Origin Energy says power price rises won’t be crippling and market intervention ‘is working’

Frank Calabria says domestic price rises at the higher end of pessimistic predictions might be avoided.

Looming electricity price increases might not be as bad as first feared, Origin Energy said, as the Australian Energy Regulator signalled a controversial intervention in the market had led to record wholesale prices cooling off.

Treasury has previously forecast that wholesale electricity prices would remain high through to at least 2024, with prices rising 23 per cent in the year ahead instead of 36 per cent without the intervention measures.

Origin chief executive Frank Calabria told The Australian it had been well-flagged that price increases could be “up towards even 30 per cent or higher’’.

But he said a tailing off in forecasts for future wholesale prices meant increases at the higher end of the scale might be avoided.

“The government is obviously very focused on that … (but) they’re seeing the forward indicator of prices coming down, and so that will feed in, as will (the higher prices before that) to its calculation.”

“That will have an impact of reducing what would otherwise have been a higher percentage increase so that's the thing that’s still playing through.’’

The Origin chief – juggling a $18.4bn takeover bid led by Brookfield Asset Management – said forward-looking data was not yet in, and would filter through over the next couple of months.

“You’ve got this lagged recovery. But if the wholesale price that you’re seeing sustains itself and continues, then you’d expect that to moderate over time in terms of prices.’’

The Australian Energy Regulator’s latest wholesale markets report, released on Thursday, backs Mr Calabria’s analysis.

AER chair Clare Savage said while wholesale prices remained high, early indications suggest that the outlook for 2023, while still carrying risk, may have improved.

“A reduction in forward contract prices were observed since discussion of market intervention began with the October Budget and continued following the announcement of coal and gas price caps by national cabinet in December 2022,’’ Ms Savage said.

“While lower spot prices were also observed, there are likely other contributing factors and it remains too early to tell what impact the interventions have had on spot outcomes but, we will continue to monitor and report on the effect of the price caps on both forward contract and spot prices.’’

In the December quarter wholesale gas and electricity prices fell from the record-high levels earlier in the year, but remained higher than prices for the same period in 2021.

New South Wales and Victoria are expected to record the highest electricity prices

over 2023.

The actual price impact on consumers going forward remains uncertain, with power price relief for households well flagged for the May federal budget as cost of living pressures continue to bite.

Origin also said on Thursday it was not putting a timeline on a potential binding takeover bid from suitors Brookfield Asset Management and EIG Partners, but said talks over the $18.4bn proposal “continue to be constructive and ongoing’’.

Mr Calabria also batted away suggestions that an alternative to a full bid for the company was being contemplated, telling an analyst call on Thursday the conversations were “focused on the consortium proposal before us’’.

There have been rumours in the market that EIG Partners has been close to walking away from the deal, which was pitched in early November at $9 per share.

Origin shares closed at $6.88 on Thursday, down 3.2 per cent, valuing the company at slightly more than $12bn.

While releasing its first half results to the ASX on Thursday, Origin issued a separate statement reiterating that the parties remained engaged in a constructive dialogue.

“Origin advises that the consortium has substantially completed due diligence and active

engagement continues on a non-exclusive basis in relation to the submission of a binding

proposal,’’ it told the ASX.

“Any binding proposal will be subject to a number of conditions, including approval from the ACCC and FIRB and other terms and conditions, which will be subject to negotiation between the parties as part of a scheme implementation deed.

“At this stage, shareholders do not need to take any action and Origin will continue to keep shareholders updated in accordance with its continuous disclosure obligations.’’

In response to a question from an analyst, Mr Calabria declined to put a timeline on the process, saying the talks “continue to be constructive and ongoing’’.

RBC Capital Markets said recent and flagged future interventions by the federal government in the gas market, the latter of which could adversely affect the company’s APLNG gas export terminal if instituted, “may be of some concern’’ to EIG.

“We continue to see no major roadblocks to the non-binding and indicative offer for Origin by Brookfield and EIG progressing to a formal bid, however gas market legislation changes since the initial offer have raised concerns with respect to the outlook for future East Coast domestic gas pricing and could possibly impact APLNG contractual LNG exports,’’ the broker said.

“This creates increased potential for a price revisit by the consortium, in our view.’’

Mr Calabria told The Australian on Thursday that in the event the transaction did not go through, the company was nevertheless well-placed to source the capital needed to make the transition to a greener energy economy in coming years.

“If we weren’t subject to the takeover bid, we’d be very clear that we would partner with organisations, of which there are many, that are investing in renewables, storage and distributed energy, but we would be doing that alongside them. There’s no shortage of capital available for us to be able to invest in the transition.

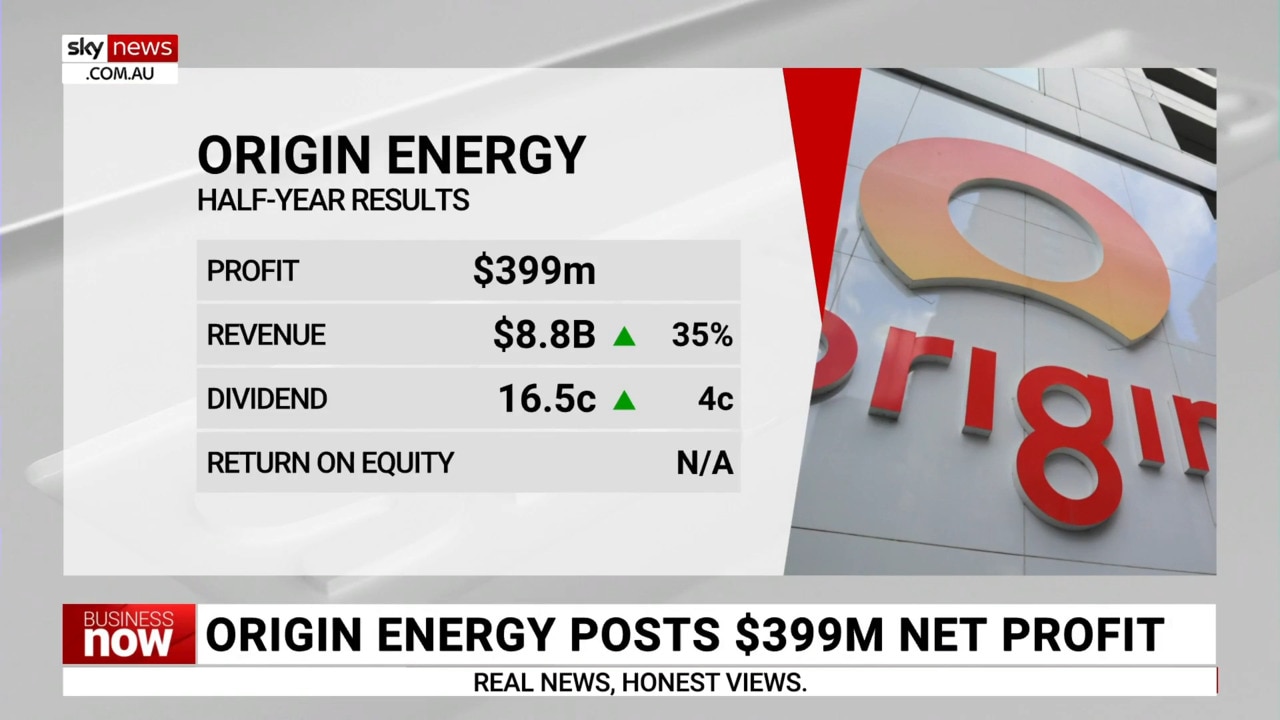

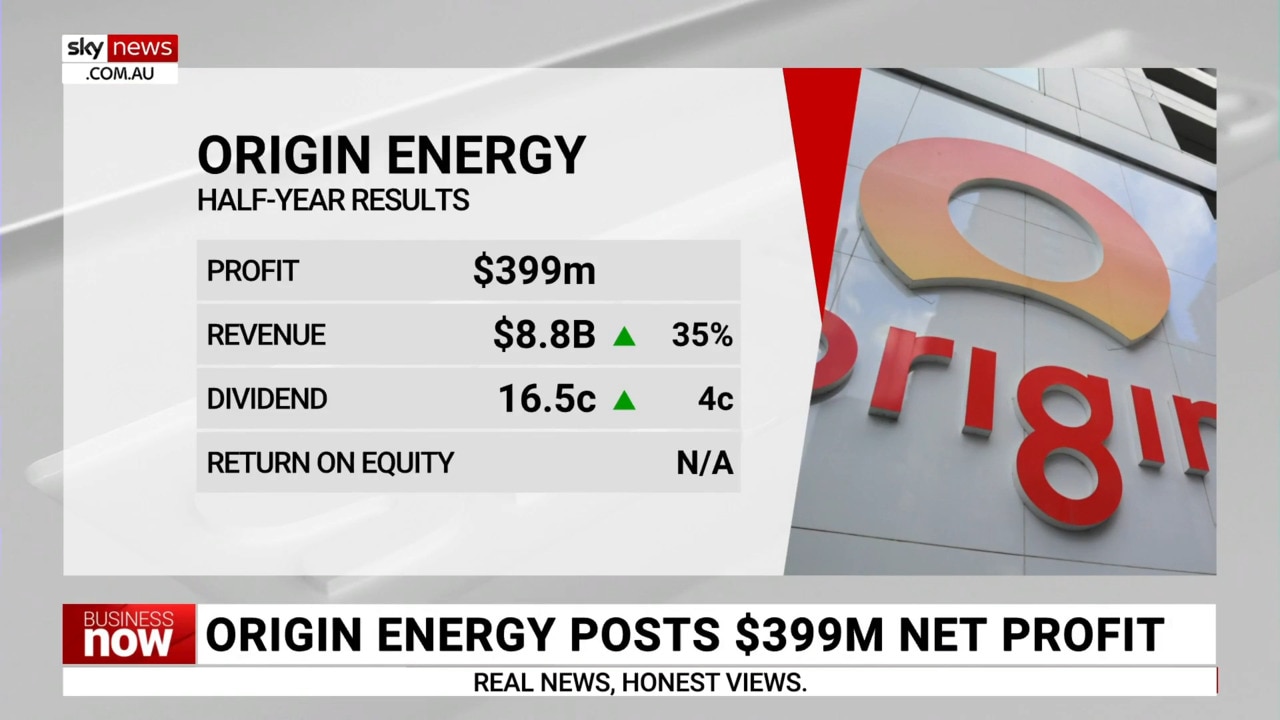

Origin on Thursday reported a statutory net profit of $399m, up from a $131m loss in the previous corresponding period.

Underlying profit fell $224m to $44m, with Origin saying that higher earnings from its integrated gas business were offset by lower earnings in energy markets, along with an income tax expense associated with unfranked distributions from Australia Pacific LNG.

Mr Calabria said the first half result was “mixed, reflecting a higher earnings contribution from integrated gas, contrasted with more challenging conditions for energy markets resulting in lower earnings from that business’’.

“Australia Pacific LNG, which continued to be a major supplier to the domestic gas market, delivered a strong cash distribution to Origin of $783m.

“In energy markets, the electricity business was adversely impacted by the under-recovery of higher wholesale costs in customer tariffs.’’

Regarding the company’s Eraring coal-fired power station, Mr Calabria said the base case remained to close that facility in August 2025.

“When we made the announcement and even since then we have been consistent that we would continue to monitor the market that’s going through a transition,’’ he said.

“That watching brief has always been a precondition of that and we will continue to do that.

“You can see that there’s a lot going on in the transition and the timing of new assets and developments coming on is a key consideration.’’

Origin in January upgraded its full year earnings outlook from underlying EBITDA of $500m-$650m to $600m-$730m.

On Thursday the company said it now expected the full year result to come in at the higher end of this range.

“Since providing an update to guidance on 27 January 2023, operating and trading performance, including at (UK energy retailer) Octopus, has continued to improve and as a result, energy markets’ underlying EBITDA for FY2023 is now expected to be towards the higher end of the $600m-$730m range,’’ the company said.

“This excludes the impact of the introduction of the legislated coal price cap.’’

The company said its domestic gas business was performing well, driven by higher sales to business customers.

“The retail business also performed well, driven by significant growth of community energy services and the addition of 30,000 customer accounts,’’ Origin said.

Underlying EBITDA in the integrated gas business increased 10 per cent to $954m due to higher realised oil prices, partly offset by losses from hedging associated with higher commodity prices.

Origin said its virtual power plant program had grown from 258MW in June to 449MW in December, with the company aiming to grow this to 2GW.

Origin will pay a fully franked dividend of 16.5c per share, up from an unfranked dividend of 12.5 per share in the previous first half. The dividend will be paid on March 24 to shareholders registered on March 1.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout