Miners soar as gold and iron ore prices rise

Australia’s mining stocks are enjoying a stellar start to the year, with Fortescue Metals and the nation’s gold miners soaring.

Australia’s mining stocks are enjoying a stellar start to the year, with Andrew Forrest’s Fortescue Metals Group and the nation’s red-hot gold miners all soaring higher over the past month.

Shares in Fortescue jumped another 4.7 per cent yesterday to close at $6, touching its highest level since 2017 as it continued to capitalise on the recent rally in iron ore prices.

The nation’s two biggest iron ore producers, Rio Tinto and BHP, also rose by 3 per cent and 1.1 per cent respectively.

The trio have been the beneficiaries of a strong rise in iron ore prices in recent weeks, exacerbated recently by the tragic collapse of a tailings dam in Brazil that could knock out a large chunk of that nation’s iron ore industry.

The spot price for 62 per cent iron ore delivered to Qingdao climbed from less than $US58 a tonne in July to more than $US81 a tonne as of yesterday.

The price rise has continued amid the fallout from the January 25 tailings dam collapse at Vale’s Feijao mine in Brazil that killed 99 people, with a further 259 people missing.

While Feijao is relatively small by global standards, representing about 0.5 per cent of the global traded iron ore market, Commonwealth Bank mining and energy commodities analyst Vivek Dhar said the latest tragedy could see other Brazilian mines being forced to close.

“The concern is that Vale’s production could fall more than Feijao’s output as Brazil’s environmental regulators look to punish the company,” Mr Dhar said.

The market’s response to the fallout from the Feijao disaster is in contrast to that which followed the Samarco tailings dam collapse in late 2015. While Samarco was a much larger producer than Feijao, iron ore prices barely moved in response to that disaster.

“That mostly reflects the economic environment at the time as commodity prices were in free-fall,” Mr Dhar said.

“But today’s climate is different and iron ore markets are worried. While we expect the spike to last two to three weeks, the risk is that prices stay higher for longer as markets worry about future Vale supply.”

Shares in Fortescue had been rising strongly well ahead of the recent Brazilian tragedy as market conditions started to move back in Fortescue’s favour.

At the same time as the nation’s iron ore miners have received a boost, Australia’s gold sector continued to go from strength to strength amid record-high Australian dollar gold prices.

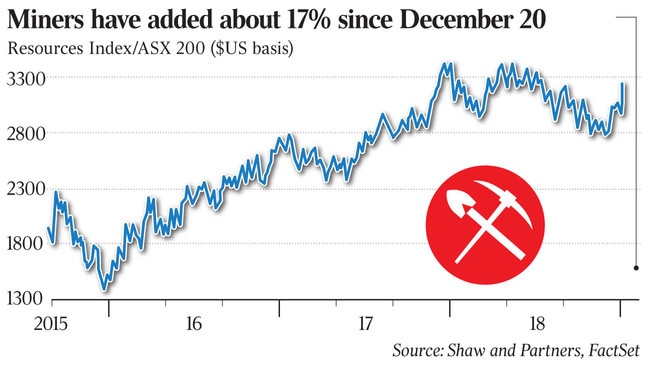

Shaw & Partners analyst Peter O’Connor noted the mining sector had added a “whopping” 17 per cent since December 20, when the mining index plumbed a 15-month low.

Mr O’Connor described the rally as “seat-of-the-pants stuff”, noting that almost half of the mining stocks under his watch were now trading at or near their 52-week highs. That is up from none just six weeks ago.

Argonaut analyst James Wilson said Australian mining stocks had been helped along by favourable foreign exchange movements, while the gold sector had received an extra boost from a higher US dollar gold price.

He said the share price rally among gold stocks also reflected the strong cash generation and good dividend payments of Australian gold miners compared to their international counterparts.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout