Lynas could be forced to shut Malaysian plant

Rare-earths producer Lynas has warned it could be forced to close its Malaysian processing facility in just six months.

Rare-earths producer Lynas has warned it could be forced to close down its Malaysian processing facility in just six months, as the company’s auditor warns of material uncertainty over Lynas’s ability to continue as a going concern.

But Lynas chief executive Amanda Lacaze said she was still confident the company would find a way to resolve the latest regulatory roadblock threatening the company’s future.

Lynas’s regulatory headaches in Malaysia are also being exacerbated by soft market prices for its rare earths, a situation Ms Lacaze said reflected efforts by rival rare-earths players trying to squeeze Lynas out of the market.

While Lynas has attracted warnings of material uncertainty from auditors in the past, they have previously centred on its debt position.

This time, the accounts warned of material uncertainty over whether Lynas’s advanced materials plant in Malaysia would be able to operate beyond September 2 following new conditions imposed on the plant last year.

Malaysian regulators in December announced rules requiring the export of water leach purification residue from the plant, the latest in a line of regulatory and political difficulties facing Lynas in the country. Lynas, which has since appealed against the decision and is negotiating with regulators over alternative options for the residue, said yesterday that meeting the new conditions was “unachievable”.

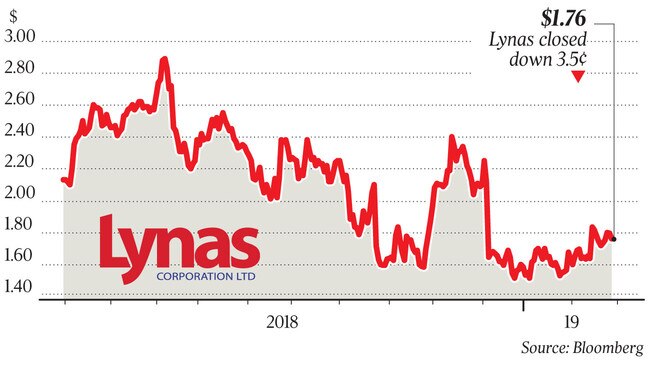

Lynas shares fell almost 10 per cent immediately after the release of the result before recovering late in the day to close 2 per cent lower at $1.76.

Ms Lacaze told The Australian the board had made an informed and carefully considered decision to sign off on the latest accounts.

“The directors of the company firmly and very comfortably reached the conclusion that the accounts should be issued on a going-concern basis. As directors, we are confident that is the right decision,” she said.

“Accounting standards are at times unforgiving instruments, and they point auditors in a particular direction.”

Ms Lacaze said she still believed Lynas had a future in Malaysia despite persistent opposition to the project from some politicians.

“For most people we are simply not an issue. We’ve been here for five years, we’ve run our business without any negative effect, we’ve worked hard to contribute to the local community,” she said. “We recognise there is a small minority who make a lot of noise.”

The auditor’s warnings overshadowed a financial result that was otherwise better than expected given the combination of softer rare-earths prices and the month of production lost as a result of Malaysia’s regulatory decisions.

First-half net profit was $19 million, down 62.6 per cent from a year earlier, while revenue fell 10 per cent to $179.8m.

Ms Lacaze said softer rare-earths prices were being driven by a drop in sentiment in China and rivals fighting for market share.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout