Iron ore price spike to drive household wealth higher: RBA

The recent spike in iron ore prices will fatten wallets and bolster Canberra’s coffers, tips RBA.

The Reserve Bank predicts that higher iron ore prices will boost the nominal incomes of Australians, as larger mining profits are returned to shareholders and as a lift in government revenue potentially increases public sector spending.

An increase in public sector revenue could boost GDP growth if spending flows through to consumption or investment, or is distributed and spent by other sectors in the economy, the RBA said in its August monetary policy statement.

A lift in household wealth due to the higher share prices of mining companies could support household consumption, with estimates suggesting that between a fifth and a quarter of the Australian iron ore mining industry is owned by households, the RBA said.

“Market expectations and guidance from mining firms suggest that much of the increase in profits could be returned to shareholders,” the statement said.

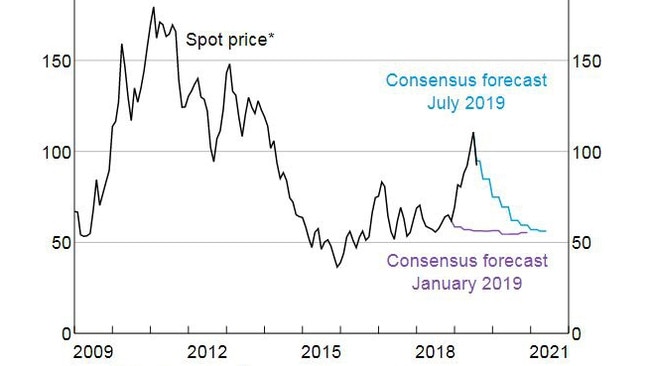

“Given the recent strength in prices, and assuming prices gradually decrease in line with the path suggested by market expectations, nominal household disposable income and government revenue combined could be around $5-to-10 billion higher each year on average over the next few years, relative to a scenario where prices had evolved as was expected in early 2019.”

Iron ore surged above $US120 a tonne in recent weeks after the spot price had been tracking higher since January in the wake of the deadly Vale mine disaster, which prompted the closure of some Brazilian mines and squeezed supply.

Brazil is the world’s second largest exporter of iron ore after Australia.

Iron ore had been trading at around $US75 a tonne in early January, prior to the dam disaster in Brazil.

The price was $US94.80 on Thursday night, up 2.2 per cent.

The RBA said today that demand for iron ore had been strong in recent months, as Chinese steel production had been increasing, although trade tensions were creating “significant” uncertainty for the global economic outlook.

Iron ore prices were expected to remain elevated over the near term but are tipped to gradually decline over coming years as global supply increases with the return of Brazilian capacity and as Chinese demand slowly eases, the RBA said.

While some of Brazil’s production has come back online recently, it could take up to three years for exports to return to their former capacity.

In 2018, Australia exported around $63bn worth of iron ore, accounting for around 15 per cent of total exports by value and equivalent to 3.3 per cent of nominal GDP.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout