Lithium players could be in for more pain before tide turns

At least one of Australia’s new wave of lithium producers may need to fall over before the sector can recover from the slump.

At least one of Australia’s new wave of lithium producers may need to fall over before the sector can recover from the slump that has savaged stock prices and left some miners unable to sell all their output.

The nation’s lithium stocks have been smashed over the past 18 months as a wave of new supply swamped the market for what is one of the key ingredients in electric vehicle batteries.

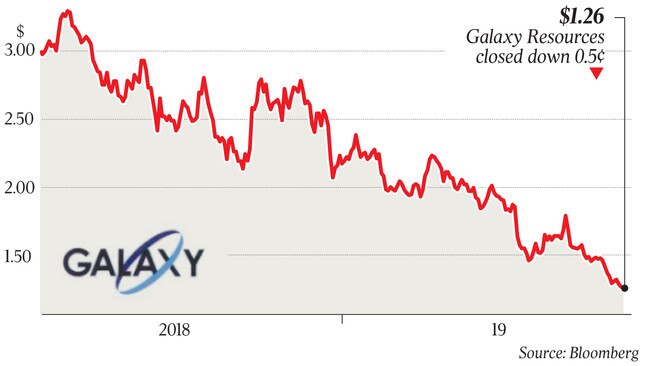

Since early 2018, when investor excitement about electric cars was at its peak, Pilbara Minerals has more than halved. The likes of fellow lithium plays Galaxy Resources and Altura Mining have shed around three-quarters of their value.

That’s despite all three continuing to crank up production out of their Australian lithium operations, and despite deals such as Albemarle’s $1.6 billion purchase of a half-stake in Mineral Resources’ Wodgina lithium project and Wesfarmers’ $776 million takeover of would-be developer Kidman Resources.

Investors have instead been more focused on the worrying short-term developments among the miners, such as the news last week that Pilbara had been unable to sell all of the output from its Pilgangoora mine.

Pilbara had good reason to argue that the drop in demand was temporary: both its Chinese offtake partners are running behind schedule with their new lithium chemical plants that will process the concentrate from Pilgangoora.

But it was nevertheless a worrying signal for investors, given Pilbara has not even reached full production in the first stage of what it says will be a three-stage development and expansion of the mine.

The news late on Wednesday that Galaxy had delayed a third shipment of concentrate from its Mount Cattlin mine did little to settle investor nerves.

At the same time, reported lithium prices have continued to fall. Most reference prices are now below the average levels assumed when would-be developers pushed the green light for their projects.

For Romano Sala Tenna, whose Katana Asset Management’s biggest position is in lithium and iron ore producer Mineral Resources, the sector’s poor recent run does not change what is a positive “multi-decade thematic” in the longer term.

But he is among those who believe there will have to be some more pain in some corners of the industry before things turn around. “Some of the mines that have started up, we will see them burn up their capital and disappear,” he warned.

Others are avoiding the sector in its entirety until the industry is through its current issues.

Dermot Woods, executive director of Westoz Funds Management, says the fund has long been wary about the lithium space — in part because of the opacity of the lithium market and the lack of in-depth knowledge about the technical side of the industry.

“We think we’re 50 to 75 per cent of the way through the voyage of discovery there in terms of finding out how difficult it is to get the stuff out of the ground, process it, what price you’re going to sell it for and who you’re going to sell it to,” he told The Australian.

“It certainly gets interesting again in another 6-12 months when things have been up and running for a while and we can see the true costs of getting the stuff out of the ground and we can see how the marketability of the products are going.”

The recent troubles at Pilbara, he says, are a reminder that moving product in niche, small-scale markets can be much harder than many think.

“People tend to assume that if there’s a price for a product, there’s always a market for it. But that’s not always the case for the more opaque commodities,” he said.

Beside a corporate collapse that knocks out a source of supply, the other catalyst that could help improve sentiment would be another big corporate transaction.

Pilbara earlier this year signed up Macquarie to find parties interested in up to a 49 per cent interest in Pilgangoora. Many of the big lithium players have already taken positions, however, and both the macro challenges in lithium and the company-specific issues at Pilbara could make it had for the company to secure the sort of deal it may have hoped for.

“It’s a very attractive project, it’s probably one of the more strategic in terms of its scale and its location and certainly its development stage. The question will be price of the deal,” Edison Group director of mining Ryan Long told The Australian.

“Right now it’s more of a buyer’s market just because of the near-term fundamentals of the industry. Whether Pilbara are willing to swallow the terms of a deal now, or whether they’re happy to sit back and wait, we will see.”

While the falling stock prices will be testing the nerves of many of lithium’s true believers, Katana’s Sala Tenna says the tide will eventually turn.

“In many respects (it’s) the birth of a new commodity,” he said. “We’re not going to get demand where it needs to be in 12-24 months. It’ll take five to 10 years to get anywhere near where it needs to be.”