Pilbara Minerals’ Pilgangoora lithium mine tempts Wesfarmers

Wesfarmers will get a second chance to grab an interest in a big WA lithium mine.

Wesfarmers will get a second chance to grab an interest in a big Western Australian lithium mine after Pilbara Minerals announced it would look to sell an interest in its Pilgangoora project.

Pilbara yesterday said it had appointed Macquarie Capital to scout for buyers for a minority stake in Pilgangoora.

A sale of a stake would bankroll the estimated $457 million needed for the second- and third-phase expansions of the mine, which would make Pilgangoora one of the largest mines of its type in the world.

Macquarie also ran the process late last year that saw Pilbara’s neighbour, Mineral Resources, secure a deal with US lithium giant Albemarle Corp. Under that deal, Albemarle bought a 50 per cent interest in Wodgina for $US1.15 billion ($1.6bn).

Sources confirmed to The Australian that Wesfarmers, which this week revealed it had approached rare earths producer Lynas Corp with a $1.5bn takeover offer, was an underbidder in that process and that it has also looked closely at a number of lithium projects both in Australia and overseas.

The conglomerate has shown through the Lynas approach an open interest in building an exposure to the new generation of minerals and chemicals central to the electric vehicle and new energy industries.

Pilbara managing director Ken Brinsden told The Australian the group had chosen Macquarie to lead the process given their recent record in the lithium space.

“Running with Macquarie as an adviser to a process like this makes sense because of the success that was generated in the Wodgina deal, and also the fact they are current in the market,” Mr Brinsden said.

“They understand who is expressing interest and their appetite to participate.”

A spokeswoman for Wesfarmers said the company did not comment on speculation.

The sale of a minority stake is also likely to appeal to Chinese parties, given the reduced likelihood of running into any Foreign Investment Review Board hurdles.

Many Australian lithium stocks are trading at or near two-year lows amid a cooling in lithium spot prices, but Mr Brinsden said interest in the supply chain from major end-users in projects and offtakes was still very strong.

“The strategics and the way they view the lithium-ion supply chain as compared to the price equity markets are putting on the value of those assets today are two different things, in which case it’s worthwhile exploring that option (a sale of a minority stake) as a really cost-effective means of continuing to fund the company,” he said.

The potential sale will exclude Pilbara’s agreement to explore the development of a downstream lithium processing plant in South Korean in joint venture with Korean giant Posco.

But the company is open to exploring the development of a second downstream plant with a new project partner, either in Australia or overseas.

The potential sales process overshadowed the release of mixed operational news from the project. Pilbara yesterday officially declared that Pilgangoora had achieved commercial production, but it noted that lithium recoveries from the mine have been below planned levels.

Lower than expected recoveries have been a persistent problem for Australia’s new lithium producers, and Mr Brinsden said it would take some time for the company to finetune and optimise the production process.

“Broadly we are on the right path but those hiccups have been frustrating,” he said.

“The good news is they’re well understood so we know why recovery has been impacted and ultimately how that impacts the overall production.

“For the most part we’ve been able to solve them pretty quickly,” he said.

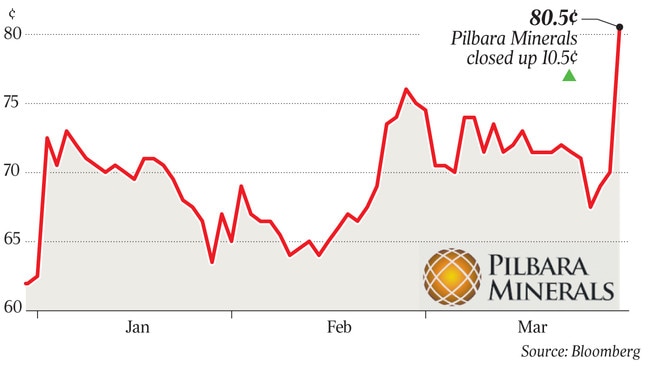

Shares in Pilbara jumped 15 per cent yesterday to 80.5 cents, making it the best performed stock in the ASX 200 index.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout