Pressure on energy users as east coast gas prices jump 40pc

East coast wholesale gas prices paid by business and energy users jumped by nearly 40 per cent last year, according to EnergyQuest.

East coast wholesale gas prices paid by business and energy users jumped by nearly 40 per cent last year, while prices received by Origin Energy, Santos and Beach Energy jumped between 7 per cent and 14 per cent.

The figures, compiled by consultant EnergyQuest, show the growing impact of east coast LNG exports and increased gas power demand as older, cheaper gas contracts expire.

They contrast with a recent consultant report, commissioned by the COAG Energy Council, that the Australian Petroleum Production and Exploration Association said was “official” evidence that wholesale gas prices fell last year.

The conflicting price reports are partly driven by some price measurements only recording new prices while others, like the Australian Bureau of Statistics and producer data, include legacy contracts.

They back up a recent criticism from the International Energy Agency, which said Australia had weak energy data for a top global gas and coal exporter.

Even so, the figures underscore the acute pressure faced by business as wholesale gas prices escalate.

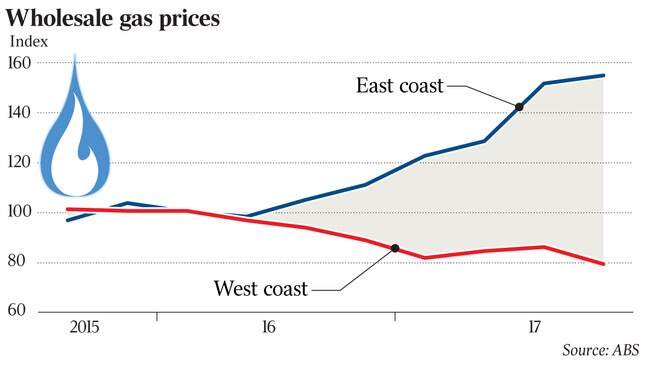

According to the ABS, which last year launched a new price index that tracks prices received by producers for natural gas on the domestic market, east coast domestic gas prices for the three months to December rose 39 per cent from a year earlier.

By comparison, West Australian prices slipped 11 per cent.

“There were substantial increases in east coast gas prices in 2017, both contract prices and short-term prices,” EnergyQuest managing director Graeme Bethune said.

The figures are compiled in the March edition of EnergyQuest’s quarterly report, which is generally regarded as the most comprehensive analysis of the nation’s gas industry and markets.

As reported in The Australian last month, wholesale spot prices, which make up a small part of the market, averaged more than 40 per cent higher in Sydney and Melbourne in 2017.

In January, Oakley Greenwood released its COAG-commissioned 2017 Gas Price Trends Review, which said east coast average wholesale gas prices had fallen 6 per cent in 2017 after a 29 per cent jump in 2016.

“This was subsequently quoted by APPEA but is contrary to all 11 other gas price indicators,” EnergyQuest said. The other indicators include five spot markets operated by AEMO (up between 15 per cent and 44 per cent), Origin (up 5 per cent), Santos (up 14 per cent), Beach (up 7 per cent), the ABS wholesale gas index (up 34 per cent), ABS manufacturing gas costs index (up 13 per cent) and the ABS consumer price index east coast cost index (up 6 per cent).

The major difference in the Oakley Greenwood report from the other indicators is that it looks at new contract prices.

This means it does not take into account average prices paid in a market where many big users still have legacy contracts of $3 or $4 a gigajoule, deals done before Gladstone’s big gas freezers started up.

The growing average price is partly due to these contracts rolling off and consumers signing new ones at up to three times their old prices.

Oakley Greenwood’s report actually has the second-highest 2017 gas price, of $9.19 per gigajoule, of the 11 indicators, coming in second only to Sydney spot prices of $9.21.

Thanks to legacy contracts, the average received price of Origin, Santos and Beach were still about $6 per gigajoule. The Oakley Greenwood report backs up findings of the ACCC in December that offers for new contracts had come down to a level of $8 to $10 per gigajoule, from some offers of more than $15 before Malcolm Turnbull threatened to put in place export restrictions.

The quality of Australia’s official data was criticised by the International Energy Agency last month in its review of our energy policies.

“Australia is a leading coal exporter and is becoming a major gas exporter but the weakness of data remains a concern, including for assessing gas supply adequacy and energy security,” the IEA said. “One example is the gas sector, where insufficient reliable and transparent data on gas supply, storage, transportation and gas consumption by power generation are hampering the analysis of gas security challenges.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout