Raleigh Finlayson’s pursuit of St Barbara’s Gwalia gold mine has a hint of unfinished family business

There’s a bit more at stake than just ownership of a pretty decent gold mine in the talks between Raleigh Finlayson’s Genesis Minerals and St Barbara.

As with all things in the West Australian gold industry, there’s a bit more at stake than just ownership of a pretty decent mine in the talks between Raleigh Finlayson’s Genesis Minerals and St Barbara, with the consolidation of the Leonora district at stake.

Finlayson is second on the card on the program on Monday, and is likely to face plenty of questions about the progress of talks between Genesis and St Barbara.

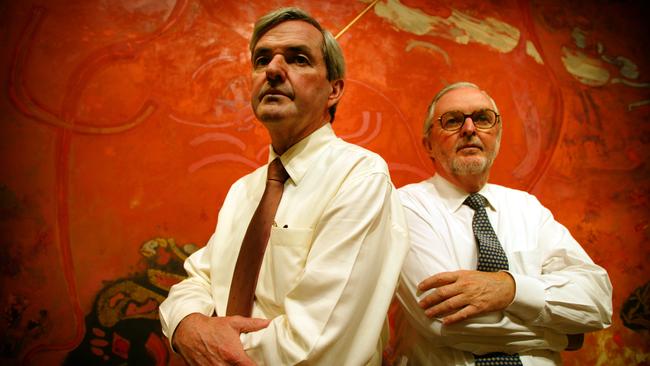

The main target of any merger would be St Barbara’s Gwalia gold mine, and even the casual scholar of WA mining history will remember that Gwalia was once owned by Sons of Gwalia, run by brothers Peter and Chris Lalor until its collapse in 2004 under the weight of a toxic hedge book.

Adding weight to that theory is the fact that Genesis has codenamed its talks with St Barbara Project Roosevelt – a reference to Franklin D Roosevelt, who followed one-time Gwalia mine manager Herbert Hoover into the White House in 1932.

Then there’s the fact that Finlayson is a nephew of the Lalor brothers, giving the talks just a hint of “unfinished family business”. Even more so when you consider the talk that Genesis is said to want a deal for just St Barbara’s WA assets – meaning St Barbara’s troubled Canadian Atlantic Gold assets would somehow need to be set aside.

Oddly enough, former Atlantic president Stephen Dean – who led the sale of the Canadian mines into St Barbara in 2019 and recently left the St Barbara board – was also president of Teck Cominco when the Canadian miner sold Pacmin Mining Corp to Sons of Gwalia in 2001.

That transaction ended badly when the main target of the acquisition, Pacmin’s Tarmoola mine, suffered a pit wall collapse that helped set Sons of Gwalia on the road to ruin.

Given the family history, it’s hardly surprising that Finlayson’s Grandsons of Gwalia play is a trifle leery of taking on Atlantic. Truly, there is nothing new under the sun in WA.

Queen of the Desert

Except, perhaps, the lengths some will go to attract a bit of attention at Diggers. With more than 2600 delegates, and a tight program settled months in advance, it can be a bit tough to attract a bit of attention if you’re not on the main card of the conference.

Though falling commodity prices will take some of the gloss off this year’s Diggers, two years of a bull market have ensured Australia’s mining juniors are cashed up the wazoo, and even having access to a decent pot of money isn’t necessarily enough to cut through the clutter.

Enter Ben Cleary’s Tribeca Investment Partners, which has rented a bus for the event, with the intention of parking the thing somewhere in the vicinity and conducting all of their meetings with company CEOs inside, rather than in the relative comfort of a cafe, for example. Diary can only assume it’s cheaper than paying for accommodation elsewhere in Kalgoorlie, which has been fully booked out for months.

Other notable carnival events in the Diggers sideshow include stock promoter Tolga Kumova offering free kebabs to anyone prepared to listen to a pitch on Aston Minerals and lithium play Patriot Battery Metals.

Lobbyist Gold Industry Group is again trying to convince delegates to get out of bed in time for a 7am breakfast on Tuesday, proof positive that some ideas – like the Wiluna Gold mine – are so bad they simply can’t be killed.

And mining veteran Peter Cook, now retired from active duty, will again be headlining the cocktail party of event sponsor Cannacord Genuity with his cover band, Smoking Gun. Unlike a 7am breakfast that’s not nearly as bad as the idea sounds.

One notable change in the Diggers sideline, though, is the split up of the traditional sundowner joint venture between the WA School of Mines Alumni and Women in Mining WA.

After running a joint event for years, this time around each are running their own function – WIMWA on Monday, and WASMA the following day.

One of the causes of the split appears to have been the response to speeches last year from long-term WIMWA members who, by all reports, gave a pretty frank and less than flattering assessment of where the industry was actually at in its treatment of women, despite all of the fine words being bandied about.

Given those comments predated both Rio Tinto’s appalling culture report, delivered in February, and the findings of the WA parliamentary inquiry into sexual harassment in June, Diggers Diary finds it hard to believe that what was said could have been more confronting than the reality of the industry for many women.

But still, the content was enough to spark a couple of complaints – anonymous, of course – and presumably on the basis that the complainants were fine with women being an accepted part of the industry, but only if they weren’t going to be difficult about it. While it’s all very polite in public, that appears to have been enough to spark a parting of ways.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout