Origin Energy shares down amid Brookfield’s $18.4bn takeover deal uncertainty

The energy major has given its suitor an extra week to conduct due diligence for its $18.4bn takeover. But investors are nervous.

Origin Energy shares dipped as a further extension for bidders Brookfield Asset Management raised uncertainty over the $18.4bn deal proceeding as planned.

Brookfield was granted another week to complete an exclusive period of due diligence, but ongoing ructions over the federal government’s energy intervention package has sparked some doubt over the consortium’s $9 a share bid.

“Origin’s shares have pretty consistently traded at a discount to the non-binding offer price, which indicates the market thought there was a reasonable chance that the offer price might be lowered, or the deal might even fall over,” Morgans analyst Max Vickerson told The Australian.

“The combination of government intervention into the market since the bid became public and a second extension needed for the exclusive due diligence period will be adding fuel to speculation that the deal won’t happen at $9 per share.”

Shares in the power giant fell as much as 3.7 per cent in morning trading on Tuesday and closed down 2.1 per cent, or 16c, at $7.49. The intra-day fall was the lowest trading price in nearly a month.

The buyout would result in Origin being split into two. Brookfield would control Origin’s energy markets business, comprising electricity and gas retailing, while EIG’s MidOcean unit would buy the integrated gas business, which includes the prized APLNG export plant.

The last deadline expired on January 16, but Origin said it had extended the process until January 24.

“The consortium has advised that it is working to complete its due diligence and has requested additional time to do so. In accordance with Origin’s exclusivity arrangements with the consortium, exclusivity will end on 24 January 2023,” Origin said in a statement.

The $9 a share bid has received broad support from shareholders, even as the Albanese government’s market intervention has raised concern over the deal proceeding.

The buyout bid from Brookfield and MidOcean was first disclosed on November 10 with an eight-week due diligence period granted to assess the company’s books.

Origin on December 21 then agreed to extend the consortium’s exclusivity period to January 16 with a plan for the pair to then turn their buyout offer into a signed, binding deal. Origin has endorsed the bid in the absence of a higher offer.

The deal, the third offer by the consortium since talks started in August, includes a plan for Brookfield to invest an extra $20bn in Origin through to 2030 to build new renewable supplies and back-up energy capacity.

Companies including Origin face a difficult challenge as they work to wind down giant coal-fired generation plants and accelerate a switch to renewables amid historically high wholesale electricity prices.

Origin is also among big industry players caught in the cross-hairs of the federal government’s energy market legislation.

The national cabinet’s sweeping market intervention has caused shock among energy producers with a combination of price caps on gas and coal and a new code of conduct that could result in a requirement for gas to be permanently sold at a “reasonable price”.

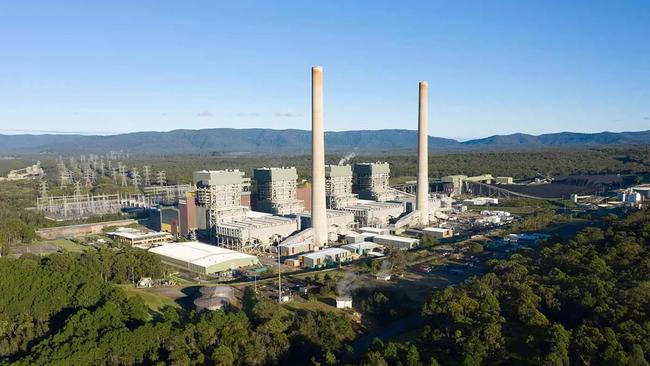

Origin has 4.5 million customers and operates Australia’s biggest coal power plant – Eraring in NSW – along with a 27.5 per cent stake in the APLNG project in Queensland.

The energy operator, which will report its quarterly results on January 31, has forecast a lift in energy markets earnings of up to 78 per cent for the 2023 financial year, with a boost in gas profits offsetting sluggish conditions from its electricity business.

Further growth in energy markets profits is expected in 2024 as higher wholesale electricity prices flow through to customer bills, the Sydney-based company said as part of an annual general meeting update in October.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout