Norway sell-off fuels oil and gas rethink

The move by Norway’s sovereign wealth fund to cut exposure to Australia’s oil and gas operators may be a tipping point.

The decision by Norway’s giant sovereign wealth fund to cut exposure to Australia’s oil and gas operators may mark a tipping point as the industry weighs whether the move will spur the nation’s superannuation funds to trim their own fossil fuel investments.

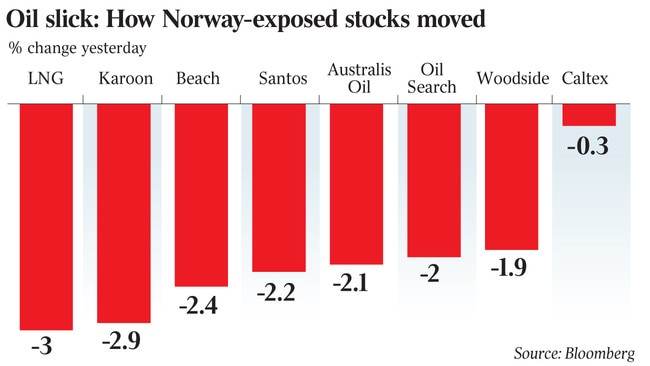

Australian energy stocks sunk yesterday, with a dozen local explorers or producers included in a global list of stocks marked for disposal by Norway’s Government Pension Fund Global as the oil-dependent country trims its exposure to crude.

Australia’s three-largest pure play oil and gas companies all fell, with Woodside Petroleum down 1.9 per cent, Santos off 2.2 per cent and Oil Search shedding 2 per cent. Beach Energy lost 2.4 per cent while Karoon Gas dropped 2.9 per cent, and LNG Limited slid 3 per cent.

Karoon Gas managing director Robert Hosking said while some of Norway’s strategic shift was part of a long-telegraphed path to diversify its income, the move reflects a broader structural shift to recognise emissions amid a changing mix of energy sources.

“It might be a good driving force that they do this,” Mr Hosking told The Australian. “In 30 years we will see a different world. It has been heading that way, but it’s proving a slow uptake. Just like you saw the phasing out of whale oil when petrochemicals took over, you’re going to eventually see the phasing out of oil.”

A potential overhang in the market could be created by the move, particularly if Australian superannuation funds were to consider similar divestments of their holdings in local energy stocks, contrarian fund manager Allan Gray said.

“Of course there could be a overhang if all Australian super funds were to sell their energy holdings. But they would be very foolish to wave a flag too far before the event,” Allan Gray managing director Simon Mawhinney said.

“Norway did this for good reasons because their exposure was too high. But energy holdings for most super funds actually add diversification. It’s not quite the same comparison.”

The push for Australian companies to decarbonise and explain their environment strategies will only grow, according to Citi. However, rather than calls for outright divestment, it expects investors and super funds to seek engagement as a more effective way of triggering change.

“Australian companies tend to gravitate towards engagement rather than divestment,” Citi’s head of environmental, social and governance research, Zoe Whitton, told The Australian. “It’s often a more sophisticated approach than straight divestment.”

Woodside and Santos are already in the firing line over meeting Paris climate targets from the Climate Action 100+ initiative, which controls $US32 trillion ($45 trillion) in global investment and is backed by major Australian super funds.

The group’s members in Australia include AustralianSuper, AMP Capital, Cbus, IFM Investors, QSuper and BT Financial, sparking talk that local corporations face a step-up in demands from investors to avert a “business as usual” approach.

Citi said Norway’s decision to pull investments at the exploration and production level was borne out in its own research that showed heightened environmental risks for companies with a pipeline of undeveloped oil and gas assets.

“If you think of oil and gas risk in a decarbonising world, there is a lot of contention over which assets will be used,” Ms Whitton said. “You probably don’t need too many new assets. Logic flows that the new entities are more at risk.”

Oil and gas will continue to run the economy for decades to come, but cleaner sources of fuel would eventually challenge the position of traditional sources in the market, according to Karoon Gas’s Mr Hosking. “It’s all coming. We’ve got to be aware of it. I’m not going to be the guy standing in the queue saying oil and gas forever,” he said.

Cooper Energy, which is developing the $600 million Sole gas field in the Gippsland Basin, said any move by the Norway fund was not material to Cooper but it recognised the broader trend. “It’s a thematic which a few are picking up on which globally one has to be mindful of,” managing director David Maxwell said.

International investors account for 10 per cent of Cooper’s share register, Mr Maxwell says.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout