owned player has been holding talks with Victorian utility AusNet over the last few months to construct a new transmission line potentially by 2022 with access to an additional 1500MW of Snowy’s baseload supply as the state shifts focus to renewable energy supply from its ageing coal plants.

With the state suffering power cuts in January during a heatwave and the nation’s power grid operator warning of market risks from the retirement of coal-fired power plants, the Snowy chief yesterday said it was time to act.