Australian needs policies to promote gas, says Origin Energy CEO after swinging to profit

Energy boss Frank Calabria says the nation must incentivise new gas fired power generation capacity, and authorities will need to develop plans to smoothly manage the retirement of coal.

Australia must incentivise new gas fired power generation capacity — and authorities will need to develop plans to smoothly manage the exit of coal — to ensure the nation can meet “staggering” green targets, the boss of the nation’s largest energy retailer has warned.

Origin Energy chief executive Frank Calabria described the scale of moving quickly to renewables as “staggering” and requiring significant investments, warning Australia still does not have the correct policy settings to drive the much-needed spend.

A capacity investment scheme, agreed to late last year by national and federal energy ministers, is the centrepiece of Australia’s plan to ensure sufficient power generation is available as traditional coal power stations retire.

The scheme sees the government underwrite revenue for a mix of zero emissions dispatchable generation and storage projects, but gas is exempt.

“The proposed capacity investment scheme excludes gas fired peaking generation, and we do think that will be needed when coal goes out,” Mr Calabria told The Australian.

“The second thing is there is no mechanism for the orderly exit of coal, and it would be better if we had one. We have the road maps in NSW and the federal government has its capacity investment scheme that looks to bring more storage into the system, but I don’t think these are the complete answers for an orderly transition.”

Origin has endured a rollercoaster two years, but the company on Thursday said it has swung to an annual profit of $1.05bn, driven by record gas prices amid the global energy crunch.

The utility last year reported a $1.53bn loss, but the company recorded strong revenues across its asset base after a global energy crunch sent the price of gas to record highs and Australian regulators approved increases to household and business bills that allowed retailers to recoup losses incurred in the previous year.

Origin said it expects to see further growth in its 2024 financial results as energy prices remain high, before gains temper in 2025.

Macquarie analyst Ian Myles said the outlook on electricity prices was in stark contrast to AGL Energy, which last week warned of only limited relief, if any.

“The flagging of peak electricity earnings sits in conflict with AGL’s comments, but possibly reflects Origin’s small long coal position and maybe the impact of batteries in gas,” said Mr Myles in a note to clients.

Without the security of gas that can be turned on and off quickly, Australia’s energy industry is alarmed about the prospect of coal exiting the system before being adequately replaced, which would inevitably send the price of electricity soaring.

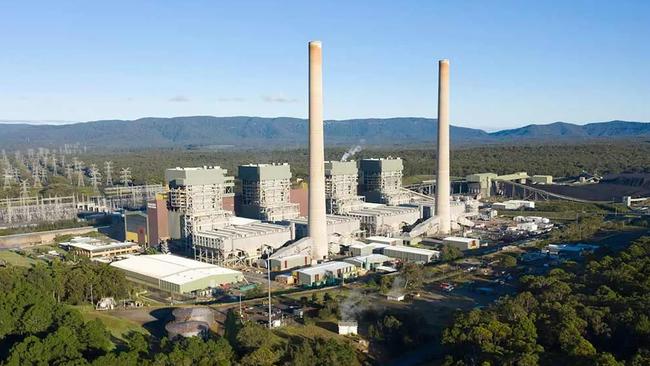

Origin finds itself in the midst of the issue as it mulls when to mothball its Eraring coal power station. Origin has said it intends to close the generator, which provides about a quarter of NSW’s energy needs, as early as August 2025.

Mr Calabria said there is no change in Origin’s so-called “base case”, but said the company is working though its assessment of the market readiness of withdrawing Eraring 2880MW capacity from the system.

Mr Calabria told The Australian the company was working through the considerations and the rest of the year was a “key” time for the company as it mulls when it can retire Eraring. A final decision, Mr Calabria said, would need to made 18 months prior to August 2025.

A premature exit of Eraring would send the wholesale price of electricity soaring in 2026, which would flow through to households and businesses in 2027, but the market remains anxious over the decision.

Authorities are also under pressure to ensure Eraring exits only when it has been adequately replaced.

Australia – one of the world’s largest emitters on a per capita basis – has set ambitious targets of rapidly phasing out the use of coal to generate electricity. The Albanese government has legislated targets of having renewable energy provide 82 per cent of the country’s electricity by the end of the decade. Coal currently generates about 60 per cent of Australia’s electricity.

Prime Minister Anthony Albanese insists gas will be vital to supporting renewables, providing so-called firming capacity, an energy source that can generate electricity when the sun is not shining or the wind is not blowing.

Critics of the government have, however, highlighted recent legislation such as the mandatory code of conduct – that gas developers say curtails investment in new supplies – as undercutting those claims.

Efforts to harmonise energy policy have been hamstrung by states, primarily Victoria. Australia’s second most populous state led opposition in 2022 to including gas in a capacity mechanism that would have paid generators – albeit renewables or gas – to guarantee supply.

Higher electricity bills risks undermining public support for the energy transition that is vital if Australia is to meet its carbon emission reduction goals, but it threatens the longer term profitability outlook for retailers like Origin.

Origin said the board has approved a fully franked final dividend of 20c a share, taking the total for the year to 36.5c a share.

The result will be welcomed by Origin shareholders and demonstrates the rationale behind Brookfield and MidOcean’s $18.7bn offer for Australia’s largest electricity and gas retailer, but it will likely stoke public frustrations about the profitability of utility companies amid a cost of living squeeze of the wider public.

Mr Calabria said Origin will increase its spend on supporting customers struggling to pay their bills.

The annual result could be Origin’s last as a publicly listed company.

The Australian Consumer and Competition Commission is reviewing the bid from Brookfield and MidOcean, a deal that is seen as a watershed moment for Australia’s energy transition aspirations.

Should the competition regulator approve the deal, Australia is likely to accelerate its transition away from fossil fuels. Keen to satisfy the public interest test of the regulator, Brookfield and EIG said investment in new clean energy would now total between $20bn and $30bn.

Under the deal, Brookfield and MidOcean will split up Origin, with Brookfield taking its energy markets business – including power generation, trading and retailing – and MidOcean buying its 27.5 per cent stake in Australia Pacific LNG.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout