Production subsidies the focus of $2bn Hydrogen Headstart funding

The federal government’s Hydrogen Headstart fund will only back the cheapest green hydrogen projects and a tiny fraction of Australia’s pipeline, Senate estimates has revealed.

The federal government’s $2bn Hydrogen Headstart fund will back in production of 180,000 tonnes of green hydrogen a year, at most, a tiny fraction of Australia’s five million tonne project pipeline.

Officials from the department of energy and climate change confirmed the outline of the scheme to a Senate estimates committee this week, saying the fund, announced with the May 9 federal budget, will be limited to backing the cheapest two to three hydrogen projects capable of delivering green hydrogen.

Full details of the scheme are still under development but the department and the Australian Renewable Energy Agency, with input from state governments and industry.

But the head of the department’s adaptation and new industries division, Shane Gaddes, told a Senate estimates committee $2bn fund would likely be structured as a $2 to $4 a kilogram production credit – similar levels as those on offer to would-be hydrogen producers in the US under the Biden administration’s Inflation Reduction Act, though on a far smaller scale.

“It’s very similar to a scheme called the Fuel Security Services Payment, which is already in place and which supports refineries in Australia,” he said.

“It’s designed as a production credit. It’s paid at the time production occurs, and it fills the gap between the price at which the hydrogen is produced and the price at which it is sold.”

Mr Gaddes said the first funds are unlikely to flow until 2026 or 2027, with no cash to be handed out until a hydrogen project is in production, with the subsidy likely to underpin costs of the project and make sales agreements easier to sign.

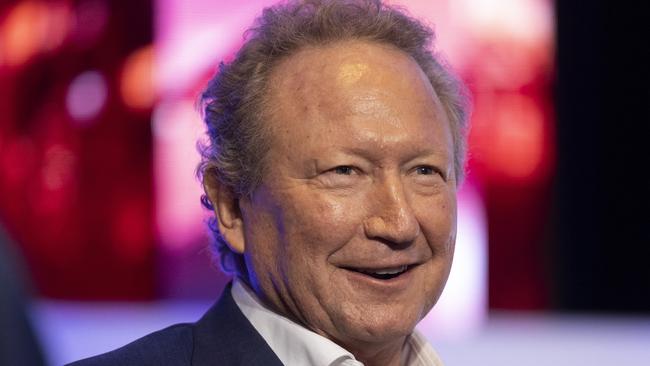

The details suggest major players such as Andrew Forrest’s Fortescue Future Industries sit in the box seat to capture the bulk of the funding, given FFI’s project – particularly the Gibson Island joint venture with Incitec Pivot in Queensland – are among the most advanced in the country.

In particular, Gibson Island is unlikely to need construction of dedicated renewable energy generation, with the Queensland state government signing up in early 2022 up to extend transmission lines to the facility to allow the delivery of power to the proposed plant.

The $2bn fund would only back in a tiny fraction of the hydrogen production needed to reach Australia’s ambitions of being a major exporter of the commodity, however, with Mr Gaddes telling the estimates committee Hydrogen Headstart is only likely to back facilities worth a combined 1000MW of capacity.

It takes 50 to 55 megawatt hours to produce a tonne of hydrogen, suggesting that the federal backing would support the production of a maximum of 180,000 tonnes a year – and in reality, far less than that, given that output would require running the plant 24 hours a day, 365 days a week.

Most estimates of power production from wind and solar generation assume an average capacity factor of about 50 per cent, and Geoscience Australia research has estimated a maximum capacity factor of about 64 per cent without firming power such as pumped hydro, suggesting the likely hydrogen total output will be closer to 90,000 to 100,000 tonnes a year.

That is only a tiny fraction of the 5.1 million tonnes of annual capacity of 48 hydrogen projects already in the development pipeline in Australia, according to figures contained in the federal government’s most recent State of Hydrogen report, released by energy minister Chris Bowen in April.

Mr Gaddes noted the initial $2bn program is likely to be followed up with further federal funding, and was designed to “pull through” some of that development pipeline by underpinning project economics.

“The Hydrogen Headstart program is designed to pull through the pipeline some of the investment in hydrogen which isn‘t reaching financial investment decision. Currently there’s $200bn to $300bn worth of investment announced but it hasn’t quite been able to reach the final investment decision because of the cost gap between the cost of producing and the market price for green hydrogen,” he said.

The federal government funding program was broadly welcomed by the hydrogen sector when the budget was delivered, with the Australian Hydrogen Council describing the package as a “strong signal” of support for the emerging industry in the face of fierce global competition for investment in the sector.

But to reach production levels required to build a significant hydrogen export industry by 2050, Australia would be required to build staggering amounts of solar and wind power, according to new research by Bloomberg’s New Energy Finance analysts.

BloombergNEF’s latest paper on Australia’s new energy outlook suggests that reaching production levels of 28 million tonnes of hydrogen a year by 2050 – about 5.7 per cent of the likely market share of the commodity – would require the construction of 812GW of wind and solar generation, 21 times the levels already installed in Australia today.

“The massive amounts of new wind and solar installed under the hydrogen export scenario requires $592bn in investment between 2022 and 2050,” BloombergNEF analysts say in the report.

“Around $369bn, or 62 per cent, will flow into new wind capacity, with the remaining $223bn going to solar.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout