The net beneficiaries will be the inefficient and declining petrol refining industry.

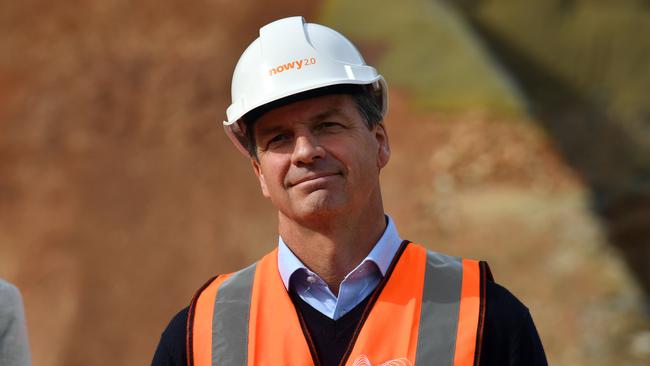

Taylor is presenting the package as a fuel security one, with the idea being some form of refining industry is as important in fuel security as storage tanks.

There is fast-declining oil from the Bass Strait and Cooper Basin but high hopes for the Beetaloo Basin in the Northern Territory and, if Australian can maintain at least two refiners compared to the present four, then the argument goes that it ensures fuel security for the country.

The package also sets increased minimum storage levels to ensure Australia has sufficient diesel and other supplies in the event of a supply-side shock, which looks a lot more real post-COVID than it did a year ago.

Not surprisingly, the refining industry came out strongly in favour of Taylor’s package as recognition of the industry’s importance to the country. Viva’s stock price recovered its losses after last week’s downgrade, closing up 4.7 per cent at $1.59, and Ampol rose 1.7 per cent at $24.02.

Now the timing of last week’s plea for help from Viva’s Scott Wyatt becomes plain for all to see because he will pocket $74m a year under the tariff plan, which imposes import duties of 1c a litre on imported product.

The product is refined offshore and made into diesel, aviation fuel or whatever, and the aim here is to penalise those imports in favour of local production.

In round terms, there are 160 litres of oil in a barrel so the tariff duty works out at $1.84 a barrel.

That is an increased impost that will be paid by consumers.

Matt Halliday at Ampol will pocket $63m, Mobil some $52m and BP about $88m.

The oligopoly also imports most of the product into the country and Wyatt at Viva, by way of example, imports half his output, so the cash grant may not be quite as good as it looks on paper.

The government wants to keep a domestic refinery industry and its numbers say the increased cost to consumers of imported fuel against local refined oil works out at about 1c a litre.

The bill will be paid by importers, but at the end of the day the refinery oligopoly will hand on the cost to consumers.

The importers include Chevron, United and 7-Eleven and the big mining companies who import diesel directly.

It beggars belief that someone with such a sound economics background as Taylor would resort to such blunt instruments as protectionism, which not only costs consumers money but, as the car industry history shows, is not guaranteed to save the industry.

But Taylor is unashamed in his belief that Australia needs to maintain a domestic refinery industry for its own economic and fuel security.

The rationale claimed is that this supports a wider industry network that both services the industry and uses its product.

Taylor would rather have some refining expertise on the ground so Australian oil is not shipped offshore then imported as refined product.

Question, then, whether this package is enough, but more to the point just why the policy is throwing money at an industry whose fundamental economics have been so shaky for so long.

Australian Institute of Petroleum figures show the four remaining refiners produce 27,800 megalitres of fuel a year between them, compared to the Asian refiners that produce between 30,000 and 70,000 each.

In other words, the smallest Asian refinery is bigger than all four Australian refiners combined.

Mobil is reported to have had its loss-making Altona refinery on the market for the past 18 months and, not surprisingly, it has not been rushed off its feet by potential buyers.

The support package includes $200m a year to support business in building increased storage capacity that is also directed at the refiners.

There are also increased fuel storage minimum requirements where again the refiners will be exempt, so this regulatory impost hurts importers and boosts refiners.

Fuel supply certainty has some merit, but it can be achieved in other ways than old-fashioned protectionism.

But that is what Taylor has imposed.

Fees message is clear

If the nine NAB fees-for-no-service pleas applied under the penalties introduced last year of up to $525m per offence, the $57.5m penalty would have been a multiple of that amount.

As it is, the penalties were a record with Federal Court judge David Yates saying: “Fees-for-no-service conduct is particularly egregious, having resulted in substantial financial loss for thousands of unsuspecting consumers.’’

ASIC has cases against Westpac and State Super that will also come under the old penalties, but the message is clear even in this case where the bank pleaded guilty.

The intensive corrections order against former Maple Brown Abbott trader Michael Ho last week shows ASIC is making ground in holding perpetrators to account. Unlike US and UK authorities, the Australian corporate plod cannot issue its own fines and must get them through the court process

Healthy digital outlook

Digital health is a global phenomenon, as shown by such deals as the recent $US18.5bn US merger between Teladoc and Livongo combining a virtual service care provider with a company specialising in monitoring conditions of diabetics and other illnesses.

In a decade, according to Lisa Suennen from US venture capital firm Manatt Digital, the industry has grown from $US300m to $US16bn ($22bn).

The key challenges for smaller markets like Australia are access to capital and the availability of technology entrepreneurs

As noted recently, ANDHealth’s Bronwyn Le Grice said some COVID regulatory changes and the rapid acceptability of telehealth was hoped to open the door in Australia to the wider digital health industry.

ANDHealth is a not-for-profit organisation aimed at bridging the gap for digital health companies to navigate the path from ideas to institutional backing to international markets.

Local success stories include DoseMe, which has technology to help on precise doses for patients and was acquired by US-based Tabula Rasa two years ago; Seer Medical, which provides ECG monitoring; and Vitalic Medical, which provides early health warnings.

The sector includes connected and wearable devices so doctors can monitor patients and only intervene if the treatment plans are off track.

Le Grice said changes were needed to allow for software to be treated as a medical device.

Federal Energy Minister Angus Taylor has resorted to a combination of old fashioned protectionist import tariff duties and straight subsidies in an attempt to boost Australia’s fuel security.