Origin gas boost as revenues double

The power giant cashed in on strong gas prices and secured half of its coal supply for 2023

Bumper gas prices have delivered for Origin Energy with a record $1.6bn cash payout from its APLNG project, while it started to lock away new volumes of coal to supply its Eraring power plant in 2023 after supply issues earlier this year.

While production from its stake in the Australia Pacific LNG project in Queensland was flat at 170.5 petajoules for the June quarter, revenue more than doubled to $2.74bn from $1.35bn a year earlier with average commodity prices lifting to $16.43 per gigajoule.

Upstream production from APLNG of 692PJ was in line with guidance of 685-710PJ. Annual revenue for the gas export project of $9.26bn beat a Macquarie estimate of $9.15bn with the broker forecasting a further 30 per cent jump next year.

The electricity and gas retailer is one of three Queensland LNG producers in the crosshairs of a review of the gas trigger being undertaken by the Albanese government despite being a ‘net contributor’ to the domestic market, the broker noted.

“The risk beyond oil price is the ADGSM review, and how the government may intervene to ensure domestic volumes are adequate and prices are lower,” Macquarie said.

A $2.2bn non-cash impairment will be recorded at its upcoming 2022 results, sparked by a $4.4bn rise of in-the-money derivative assets connected with the hedging of high wholesale electricity and gas prices.

The writedown will be booked to statutory profit and will only affect goodwill — with no tax impact.

Ord Minnett noted the writedown had been driven higher by wholesale prices which should have a positive impact on cashflow.

“While the asset writedown could be perceived negatively, it actually reflects better market conditions with elevated forward prices likely meaning improved cashflow,” Ord Minnett said.

Electricity sales rose 6 per cent to 9.5 terawatt hours on the prior three months while gas sales jumped 61 per cent to 69PJs, reflecting high demand for the fuel in the national electricity market after coal shortages hit in the second quarter.

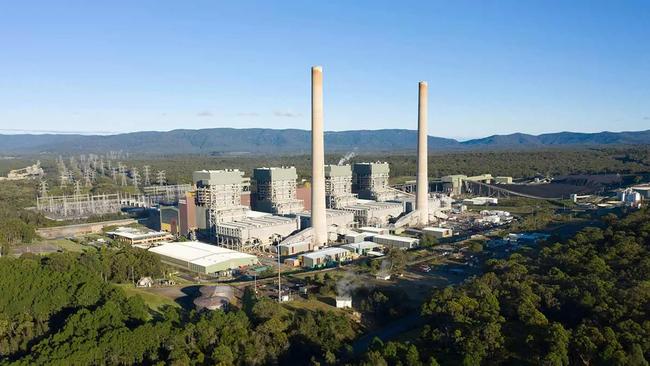

Origin was hit earlier this year with coal supply issues at its Eraring power station in NSW but said it had now contracted 3 million tonnes or roughly half of its targeted supply for the 2023 financial year, easing concerns in the market amid a period of high wholesale prices.

The problems with its energy markets business have in part been caused by issues with its supplier, Centennial Coal, which is struggling with production constraints at its Mandalong mine.

Deliveries from the Mandalong mine are expected to be interrupted during the remainder of this financial year and into the first half of the 2023 financial year. Equipment supply chain delays are also expected to affect coal deliveries in the 2023 financial year.

The spotlight will fall on pricing given rocketing commodity prices, however, with Origin noting on Friday that contracted supplies were from both legacy priced contracts and contracts priced at market forward prices at the time of contracting.

The power giant slashed its energy markets earnings forecast for 2022 by a quarter on June 1 and withdrew earnings guidance for the 2023 financial year amid huge volatility in electricity markets and coal supply problems at its Eraring plant in NSW.

The power operator said energy markets’ underlying earnings would fall by 26 per cent at the mid-range to $310m-$460m, from the original guidance of $450m-$600m.

Across the national electricity market wholesale electricity prices more than tripled in the second quarter of 2022 to average $264 per megawatt hour compared with $87MWh in the first three months of this year, the Australian Energy Market Operator said, with Queensland and NSW posting the highest prices.

Gas prices across the east coast markets also soared to more than $28 per gigajoule on average from less than $10/GJ in the first quarter, and peaked at more than $41/GJ on June 30, exceeding international LNG netback prices in both May and June as Russia’s restrictions on supply roiled global markets.

Origin shares closed up 4.2 per cent at $5.94.