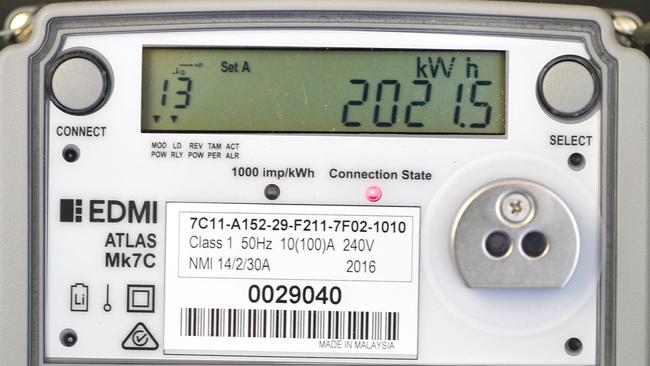

Power companies in electricity bill push

The energy companies’ move to keep in place a set profit margin for electricity retailers may stifle efforts to reduce household bills.

Top energy companies have raised the alarm on official calculations used to guide electricity bills, warning their customer profit margins have sunk to decade lows and soured the appetite of the biggest operators to invest money in the sector.

The energy companies’ move to keep in place a set profit margin for electricity retailers may stifle efforts to reduce household bills when the next round of price caps take effect from July 1 next year.

The Australian Energy Council – representing big power companies such as AGL Energy, Origin Energy and EnergyAustralia – commissioned consultancy Marsden Jacob Associates to conduct a private probe into how the national regulator determined the default market offer, which sets a price cap on how much energy retailers can charge consumers.

Sources said several energy companies had raised issues over the price-cap assumptions and wanted to test the national tsar, the Australian Energy Regulator, over its methods for calculating the offer. The challenge by the industry, if successful, puts pressure on the regulator to retain industry profit margins during a national cost-of-living crisis.

The AER has approved two consecutive years of price rises of up to 20 per cent, at a testing time for the economy following 13 interest rate rises and soaring levels of inflation. However, the council representing the big energy companies said current margins for their retail customers were too thin, noting the industry had been competing in a highly volatile and challenging environment.

“The AEC understands the balance the AER needs to find when setting the default market offer price, between protecting customers from unreasonably high prices, supporting reasonable and efficient margins and supporting competition,” the AEC said in a submission to the AER ahead of a determination on the 2024 offer.

“The AEC considers that in recent years the pendulum has swung well away from supporting reasonable and efficient margins and that the retail market is becoming increasingly unattractive as a site for equity investment.”

An AER issues paper is the first step in setting the 2024-25 default market offer, with a final determination to take effect from July 1.

“We are currently looking at all the issues raised by stakeholders in their submissions,” the AER said on Wednesday.

“Our draft determination will include a response to stakeholder submissions and is due out in March 2024.”

Electricity retailers have become concerned the default market offer could be cut as the regulator balances tough household budgets with adequate returns to industry players.

Large retailers use the default offer as a yardstick to set their own offers for customers on market contracts.

A potential cut by the AER in its estimates for retail costs, reflecting a company’s operating expenses, has also caused concern among many large companies.

A retail allowance of 10 per cent for households and 15 per cent for businesses was set but is up for review as part of next year’s settings.

“The AEC is concerned that there may be calls to reduce the retail allowance in the next default market offer due to concerns about overall cost-of-living pressures,” the AEC said in a statement on its website.

EnergyAustralia pointed out that 11 retailers had exited the market in the past 18 months and noted that residential customers had gradually declined from a peak of 8.9 per cent in 2016-17 to 2.5 per cent of total costs in 2021-22, marking the lowest retail margin on record.

Still, consumer advocate groups have told the national regulator that households must be protected from bill shocks.

Energy Consumers Australia said a retail margin of 10 per cent for residential consumers and 15 per cent for small businesses “does not give adequate weight to the AER’s objective to protect consumers from unreasonable prices”.

“We believe there is significant risk and headroom built into other elements of the cost stack that further negate the need for such a high retail margin,” the consumer group said.

The prospect of a spending freeze arrives at a time of heightened uncertainty in the energy sector after the Albanese government expanded the capacity investment scheme to deliver new battery, wind, solar and pumped hydro generation.

A record number of Australian households are struggling to pay their electricity bills after prices rose by as much as 28 per cent in the year ended June 30, the country’s energy regulator said.

The AER earlier this year approved price increases for much of the country by as much as 25 per cent to allow retailers to recoup losses incurred when a global energy crunch sent their costs to near record levels.

Alinta Energy said one solution to the standoff would be for the regulator to set a maximum percentage differential between an energy retailer’s default and market offer prices.

“This approach would protect consumers from unreasonable prices (a retailer setting an unreasonably high standing offer price would be priced out of the competitive market) whilst retaining incentives for consumers to engage in the market by permitting discounts in market offers of, in the above example, up to 20 per cent,” Alinta said.

Profits have been choppy for Australia’s big energy retailers in the last few years.

AGL posted 2023 underlying profit after tax of $281m, up by nearly a quarter from the previous year, although on a statutory basis it was hit by an annual net loss of $1.26bn.

Origin Energy swung to an annual profit of $1.05bn, driven by record gas prices amid the global energy crunch, while EnergyAustralia recorded losses of more than $100m for the first six months of 2023.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout