PNG gas project nears deal in boost for Oil Search and Santos

A gas agreement is set to be signed for the delayed P’nyang project in Papua New Guinea, boosting the business case for the $21bn Santos-Oil Search merger.

A long-delayed agreement for Papua New Guinea’s P’nyang gas field is set to be signed, lifting the prospects of an LNG expansion and boosting the value Santos stands to gain from a $21bn merger with Oil Search.

ExxonMobil, the operator of the P’nyang gas field, has been locked in talks with the government in Port Moresby and may sign terms for an agreement as early as this week, sources told The Australian.

Moving ahead with a deal on P’nyang will strengthen the merger case for Santos given the combined clout it will gain in PNG should the tie-up proceed.

Conversely, it may also fuel criticism that Oil Search could have been able to strike a better deal for itself from Santos given the value of its P’nyang holding.

Oil Search owns 38.5 per cent of the P’nyang venture, but Santos does not own a stake.

The major gas field could expand the existing PNG LNG plant part-owned by Oil Search and Santos or provide extra gas to top up that facility once existing fields begin to run out.

The P’nyang project has proved a tussle between Exxon, which operates PNG LNG, and the government dating back to 2019, when talks broke down after the US major failed to offer more generous terms.

PNG has been under pressure to secure a better outcome for the state over concern it failed to strike a competitive deal for the original PNG LNG plant, which started operating in 2014 and is jointly owned by Oil Search, Exxon and Santos.

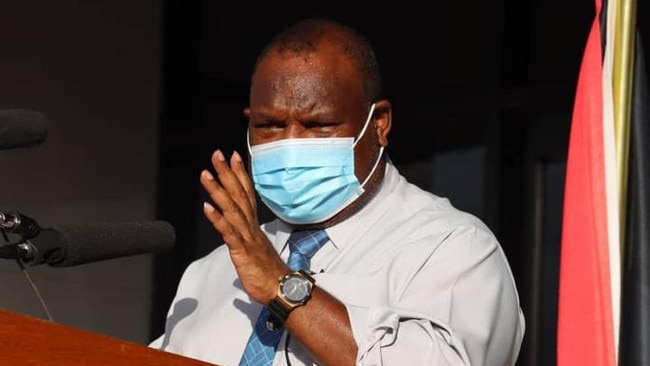

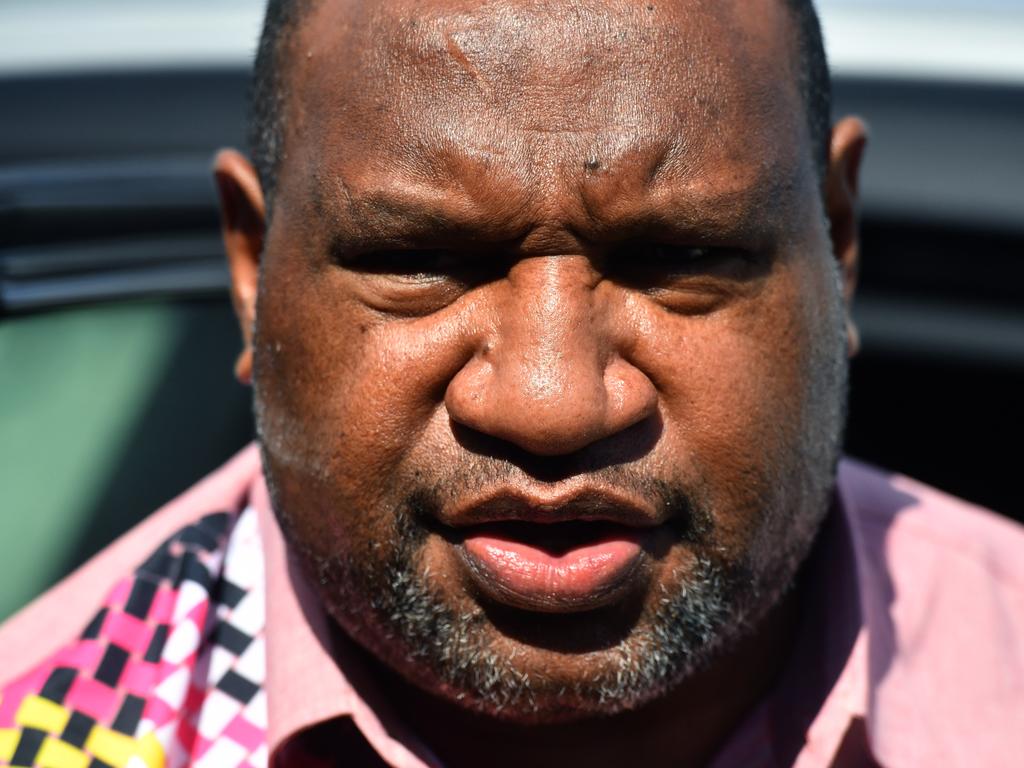

With PNG looking to ask Australia for a new loan for up to $580m to help repair its ailing budget, Prime Minister James Marape has been under pressure to deliver P’nyang and ensure a next local leg of gas expansion occurs later this decade.

Mr Marape, due to deliver a speech on PNG’s resources industry at a Brisbane conference on Wednesday, already ratcheted up tensions for the merger after sending Santos a letter confirming the Pacific nation wants an extra 10 per cent stake in the lucrative PNG LNG project.

The blockbuster merger, recommended by Oil Search, would hand Santos 42.5 per cent of PNG LNG once it adds Oil Search’s stake to its own smaller share. Most investors expect Santos chief executive Kevin Gallagher to then sell up to 10 per cent to ensure it does not have a higher stake than operator Exxon’s 33.2 per cent holding.

It may also prove a commercial headache given expectations that Santos would look to sell the 10 per cent stake at market rates to either ExxonMobil or through a swap deal with France’s TotalEnergie, giving it a foothold in the Papua LNG project.

The two companies have signed a merger agreement, with Santos controlling 61.5 per cent of the beefed-up producer to Oil Search’s 38.5 per cent, a sweetener to the previous 63-37 per cent ratio rejected by Oil Search’s board.

Still, The Australian has reported a number of large Oil Search shareholders are against the gas producer’s merger, amid ongoing concern the company is being handed over too cheaply to one of its major energy rivals.

Credit Suisse said a degree of investor unease was justified but is not convinced voting on December 7 against the tie-up will produce change and expects a deal to win sufficient support.

“We can understand some investors harbouring misgivings about Oil Search’s sale process (or lack thereof) and value … but struggle to see how voting down the merger will improve the situation in the near term,” Credit Suisse analyst Saul Kavonic said.

It “would leave the company in the hands of the very board that is responsible for this situation arising”.

Several investors have canvassed the possibility of former Oil Search chief executive Peter Botten returning to the company as chairman, replacing Rick Lee, should the company vote down the proposal and remain an independent entity. The three proxies – Ownership Matters, ISS and CGI – have recommended the tie-up despite concern the company is being handed over too cheaply to a major rival.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout