MMG in move to increase liquidity

Copper and zinc miner MMG is stepping up studies of a rights issue to increase liquidity and pay down debt.

Copper and zinc miner MMG is stepping up studies of a rights issue to increase liquidity and pay down debt in the dual-listed company now that its $US10 billion ($13.1bn) Las Bambas copper mine in Peru has almost ramped up.

As well as a rights issue, which could flow on to the issue of new Australian shares if there is a shortfall in its Hong Kong-listed base, MMG is considering raising cash by selling its Golden Grove copper and zinc mine in Western Australia, where it has started a process for what could be a $250 million-plus sale.

The Melbourne-based and Chinese-controlled company yesterday reported a first-half net loss of $US93m, widened from a loss of $US48m a year earlier, as lower prices hit revenue and the company boosted its exposure to copper with the start of Las Bambas and the closure of the Century mine in Queensland.

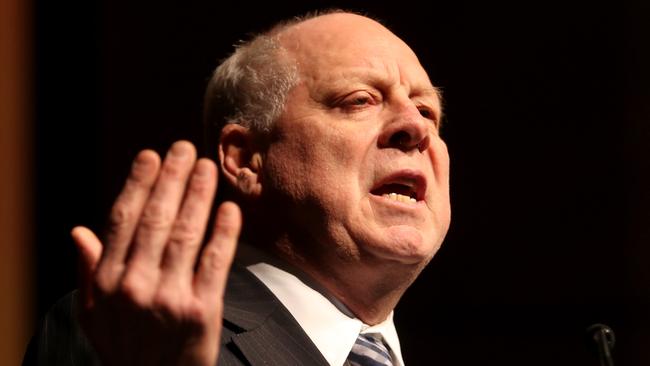

“This is the bottom of the changeover from zinc to copper. We didn’t have Century and Las Bambas was not commercial in the first half, as well as copper prices being lousy,” MMG chief Andrew Michelmore told The Australian.

Now that Las Bambas has ramped up faster than the market expected and the construction risk has been largely taken away, MMG is turning its attention to increasing liquidity and reducing debt.

In Hong Kong, only about 500,000 shares of the company, which is 74 per cent-owned by China Minmetals, turn over each day. This is about one-twentieth of what is seen as needed to attract institutional investors.

In Australia, where Minmetals launched a secondary listing in March, trading has been virtually non-existent.

“Now that we have Las Bambas ramped up, we’ll be looking in the market to see when would be appropriate to put in more equity and how much might be appropriate,” Mr Michelmore said. “If we were to do any rights issues, and there were shortfalls, it gives us the opportunity to put it on the ASX.”

The company is keen to get more Australian investors and analyst coverage, given the better knowledge of the mining sector on the ASX compared to Hong Kong. On Golden Grove, Mr Michelmore said the company was in final talks to appoint an investment bank to manage the sale. He would not comment on expected value.

Golden Grove’s book value at the end of 2015 was about $US220m, so any sale would be likely to fetch more than this.

BHP chief Andrew Mackenzie referenced the strong job MMG had done starting up Las Bambas on Tuesday night, saying it had been pressuring copper prices. “There has maybe been a little less growth in demand out of China, but it is mainly because of the new production primarily from Peru, which has come on pretty much as foreseen,” Mr Mackenzie said when asked about low copper prices.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout