Miners should be at the top of their game with soaring gold price, says Evolution’s Klein

Australia’s top tier gold miners reported solid production results ahead of delivering annual financial results in August.

Gold miners should be delivering “super returns” while the sun shines on the precious metal, according to Evolution Mining boss Jake Klein, as Australia’s top tier gold miners reported solid production results ahead of delivering their annual financial results in August.

Evolution and Northern Star Resources both reported June quarter production figures on Thursday, with both flagging strong cashflows from their operations from the rising gold price.

Evolution Mining told the market on Thursday that it planned to accelerate the development of an underground gold mine at its Cowal operation in NSW as it declared a first underground ore reserve at the mine and booked record cashflows across its business.

Gold output was 218,104 ounces for the June quarter, up 31.8 per cent on last quarter’s 165,502 ounces.

Over the last financial year gold output amounted to 746,463 ounces, with an all-in sustaining cost price of $956 per ounce produced in Australia and $1943 per ounce produced from the newly acquired Red Lake operation in Canada.

Total achieved gold price across the group’s mines was $2500 per ounce, boosting mine operating cashflow to $352.1m, a 36 per cent increase on last quarter’s $257.4m.

Net mine cashflow was $224.5m, up 40 per cent on last quarter’s $159.7m.

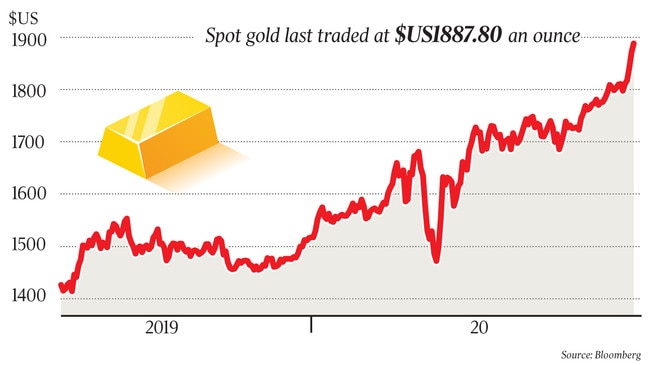

In a call to investors, Evolution executive chairman Jake Klein said he anticipated the high gold price would persist “in the medium term” due to government coronavirus fiscal stimulus, and that the company would maintain capital expenditure while looking after shareholders.

“We are in a great part of the cycle at the moment and as I said earlier, I think there are lots of reasons to believe there is a long way to go in the cycle,” Mr Klein told investors

“But where there is a great gold price we need to be making super returns, and you can see that in Evolution we are investing in our world-class assets that will grow us and sustain us in the future — we also have paid out 13 consecutive dividends and have a target of paying up to 50 per cent of free cashflow.

“And so in this environment, investors are getting a good yield if they’re investors in Evolution.”

Northern Star ‘solid result’

Listed miner Northern Star also produced a solid result, saying it expected to return to paying dividends “in the ordinary course of business” after its operations produced 267,361 ounces of gold in the June quarter despite its Alaskan operations being hit hard by the coronavirus and limiting output to 75 per cent.

The company’s gold mines still generated underlying free cashflow of $218m in the June quarter as the gold price rose, with the company promising to reduce its hedging position to take advantage of the higher gold price.

Northern Star finished June with $770m in cash and bullion, and corporate debt worth $700m.

Executive chairman Bill Beament flagged a potential financial hit in the second half of the year as the company closed out hedging positions to take advantage of the rising gold price.

“Our results over the past two quarters have also been restricted to a degree by our decision to reduce our hedge book. We sold 170,000 ounces into hedges or approximately 34 per cent of our production over the past six months, reducing our margin somewhat in the process,” he told analysts.

“We expect to continue this strategy in the current half as we seek to increase our exposure to the significantly higher spot gold price both in Australia and the US. The reality is that a significant portion of ASX-listed gold production is not selling for anything like the current spot price.”

At June 30, Northern Star’s hedge book stood at 536,426oz at an average price of $2085/oz, well below current spot gold prices of just under $2600/oz. The company said its hedging position was about 15 per cent of its next three years’ worth of expected production.

Northern Star’s average realised gold price across the June quarter was $2487/oz. The average gold spot price was about $2608/oz, according to Bloomberg data.

Evolution Mining closed on Thursday at $6.31 a share, down 2.02 per cent.

Northern Star closed at $15.90 a share, down 0.19 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout