Pump and dump: how ASIC pursued the market manipulators

Market watchdog officials have played cat and mouse with small-time ASX traders suspected of participating in co-ordinated share price manipulation.

Market watchdog officials spent a fortnight playing cat and mouse with small-time ASX traders they were convinced were participating in co-ordinated share price manipulation.

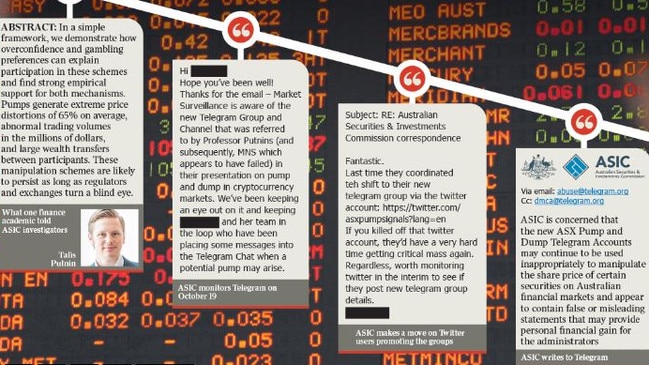

For weeks, investigators at the Australian Securities & Investments Commission kept a close eye on the so-called “pump-and-dump” channels proliferating on Twitter and Telegram. As early as September, the regulator was imploring the social media platforms to take action.

Previously, ASIC officials would have left the groups to their own devices. They were usually small – numbering some 400 members each – and in the world of market monitoring, there were far larger targets to be pursued.

But according to documents obtained through a freedom of information request, ASIC was becoming increasingly concerned at the sophistication and scale of the manipulation. Favoured targets included security authentication small-cap YPB – with a market capitalisation of just $12m – and electric battery manufacturer and graphite miner Magnis Energy.

Online message boards have long been used to push company share prices up or down. It was on a Yahoo! forum that concerns were first raised about US energy company Enron – months before its collapse. Now, however, platforms like Twitter, Telegram and HotCopper were being used to send the share prices of ASX minnows sky high. As they peaked, the traders would sell hard and take a profit, leaving others out of pocket. After ASIC wrote to Telegram on September 20, the company disabled two of the largest message threads – the ASX Pump and Dump Channel and the ASX Pump and Dump Group – where the share price manipulation was being co-ordinated.

But as quickly as they were cut down, more appeared.

“Following our last correspondence, ASIC has identified that the administrators of the restricted Telegram Group and Telegram Channel have moved to a new Telegram Group and Telegram Channel identified as ‘ASX Pump Organization’ and ‘ASX Pump Announcement Channel’ and may continue to be operating a pump-and-dump scheme (which may constitute market manipulation under the Act) on the platform that you provide,” one unnamed ASIC official wrote in a letter to Telegram on October 19.

The failure of the social media and messaging platforms to proactively remove the channels had already led ASIC to take its own action. For days, officials worried the situation would only be made worse by directly intervening.

October 11 saw their first foray. The regulator created an account and entered a group called the Pump and Dump Organization, and in a pre-trade post, warned market manipulation was illegal and could lead to $1m fines.

“USE THE MARKET ORDER AND SEND IT TO THE SKY,” the group moderator wrote, ignoring the ASIC warnings.

Officials close to the discussions about whether to intervene were concerned that further posts would only agitate the market manipulators further.

Those concerns were repeated in emails sent on October 19, as ASIC officials continued to monitor the quickly forming groups.

“Hi everyone,” one email began. “(Redacted) was in touch yesterday in relation to Telegram commentary below which, if there’s more commentary today before market open, she is fine for us to add the approved posts.”

The commentary referred to was a group message which read: “(Magnis) on the verge of massive breakout above 0.38. It is our time to shine. Clear sky ahead. Our focus tomorrow is to DESTROY THIS FINAL RESISTANCE.”

“Are you sure that’s a suitable one to intervene on,” another ASIC official wrote back. “That seems to be a quote from Star Wars – Darth Vader, I think. We’d want to be wary perhaps?”

Despite those concerns, ASIC did enter the chat.

“We remind you that co-ordinated pumping of shares for profit can be illegal,” one official wrote. “We work closely with market operators to identify and disrupt pump and dump campaigns and will continue to target actions that threaten the integrity of markets.”

Crypto manipulation

The regulator’s market monitors had also begun taking counsel from an unexpected place. Talis Putnins had studied at the Royal Military College before embarking on a career as a finance academic, first at the University of Sydney and later the University of Technology.

His interest? Cryptocurrency. In fact, Putnins had found a small measure of fame in 2017 after releasing research which tried to identify the kinds of illegal transactions bitcoin and other currencies were being used for.

Last year, Putnins and his colleague Anirudh Dhawan at the Stockholm School of Economics in Riga published a paper titled “A new wolf in town? Pump-and-dump manipulation in cryptocurrency markets”.

It documented at least 355 cases of manipulation in cryptocurrency markets in seven months, concluding it created “extreme price distortions of 65 per cent on average, abnormal trading volumes in the millions of dollars, and large wealth transfers between participants”.

“These manipulation schemes are likely to persist as long as regulators and exchanges turn a blind eye,” the paper continued.

In early October, ASIC invited Putnins to brief its investigators.

A 38-slide presentation, obtained by The Australian, gave the regulators clear evidence of market manipulation.

One example cited by Putnins was Binance, a wildly-popular cryptocurrency that is now under investigation by authorities in the US over money laundering.

“Our main goal for this pump will be to make sure that every single member in our group makes a massive profit. We will also try reaching more than 100 million $ volume in the first few minutes with a very high % gain,” reads one message published in a Telegram group called Crypto Binance Trading | Signals & Pumps, reproduced by Putnins.

“We have 7 days to prepare for this pump. We are expecting hundreds of thousands of people to attend this pump and possibly more than a million people across all social media will be watching.”

The outcome of the move on September 19, Putnins concluded, was a 90 per cent increase in the price of the cryptocurrency in less than a minute.

He told regulators that the activity of similar groups was becoming “bigger and better”. Was “a self-organising, self-disciplining industry emerging”, Putnins asked.

Compared to previous market manipulation, the Telegram-led efforts were certainly more sophisticated. There was no trickery, “not even a genuine attempt to ignite momentum”, Putnins said.

The perceived lack of legal risk, because of the anonymity afforded by platforms like Twitter and Telegram, allowed the so-called pump groups to operate openly. Some had even begun to offer paid VIP services, offering early information to a select few before the co-ordinated action began to pump up the price of cryptocurrencies.

Beyond cryptocurrencies, Putnins touched on an issue that was close to the investigators.

Could the same style of “pump and dump” manipulation be used on the ASX?

Putnins showed the officials example after example of Telegram groups doing just that. One, the ASX Pump and Dump Group, was already known to the regulator. Then there were the ASX Pump Announcement Channel and ASX Pump Organisation.

“The last PnD group was banned by Australian Telegram but can still be viewed by non-Australian numbers,” a moderator known only as Ehsan Enzo wrote in both. “We are starting a new beginning and will grow back big and powerful to pump low cap pennies. We are doing nothing illegal although ASIC does not like organised buying from brave traders.”

“As we speak a pump is on,” Putnins's presentation read, referring to the manipulation of Magnis shares.

Little did he know that ASIC would act in under 12 hours.

Fizzling out

The response to the ASIC action on October 19 was swift and scathing. And it was all carefully monitored and stored away by investigators.

“ASIC, if you are busy watching over 400 little traders buying up a stock together then you are pathetic,” one user wrote.

“Go for the big funds that manipulate stocks on a daily basis.

“Your government is corrupt and a part of this Plandemic scam. Bribed by globalists and world bank. Scum of the earth. Let the riot begin!”

And while the market manipulating groups have become more sophisticated in their actions, so too – perhaps spurred on by Putnins’s warnings – has ASIC.

“Last time they co-ordinated the shift to their new Telegram group via the Twitter account (ASX Pump Signals),” one ASIC official wrote in the hours after entering the Telegram group on October 19.

“If you killed off that Twitter account, they’d have a very hard time getting critical mass again.”

ASX Pump Signals is no more. So far, it has not reappeared in a different form.

In the US, the Securities and Exchange Commission is more advanced than ASIC in its monitoring of these activities. It has already contended with the manipulation of some sharemarket investing, most notably one orchestrated by the Reddit community WallStreetBets which sent the price of GameSpot skyrocketing. An SEC investigation continues.

According to Putnins, local groups have had a pretty poor run in planning to inflate prices.

“These Australian pump and dumps seem to have died out,” he said in an interview.

“It seems not to have taken off. They attempted a few pumps. They moved a few stocks.

“It’s not happening on a large scale. It seems to have fizzled out. People got scared.”

Do you know more? rossd@theaustralian.com.au.

To view the full presentation given by Talis Putnins to ASIC investigators, go to theaustralian.com.au