Jobs to go as Rio Tinto revs up driverless trucks plan

Rio is set to shed several hundred jobs in coming years as it accelerates the automation of its iron ore mines and railways.

Rio Tinto is set to eliminate several hundred jobs in coming years as it accelerates the long-planned automation of its West Australian iron ore mines and railways.

The potential job losses — revealed in an internal Rio briefing — are a key plank in the economics of Rio’s industry-leading autonomous mining program, which began in 2008 and is now entering an intensive uptake phase after a series of delays.

The notes, from late 2016, show the expected loss of 850 jobs over four years in which Rio targets a fourfold jump in its autonomous truck fleet to 325.

The expected job losses had since been reduced, Rio said yesterday, without revealing by how much. It said it would need more people to operate the autonomous system in Perth and on site than previously thought.

The acceleration of the driverless truck plans started this year and comes as BHP Billiton and Fortescue ramp up their own Pilbara driverless fleets, OZ Minerals targets a fully automated underground mine in South Australia and the mining sector, often seen as a technological laggard, drives change on a large scale.

Consultants Alpha Beta, in a draft of a soon-to-be-released report, estimate the potential for a $65 billion boost to annual mining value added by 2031 if the automation opportunity is fully grasped.

Rio’s expected job losses are contained in an internal briefing document, titled “Technology and Automation Strategy Today to 2030”.

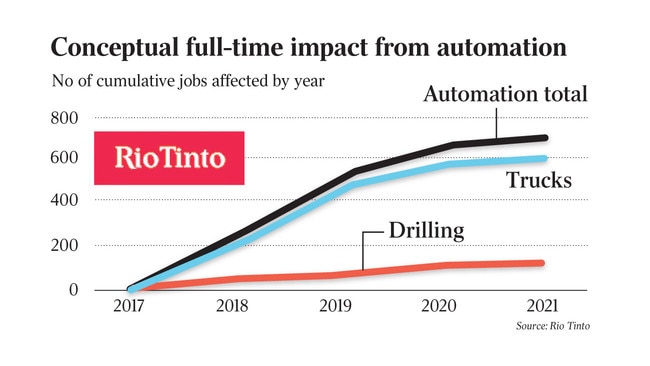

The briefing said about 600 full-time jobs (some of them future jobs) would be affected as it increased its driverless truck fleet from 77 to 325 over four years from 2017.

In the same period, Rio expected about 100 jobs to be affected by growth in autonomous drill rigs that plant explosives, while 140 jobs were expected to go as a result of the company’s AutoHaul program.

Yesterday, a Rio spokesman said the briefing numbers were indicative at the time and had changed with the company’s knowledge of automation.

“Automation and technology is clearly changing the way we work, including reducing the number of future roles for truck drivers, train drivers and drillers,” a spokesman said.

“We underestimated the success of our retraining, reskilling and redeployment efforts, as well as the number of new jobs that have been created to integrate automation into the iron ore business.”

In March, it was reported that up to 200 people at Rio’s Brockman 4 and Marandoo mines would lose their jobs by early next year because of the transition to automated trucks.

But it is understood Rio’s 12,000-strong iron ore workforce in Western Australia is internally forecast to remain steady as the automation program ramps up.

This is because projects such as the $US2.2bn ($2.8bn) Koodaideri project (expected to be approved this year, and slated to create 600 jobs) will offset the automation losses.

Yesterday, OZ Minerals chief (and former Rio executive) Andrew Cole said automation was planned at the company’s $916 million Carrapateena copper mine in South Australia.

“Our base case is to make our underground mine operation fully autonomous — so no people in the production at all,” Mr Cole said after a presentation to the Melbourne Mining Club.

“We already use automation in our mining operations. We have people sitting in Prominent Hill (OZ’s nearby flagship mine) now on surface in a small room operating boggers underground at 600m,” Mr Cole added.

Government-funded growth centres National Energy Resources Australia and METS Ignited have commissioned Alpha Beta to study the potential value of mining automation.

In a yet-to-be-released draft, Alpha Beta found there was $3bn of gross value added in 2017 from automation in the mining industry, according to NERA’s recently released 2018 sector competitiveness plan.

The annual value has the potential to grow to $33bn in 2025, as different vendors produce equipment and data that can operate together, and to $65bn in 2030-31 as open-source platforms allow more integration and equipment becomes capable of self-learning and making decisions without human input.

At the end of last year, Rio still had an autonomous fleet of 77, which was where it was in late 2016. This indicates the program stalled after Andrew Harding stepped down as iron ore boss in mid-2016 and was replaced by Chris Salisbury.

But it is now ramping up. In March, Rio said it expected to have 150 autonomous trucks in operation by the end of 2019, which the briefing notes reveal was a target previously set for 2018. It has not revealed its target beyond 2019.

In 2011, Rio had been targeting a fleet of 150 driverless trucks by the end of 2015.

The briefing refers to Rio chief executive Jean-Sebastien Jacques’ mantra of “value over volume”, saying automated equipment makes it easy to adjust iron ore production to suit the market. “Automated equipment facilitates quick reaction times to ramp production up and down,” the notes said.

In the briefing notes, Rio’s long-delayed AutoHaul driverless train project is forecast to deliver between $US60m and $US70m of annual savings, of which about $US48m is from job cuts.

But it is understood current modelling shows more drivers will be needed than previously thought, indicating a smaller than expected labour saving.

AutoHaul, approved in 2012, is expected to be completed this year at a cost $US940m, up from an original estimate of $US518m and three years later than originally scheduled.

The savings alone are not a great return on the cost.

But the value from AutoHaul will be more in the extra 20 million tonnes of iron ore each year that will be able to travel to the port thanks to fewer stops and starts and trains being able to travel closer to each other.