Mining giant Rio Tinto books half-year net profit of $US5.1bn but aluminium assets slashed in value

Shipments of iron ore were up 8 per cent but Rio Tinto has cut annual copper and alumina guidance, while slashing the value of its Australian aluminium assets.

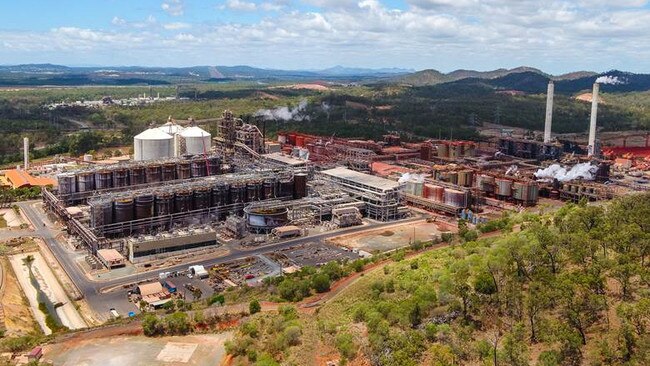

Rio Tinto has slashed $US1.2bn from the value of its Australian aluminium assets on the back of the federal government’s safeguard mechanism, writing off the value of its Yarwun alumina refinery completely due to the need to buy carbon offsets for the asset.

The impairment was recorded in Rio’s half-year financial results, released on Wednesday, with the company to pay a $US1.77 a share divided after booking a half-year net profit of $US5.1bn, on underlying EBITDA of $US11.73bn.

The company said on Wednesday its interim dividend was a payout of 50 per cent of its underlying earnings, in line with its dividend policy.

Rio said it had booked an underlying net profit of $US5.7bn, with its statutory result pulled down by a $US800m impairment to the carrying value of its Australian aluminium assets, on an after-tax basis.

The company’s underlying earnings were 34 per cent lower than the first half of 2022, but chief executive Jakob Stausholm told reporters they were an improvement over the second half of last year, as commodity prices improved from low levels late in the year.

Rio’s Pacific Aluminium assets are the biggest single source of carbon emissions across the mining giant, with its Gladstone refinery group in Queensland worth more than half of the company’s Australian emissions.

The company said the kick-off of the Albanese government’s safeguard mechanism has forced a $1.2bn pre-tax impairment as the company weighs the impact of the new rules, which require the gradual reduction of carbon emissions from major industrial companies over the remainder of the decade.

“The challenging market conditions facing these assets, together with our improved understanding of the capital requirements for decarbonisation and the now legislated cost escalation for carbon emissions have been identified as impairment triggers,” the company said.

Rio chief financial officer Peter Cunningham told reporters on Wednesday the Pacific Aluminium assets remain an important part of Rio’s international commodity supply chain.

“The trigger here was the need to buy carbon credits under the Australian system. And when we looked back and made an assessment of the business, it is a segment that’s been under pressure. Those assets have been, I think, challenged on performance over the last few years,” he said.

“There‘s a fair bit of capital needed in those businesses over the next few years as well. But I think the core final thing I’d say is they remain integral to our system. Because these do give security or supply to our system.”

Rio completely wrote off the value of its Yarwun refinery on Wednesday, and slashed $US227m from the value of its share of the Queensland Alumina group, a joint venture with Russia’s Rusal, leaving a carrying value for QAL of $US325m.

Mr Stausholm said talks were ongoing with the federal government over a way to “future proof” the company’s Queensland alumina and aluminium manufacturing centres and said he felt a “big responsibility to explore all opportunities” to keep them operating.

But the Rio boss said their fate ultimately rested on the ability of the company to replace the coal-fired generation that has powered the operations for decades with an affordable and green alternative.

“We have to find a solution to that and I‘m very determined to do everything I can. But ultimately, if we can’t get renewable energy in Australia it’s impossible to produce something and export it out of Australia,” he told The Australian.

Rio Tinto’s Pacific Aluminium business booked underlying first-half earnings of $US55m, down from $US317m in the first half of 2022.

Analysts had expected a $US1.80 a share interim dividend, according to consensus estimates published by Rio on its corporate website.

Consensus estimates tipped underlying earnings of $US5.85bn and earnings before interest, tax, depreciation and amortisation of $US12bn.

The results come on the back of the strongest first half performance from the company’s iron ore division in some time, but after Rio cut annual copper and alumina guidance in the wake of maintenance issues and equipment failures.

Rio’s WA iron ore division booked underlying earnings of $US5.8bn in the first half, down 11 per cent from the first six months of 2022.

But that was in the face of a 14 per cent decline in average iron ore prices in the period, the company said, with Rio’s Pilbara operations delivering average unit production costs of $US21.20 a tonne in the period – towards the bottom end of its $US21 to $US22.50 a tonne annual guidance, and US60c a tonne below those in the first half of 2022 – although those were still significantly affected by additional costs due to the Covid-19 pandemic.

Rio shipped 136.4 million tonnes of iron ore in the first half of the year – up 8 per cent and its best result in five years – and now says it is on track to hit the upper half of its 320 to 335 million tonne shipment guidance for 2023.

Rio’s average discount to the benchmark index improved compared to the first half of 2022, with the company realising an average $US107.20 a dry metric tonne, about 97.6 per cent of the benchmark index for ore grading 62 per cent iron.

That compared to 94 per cent in the first half of 2022 – although the overall iron ore price declined slightly for the period.

Rio Tinto shares closed up $1.63, or 1.3 per cent, to $120.81 on Wednesday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout