Record iron ore prices to deliver $150bn Australian export bounty

After topping $100bn for the first time ever in 2019-20, the value of the nation’s iron ore exports is set to jump by nearly 50pc this year.

Surging iron ore prices and increased volumes sparked by a global economic rebound will see iron ore set a new annual export record of $149bn, driving Australia’s resources revenues to an all-time high amid a broader global commodities boom.

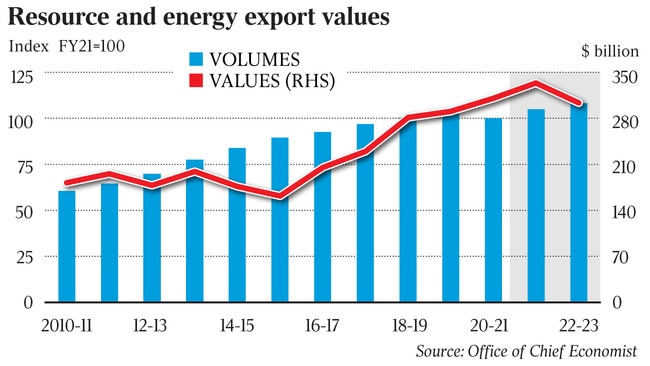

After topping the $100bn milestone for the first time ever in 2019-20, the value of the nation’s iron ore exports is set to jump by nearly 50 per cent to $149bn for the 2020-21 financial year to June 30, the federal government’s quarterly resources and energy report shows. High iron ore prices along with strong markets for coal, copper and LNG will deliver overall resources exports of $310bn, beating a $296bn forecast made in March. An even bigger leap is expected to $334bn in 2021-22 as economies strengthen, driven by a rise in infrastructure spending, before falling back to $304bn in 2022-23.

Iron ore prices smashed through the $US200 ($263) a tonne mark and reached a high of $US237 a tonne on May 12, capping a 50 per cent rise since the start of the year on renewed demand from China and tight supplies in the market because of Covid-19 disruptions in Brazil, Australia’s major rival.

Prices for the steelmaking raw material are estimated at $US150 a tonne on average in 2021, before falling below $US100 a tonne by the end of 2022 as Brazilian supply recovers and Chinese steel production softens. Prices have retreated from May highs but remain above $US205 a tonne.

Australia’s export volumes are expected to grow from about 871 million tonnes per annum in 2020-21 to 954 million tonnes by 2022-23, as several mines open or expand in Western Australia. But even with that volume lift, this year’s $149bn result would represent a market top for the commodity with lower price projections delivering earnings of $136bn next year and $113bn in 2022-23.

While iron ore does the heavy lifting, Canberra also predicts a raft of commodities will shine, driven by economic growth in China and the US as vaccine rollouts drive confidence in a fiscal recovery.

Thermal coal from Newcastle is at a 13-year high above $US131 a tonne, LNG prices have doubled since February and oil is above $US75 a barrel for the first time since April 2019.

“The sector is poised to take advantage of the global post-Covid recovery and capture opportunities from strong demand and higher prices across a range commodities,” said Resources Minister Keith Pitt, who was relegated to the outer ministry on Sunday.

“Our iron ore producers are benefiting from current high prices and decades of investment and innovation, while coal exporters have pivoted to new markets to regain much of the losses from the Covid downturn and China’s informal import restrictions.”

Copper joined iron ore in setting new records in May, prompting China to release its own metal reserves to quell a big price jump in the last year, but commodities giant Glencore said it would do little to cool a major bull market for raw materials.

LNG will turn in a modest $32bn of export revenues as the lag of last year’s oil slump dampened prices but income is forecast to jump by more than half to $49bn in 2021-22 as producers with oil-linked contracts profit from a recovery in crude beyond $US70 a barrel.

Coal continued a rollercoaster few years with strong prices and exports buoying the fortunes of the fossil fuel.

Rising prices for metallurgical coal, used for steelmaking, and a near 10 per cent jump in exports over the next two years will propel export receipts to $30bn in 2021-22 and $32bn the year after, cementing Australia’s position as a major provider to predominantly Asian buyers.

Volumes of thermal coal, facing huge pressure from investors and banks over climate concerns, are expected to rise but will remain below last year’s levels. Prices, currently the highest since 2008, will fall by more than a quarter over the next 24 months, with the government warning market conditions remain uncertain.

One of the big hurdles for Australian producers remains China’s ban on taking new shipments after Beijing in January instructed owners of the banned Australian coal to find new buyers outside China, scuttling the $14bn export trade and ramping up pressure on the Morrison government.

The ban on Australia could be in place for several years, according to Goldman Sachs, with the government’s commodity forecasters also seeing little change in the standoff.

“The current informal restrictions imposed on Australian exports to China also represent a significant variable, though no change to this policy is assumed over the outlook period,” the report states.

Rivals have been rushing to take advantage of Australia’s poor relationship with its biggest trading partner, which also presents a further risk in terms of pricing for metallurgical coal.

A price record for copper in May will lift earnings to $13bn next year before dipping again as prices moderate. Gold set to hold up well with revenues of more than $28bn in the next two years.