Mining bonanza with base metals to lead the charge in 2021

Australia’s mining sector is set for its best start to a year since the heights of the mining boom.

Australia’s mining sector is set for its best start to a year since the heights of the mining boom, as global economic powers roll out coronavirus vaccines and kickstart their economies through infrastructure spending.

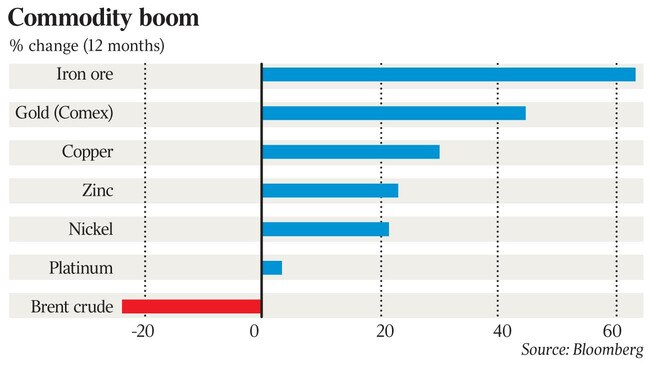

While iron ore and gold miners have been the talk of the market through a COVID-affected 2020, a raft of key Australian commodities are set to start the new year hovering near long-term highs, with base metals looking likely to lead the charge in 2021.

Despite the carnage wreaked on the coal industry by the coronavirus and China’s bans on Australian exports, the S&P/ASX Mining and Metals 300 index is sitting near its highest levels since April 2011 as investors anticipate a strong finish to the year — and not just from the cash rolling in through the Pilbara’s iron ore mines and gold producers, but from copper, nickel and zinc mines.

Copper hasn’t traded above $US8000 a tonne since February 2013, but came within a whisker of breaking the barrier on December 19, hitting $US7974 a tonne on the London Metals Exchange before falling back.

Demand for the metal is seen as a key indicator of global economic health and growth, and its price has surged more than 80 per cent since March lows, mainly on the back of a rebound in the Chinese economy, but also due to supply constraints from major South American producers hit by the pandemic.

At levels of around $US7770 a tonne this week, Australia’s copper producers are far better off than they’ve been in years, as mines in Queensland, South Australia and Western Australia look to a strong start to the year.

Copper exports were worth $10bn in export revenue to Australia in the 2019-20 financial year, according to Department of Industry figures, which is tipping a 10 per cent rise in export values in the current period as the price rises and miners lift production.

That particularly applies to South Australian copper major OZ Minerals, which is perfectly positioned as it ramps up production at its new Carrapateena mine. OZ Minerals shares hit a decade high of $19.74 on December 21.

Sharing in the base metals bonanza are Australia’s long-suffering nickel producers, with the steelmaking material hovering just below $US17,000 a tonne after hitting $US17,539 a tonne in early December, only marginally below the long-term highs of $US18,100 reached in September 2019.

With competition heating up for access to high-quality nickel from battery makers, juniors such as Mincor Resources, Panoramic Resources and Poseidon Nickel are preparing new and mothballed mines to meet demand.

Even thermal coal has come roaring back, sitting at about $US85 a tonne last week, well above lows of $US48 a tonne in September, after returning demand from Korea and Japan helped offset China’s bans on Australian exports.

Only metallurgical coal, still hard hit by China’s political war with Australia, is still suffering, with prices sitting around $US103 a tonne sold from Australian ports, well below the price before Beijing ramped up its trade war with Canberra.

And while lithium is still to fully recover from the combined impact of 2019’s oversupply of the material and the pandemic, IGO’s December decision to spend $1.9bn on a minority share in Tianqi Lithium’s Australian operations suggests there’s light at the end of the tunnel for the commodity.

And then there are the two big winners from 2020, gold and iron ore.

The rollout of vaccines has taken some of gold’s shine as a safe haven commodity, sending spot prices down from $US2063 an ounce in August to below $US1900 this week.

But at $2481 an ounce in Australian dollar terms, all but the most marginal local producers are still raking in cash.

The only question for investors in iron ore miners is how big their February dividend payments will be.

The Christmas period saw some softening of iron ore prices to fall back below $US170 a tonne. But a fatal landslide at Vale’s Corrego do Feijao mine on December 19 offered a potent reminder that the wet season is upon major producers in both Brazil and Australia, and strong demand from China is likely to keep prices at elevated levels.

The earnings season is still two months away, but analysts are already speculating that it could be a bumper dividend season for Australia’s iron ore majors, with UBS last week tipping that Fortescue’s payout could be as high as $1.40 a share, giving it an annualised yield of 12 per cent, fully franked.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout