Offers flood in as South32 readies for South Africa coal exit

South32 has been inundated with offers for its South African thermal coal business.

South32 has been inundated with offers for its South African thermal coal business, with neither its geography nor commodity deterring would-be buyers.

South32 chief Graham Kerr told The Australian yesterday that the company had received dozens of inquiries from groups interested in the assets, with final bids likely by the end of July.

The company first flagged its intention to exit its South African coal business in 2017, with Mr Kerr declaring at the time that the company no longer wanted to carry exposure to thermal coal.

But South Africa’s finalisation of a new mining charter last year, coupled with solid thermal coal prices, meant South32’s assets had attracted considerable interest.

“We’ve had an incredible amount of interest that was expressed in the business, well over 20 or 30 bidders,” Mr Kerr said.

“We’ve got a number going through, they’re getting much more information on how the business is running, what its growth plans look like. I imagine in the first half of this calendar year that will turn into two to three bidders, and I’d expect as we get around June and July we will start to see some binding bids coming in.”

The interest in the assets is in contrast to only a few years ago, when they faced the twin challenges of South Africa’s battered reputation for sovereign risk and a broadly negative investor sentiment towards thermal coal.

Sales from South32’s South African coal mines are generally split equally between the export and domestic market, with the latter suffering from shortages in recent years.

“For a global multinational company, investing in growth projects in a domestic market for utility-type returns when you add a country risk premium isn’t overly attractive but it doesn’t mean it’s not attractive to a lot of the current players active in South Africa today,” Mr Kerr said.

“The export resource will be attractive to many of the other trading companies and producers.”

South32 continues to operate its Illawarra metallurgical coal assets in NSW, and Mr Kerr said the outlook for the steelmaking ingredient continued to look robust.

Mr Kerr was in India yesterday to meet with customers, and said the country was generating meaningful growth.

“While China does have a bit of noise, we shouldn’t lose sight of the fact that India probably has the highest growth rate at the moment and India in particular has strong demand not only for manganese but also met coal,” Mr Kerr said.

“It’s a good market particularly for South32 and there’s a lot of demand for our product.”

While India has long teased with its potential to become the world’s next great emerging market, Mr Kerr said the nation was showing real signs of growth under Prime Minister Narendra Modi.

South32 also unveiled some key leadership changes yesterday, with Katie Tovich replacing Brendan Harris as chief financial officer and Mr Harris replacing Peter Finnimore as chief marketing officer.

Mr Kerr said the reshuffle should help cultivate potential future leaders for the group.

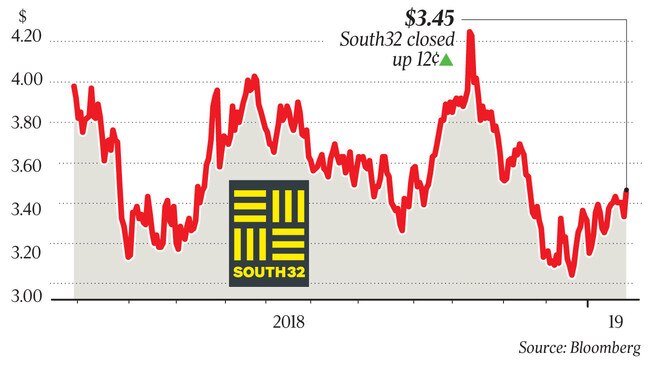

While the back end of 2018 was tough for mining equities and most commodity prices, quarterlies released yesterday showed that parts of the sector continued to perform well.

Melbourne-based Alumina, the Australian joint venture partner of Alcoa, reported another jump in earnings during December as the tight alumina market continued to underpin “robust” positive cash flows.

Whitehaven Coal, meanwhile, was the best-performed stock on the ASX 200 yesterday after it reported record quarterly coal production.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout