Oil Search to take writedown of up to $US400m

Oil Search will take a writedown of up to $US400m, marking the first in an expected wave of impairments among Australian energy producers.

Oil Search will take a writedown of up to $US400m ($575m) after the oil price crash lowered the value of its Papua New Guinea oil and gas licences, marking the first in an expected wave impairments among Australian energy producers.

The Sydney-based company will take a non-cash, pre-tax charge of between $US360-$US400m at its 2020 interim results, due to be released on August 25, after reviewing the value of its assets at June 30.

Oil Search blamed the deteriorating long-term impact of a weaker economy, the weaker outlook for oil and gas prices and unnamed other factors that could lower the value of its assets.

Some of the industry’s biggest names including Shell and BP have been forced into major writedowns in recent weeks amid the COVID-19 crisis, a slump in prices and uncertain demand due to a global economic downturn.

Australian oil and gas producers are expected to follow global majors in suffering writedowns in the coming months due to lower oil and gas prices, Macquarie warned on June 30.

The nation’s top producers have typically used $US70-75 a barrel for impairment testing purposes compared with Brent crude which is trading at $US42 currently, following several months in sub-$US30 territory earlier this year.

An ongoing strategy review launched by chief executive Keiran Wulff found exploration and evaluation assets in PNG “have been identified as being of reduced priority due to lower prospectivity or sub-optimal economics,” Oil Search said in a statement.

“As there is no current intention to pursue activities on these assets, the full value of these exploration assets is expected to be written down. An immaterial impairment relating to exploration leases in Alaska, which are scheduled to be relinquished, also is anticipated.”

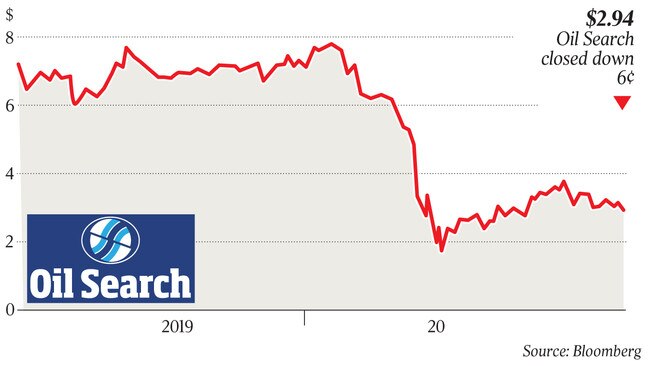

Shares in the company fell 2 per cent to close at $2.94.

The value of the company’s Hides gas to electricity project in PNG is also expected to be fully impaired after Barrick Gold stopped production at its Porgera gold mine in late June.

Oil Search on July 1 slashed nearly 600 jobs, a third of its workforce, as part of a major cost-cutting drive sparked by the oil price crash.

The PNG-focused LNG producer has already cut 427 roles and will trim a further 137 positions by the end of 2020, representing 34 per cent of its staff.

Some 100 of the 427 staff had already been shed in Sydney and its Alaskan operations in late March as the severity of the oil downturn triggered immediate reductions to conserve cashflow.

Board members and its executive team saw their pay lowered by 20 per cent until September in response to the market rout.

A strategic review, which started in February, will be delivered in the second half of 2020, Mr Wulff said, with a focus on “redefining Oil Search for the future” by considering market trends, shareholder expectations and commodity market and pricing outlooks.

The company was forced into a $US650m ($1.08bn) share sale in April to institutional investors to boost its balance sheet but analysts warned the LNG producer may ultimately need to raise extra cash to fund its growth plans.

In March, Oil Search slashed its spending by 40 per cent in a bid to conserve cash after warning of “unprecedented times” in markets.

The Sydney producer, reeling from a then 70 per cent plunge in its share price since January, suspended a sale of its Alaskan oil project and will dramatically cut costs amid investor concern over its ability to handle a hefty debt burden.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout