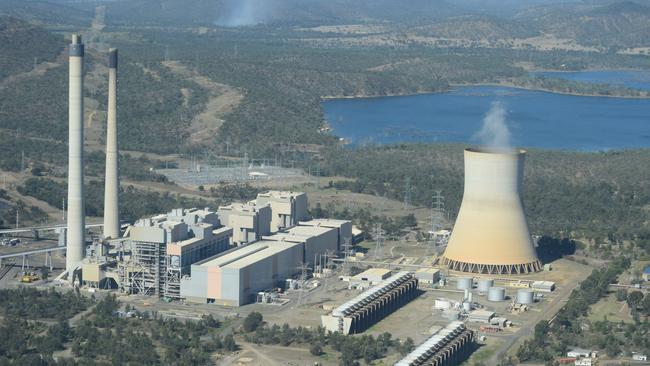

Private investor Sev.en wins latest round in the battle for control of the Callide C power station

Administrators have beat a retreat from the Callide C debacle, handing Czech investors a win and dealing a blow to the Queensland government’s plans to buy the power station asset.

The Queensland government’s plans to take full control of the Callide C power station have suffered a major blow, after administrators to the collapsed private company that owns half of the plant agreeing to step down on Thursday.

The decision of Deloitte administrators Richard Hughes and Grant Sparks to step down is a win for Czech investor Sev.en, which has been fighting for the removal of Deloitte since December, over claims Deloitte did not do enough to investigate the role of the Queensland government’s CS Energy in the explosion that crippled the plant in May 2021.

Deloitte will now make way for FTI Consulting’s John Park, appointed earlier this year by the federal court as a special purpose administrator with a brief to fully investigate the causes of the explosion.

As part of Thursday’s legal deal Deloitte, which had been arguing for creditors to be allowed to vote on an offer from CS Energy to buy out private investors in Callide C, agreed to pay the legal costs of both parties on an indemnity basis.

A spokesman for Deloitte said its partners would assist through the transition period as the administration was handed over to FTI.

“In recent days it became clear that continuing with our application may impact a potential outcome for creditors, and as result, we withdrew our applications to the Court,” the spokesman said.

The changeover effectively kills a plan to put a deal to the company’s creditors – of which CS Energy is the biggest – that would allow the state-owned power company to buy half of Callide C for about $230m.

The bulk of that amount, of about $170m, would be forgiveness of debts of the privately-owned company, IG Power Callide (IGPC), which collapsed into administration in March 2023 after a disagreement between its owners about whether to continue to pay the costs of rebuilding the plant.

Callide C was operated and half-owned by the Queensland government’s CS Energy, and half by the privately held Genuity Group — which in turn is 25 per cent-owned by Czech energy investor Sev.en, with China Huaneng Group and Guangdong Energy Group controlling the rest.

CS Energy is now likely to face far greater claims for compensation from Sev.en after The Australian’s reporting on the court case finally forced Queensland Premier Steven Miles to release a draft of a long awaited report of forensic engineer Sean Brady into the causes.

Dr Brady’s draft report, made public on Tuesday, said organisational failures and cost-cutting at CS Energy were a major contributors to the explosion of the Callide C turbine that has seen the power station out of action for most of the last three years.

The forensic engineer’s review of organisational factors also pointed to failings by the company’s management and board – and of the state government, which is CS Energy’s sole shareholder.

Between 2017 and the May 2021 explosion, Dr Brady says, Callide churned through four general managers, three maintenance managers and five production managers.

“This turnover would make it difficult to maintain a process safety focus,” Dr Brady’s report says.

Dr Brady’s report also noted that an internal CS Energy review warned of a dangerous backlog in maintenance at the generator, two years before it exploded in 2021.

This week the Queensland Premier ordered a review of CS Energy’s structure and operations, amid speculation that the state government intends to break up the company and split its assets between the state’s other power companies, Stanwell or CleanCo.

Mr Miles said on Tuesday the state government remained committed to bringing Callide C back into full public ownership.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout