Origin Energy fields $18.4bn takeover bid from Brookfield Asset Management

Origin shares soar 35 per cent as analysts say Brookfield’s bid, which would split the energy giant in two, is a knockout offer with just one hurdle.

The $18.4bn takeover bid for Origin Energy is “very likely to succeed”, according to CLSA, which views the deal as a knockout offer.

Origin shares are up 35.5 per cent to $7.87 - the highest since January 2020 - and the $9 per share offer from Brookfield and EIG marked the consortium’s third offer after negotiations first kicked off in August.

A “takeover by Brookfield/EIG at 55 per cent premium is very likely to succeed,” CLSA analyst Daniel Butcher said.

“We view the deal as a knockout offer. The conditions are fairly standard - due diligence, ACCC, FIRB - so we believe the risks to the deal becoming binding are quite low.”

Brookfield has pledged to spend $20bn funding Origin’s firmed renewables investments through to 2030 but CLSA did sound a note of caution questioning where the valuation upside would emerge for the bidders.

“Both bidders seem rock solid in their interest. But we find it hard to understand the level of value they see.”

Brookfield lobbed two takeover bids for AGL Energy earlier this year and its Origin play signals any interest in the Mike Cannon-Brookes’ backed rival has now evaporated.

“This deal makes a further takeover bid for AGL by Brookfield/Grok look very unlikely,” Mr Butcher said. “We already surmised that Grok’s interest would wane after Mike Cannon-Brookes got his way with the early closure of Loy Yang A. If EIG buys Origin energy markets, it cannot also buy AGL, for competition reasons.”

Origin Energy plans to recommend a $18.4bn takeover offer from Brookfield and EIG, marking one of the sector’s biggest buyout bids at a time of surging profits for the company’s gas business.

The $9 per share bid would see Origin split into two and follows an earlier indicative proposal from the consortium to acquire Origin for $7.95 cash per share on August 8.

The bidders then made a further pitch at $8.70 to $8.90 a share with Origin’s board taking part in initial talks which led to the $9 per share bid, up 16 per cent on its initial proposal.

The proposal from the consortium proposes that ultimately Brookfield would acquire Origin’s energy markets business comprising electricity and gas retailing and EIG’s MidOcean unit would acquire the integrated gas business which includes the prized APLNG export plant in Queensland.

However, the bid to buy Origin Energy’s power retail and supply business may face hurdles from the competition regulator given the Canadian company’s ownership of Victoria’s electricity transmission operator AusNet, MST Marquee said.

“There is probably a fair question about ACCC approval given Brookfield owns Ausnet,” MST Marquee analyst Mark Samter said.

No combination of electricity generation and transmission has taken place since the national electricity market was created in 1998.

Looming government intervention in the domestic gas market may also distort the earnings outlook, potentially creating problems for Brookfield and its consortium partner EIG.

“I would also be very interested to understand any potential ramifications on price etc from government intervention over the next couple of months too, which could clearly materially change the earnings outlook for both parts of the business,” Mr Samter said.

Origin’s board has entered into an exclusive agreement with the bidders and intends to grant due diligence and ultimately back the deal should a binding bid be tabled.

“Based on current information and market conditions, if the consortium makes a binding offer at $9.00 cash per share, then it is the current intention of the Origin board to unanimously recommend that shareholders vote in favour of the proposal, in the absence of a superior proposal,” Origin said.

The offer is pitched at a 54.9 per cent premium to Origin’s last closing share price of $5.81 on November 9 and a 56.3 per cent lift on the three-month volume weighted average price of $5.76 per share on November 9.

“This proposal confirms that Origin, its operations and management team represent a highly strategic platform, well-placed to benefit from the energy transition. Our confidence in Origin’s prospects underscored our engagement with the Consortium and delivered a material increase on their initial offer. While the due diligence process advances, we will remain focused on the successful execution of our strategy,” Origin chairman Scott Perkins said.

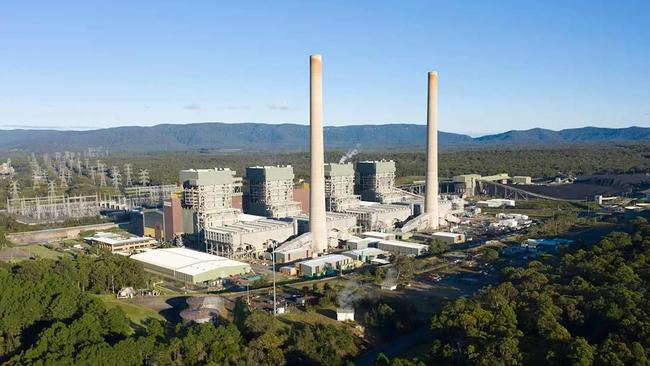

Origin has 4.5 million customers spread and operates Australia’s biggest coal power plant — Eraring in NSW — along with a 27.5 per cent stake in the Australia Pacific LNG project in Queensland.

Receiving Foreign Investment Review Board clearance looms as a major hurdle given the optics of foreign companies taking control of one of Australia’s biggest gas and electricity companies as the Albanese government juggles intervention to ease mounting cost of living pressures.

Analysts also pointed to the potential impact of intervention blunting the overall valuation of companies like Origin depending on which measures are taken by Labor.

The deal also signals Brookfield has likely walked away from acquiring one of Origin‘s chief rivals, AGL Energy, after it was foiled twice with takeover bids lobbed in a consortium with Mike Cannon-Brookes.

It also shows the ongoing appetite of EIG for big gas deals after it was foiled in its attempt to buy a 10 per cent stake in the Australia Pacific LNG project in Queensland last year with energy giant ConocoPhillips pre-empting the $2.1bn sale.

MidOcean in October bought stakes in four of Australia’s largest LNG projects in a $US2.15bn ($3.4bn) deal, marking the latest shake up in the booming sector.

Its parent company, EIG, also failed to buy Santos in a $13bn-plus deal back in 2018.

The deal lands at a time of huge upheaval in Australia’s energy sector with the threat of intervention by the Albanese government expected within weeks as it seeks to bring down gas prices for manufacturers.

Companies including Origin are also caught in a pincer as they work to wind down giant coal plants and accelerate a switch to renewables amid historically high wholesale electricity prices.

Origin chief executive Frank Calabria said the company was in a strong position to lead the energy transition.

“Over the past year, Origin has executed a number of important strategic initiatives that have strengthened the balance sheet, sharpened our strategic focus and positioned the company to prosper from the energy transition,” Mr Calabria said.

“At the same time, we have a dedicated, engaged and highly-skilled workforce who are committed to delivering good outcomes for our customers and communities. We believe Origin is in a strong position to lead the energy transition, capture opportunities and create value for shareholders.”

Origin boosted revenues to $2.77bn in the September quarter and nearly doubled the price of gas sold on the East Coast, the latest pressure point for Anthony Albanese as Labor weighs setting price caps on Australia’s domestic gas market to ease high costs.

Australian manufacturers are being offered gas contracts of up to $35GJ — more than triple levels from a year ago — as an international gas crunch filters through to the nation’s east coast, along with a forecast shortage of local supplies in the market.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout