Andrew Forrest: Mutually profitable ties bind China friendship

Andrew Forrest’s relationship with China has been enduring and profitable, making him one of Australia’s richest people.

In 2012, as iron ore prices crashed and Andrew Forrest’s Fortescue Metals Group was struggling with billions of dollars of debt, an array of Chinese steel mills stepped in with hundreds of millions of upfront payments to help the company through the crisis.

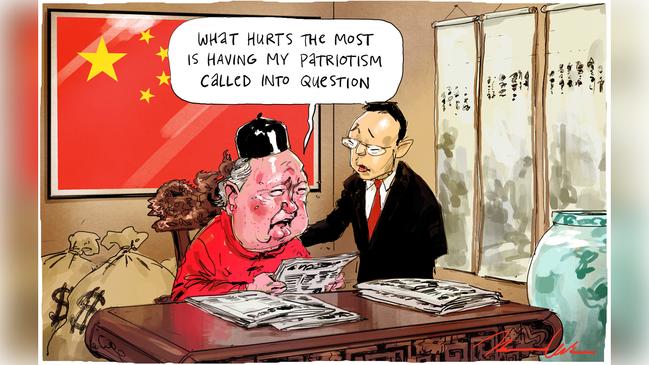

Now, as the China-Australia relationship hits a level of unprecedented turbulence, Mr Forrest is on the front foot defending China.

His relationship with China has been enduring and profitable, making him one of Australia’s richest people; it has helped him build connections to the highest levels of the Chinese Communist Party, including President Xi Jinping.

Last month, after Mr Forrest’s philanthropy arm the Minderoo Foundation organised its first delivery of personal protective equipment and medical supplies from China to Australia, he told The Australian he had relied on relationships “right up the chain” in China to secure the gear.

“I’ve been there for 31 years, so you develop relationships over time, you see people grow from junior positions to senior positions, they know you’re going to be there tomorrow and they know when things go wrong, like they did in the global financial crisis, like they did in the 2012-13 iron ore meltdown and like they are now, you’re going to protect them and they’re going to step up to protect you,” he said.

Those comments have taken on a different hue in recent days, amid a backlash over Mr Forrest’s surprise decision to bring the Chinese consul-general in Victoria to the podium alongside federal Health Minister Greg Hunt.

While Mr Forrest’s philanthropy is at a scale all but unmatched by any other Australian billionaire, events this week have prompted scrutiny over whether his charitable endeavours also at times advance his commercial interests.

The fortunes of Fortescue — and, by extension, Mr Forrest himself — are entirely dependent on China. It was Mr Forrest’s belief in an impending growth surge in China that famously prompted him to sketch out his original plan for Fortescue around a table at his home in Cottesloe in 2003, and he and Fortescue have consistently worked since to intertwine and strengthen their ties with China.

Almost every one of the more than 1.3 billion tonnes of Pilbara dirt mined and shipped by Fortescue since then has been sent to China. Mr Forrest’s 36 per cent stake in Fortescue is worth more than $13bn; in the past 18 months, he has collected almost $2bn in dividends from the company.

That cash has bankrolled Mr Forrest’s myriad business ventures and his philanthropy empire, but he has also often been accused of conflating the national interest with his own commercial interests.

He was a driving force in killing off the Rudd government’s resources super-profits tax, while in 2015 he called on prime minister Tony Abbott for an inquiry into the iron ore output of Rio Tinto and BHP.

Mr Forrest has a long history of defending China from Australian critics. In early 2018, when relations between Australia and China had nosedived after the Turnbull government introduced foreign interference laws aimed at Beijing’s influence, Mr Forrest gave an impassioned speech at a Chinese New Year function in Perth in which he described China as a “neglected ally” and warned of “indulgent and immature” commentary towards the country.

The interconnectedness between Mr Forrest, Fortescue and China has gone well beyond the trade of iron ore. In 2009, Chinese steelmaker Hunan Valin stepped in to buy a 16.5 per cent stake in Fortescue for $1.2bn — making it the second-largest shareholder in Fortescue behind Mr Forrest.

Hunan Valin still owns just over 10 per cent of Fortescue and holds seats on its board.

Fortescue has taken ownership in recent years of eight iron ore ships it purchased from two Chinese shipyards, financed by the China Development Bank.

Mr Forrest and Fortescue have also been integral in the growth of the Boao Forum, hosted each year on China’s Hainan Island. This year’s event, cancelled because of coronavirus, was also to feature a meeting of the China-Australia Senior Business Leaders Forum, of which Mr Forrest is co-chairman.

In February, as the coronavirus outbreak started, Fortescue donated $1m and sent PPE from its operations to Wuhan.

On Thursday, it emerged that Mr Forrest was reportedly eyeing off two Australian businesses part-owned by Chinese entities.

He is said to be working on an offer for Virgin Australia — whose shareholders include Chinese Nanshan Group and HNA Group — while Fortescue may be weighing up an offer for the stake in the big Greenbushes lithium mine held by debt-laden Chinese company Tianqi Lithium.

His ties with China gave him the confidence to pounce on medical PPE when shortages emerged. Any equipment found not to be up to standard, he said, would be returned to the Chinese manufacturer. “We won’t say ‘give us our money back’, we will say ‘give us exactly what’s in this contract or else the next phone call will be from people a lot higher than us’,” he told The Australian last month.

Just how high up?

“I’m afraid I’m going to have to leave you to speculate, but we can’t do what we’re doing without the full Chinese embassy to Australia support,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout