Oil Search may be forced to raise capital: UBS

Oil Search could be forced to raise equity if current oil prices persist, UBS has warned.

Oil Search could be forced to raise equity if current oil prices persist, UBS has warned.

UBS analyst Glynn Lawcock said the market was right to have concerns about Oil Search’s balance sheet, which is carrying $US3.4bn ($5.5bn) of drawn debt, and was likely to breach covenants by the end of the year if the oil price remains below $US37.50 a barrel.

But he said the company, which owns a 29 per cent stake in the PNG LNG project, could raise equity, extend the term of its main loan and roll over an upcoming $US300m debt repayment due in September to relieve some of the pressure.

“We would expect Oil Search to look to all three levers to remove the market’s focus from its balance sheet,” Mr Lawcock said.

The comments came as UBS examined the balance sheet strength of the three big oil and gas producers on the ASX, all of which have more than halved in value this year.

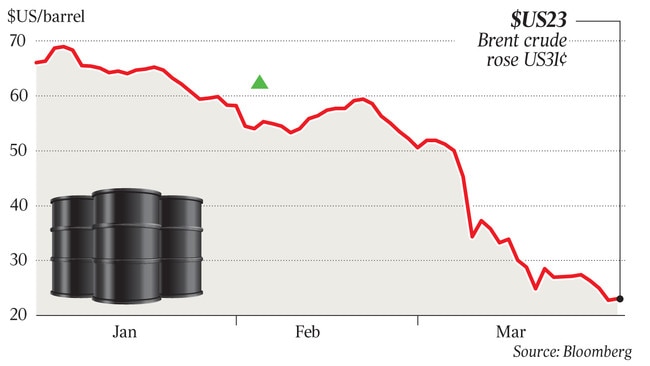

UBS has slashed its oil price forecasts for the next few years following the twin shocks of the COVID-19 outbreak and the breakdown of OPEC, with the price now expected to remain below $US60 a barrel until 2024.

The oil price downgrade means UBS analyst Glynn Lawcock now expects Oil Search to record a loss in 2020, while the earnings of Woodside Petroleum and Santos are forecast to fall as much as 70 per cent.

Woodside’s balance sheet strength makes it the standout in the sector, Mr Lawcock said, with its surprise decision in early 2018 to raise $2.5bn in fresh equity at $27 a share now looking particularly prescient.

It has been building up its balance sheet strength to prepare for the development of its Browse and Scarborough LNG projects, but with those projects now delayed it has room to ride out the downturn.

“We have the least concern for Woodside given its now fortuitous raising back in early 2018,” Mr Lawcock said. “At February 29, Woodside had $US4.9bn of cash, $US3.0bn of undrawn debt (2022-24 maturities) and $US800m in debt to be repaid over the next two years.

“Santos has gearing at around 30 per cent but fortunately $US1bn of cash and $US1.9bn of undrawn debt with no major repayments till 2024.

“Oil Search is of most concern if oil prices were to stay at current levels through to year end as this would consume most of their undrawn facilities. Refinancing and terming out of existing facilities is an option for Oil Search, as is equity. We would expect a combination of all three if the oil price were to remain low.”

UBS upgraded its recommendation for Woodside to a buy. It retained its neutral call on Santos and retained its buy recommendation on Oil Search.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout