Volatile energy policy hurting investment, says IFM

Australian energy policy is among the most volatile in the world, hurting investment plans, according to IFM Investors.

Australian energy policy is among the most volatile in the world, hurting investment plans needed to modernise the electricity market, according to one of the country’s biggest infrastructure managers, IFM Investors.

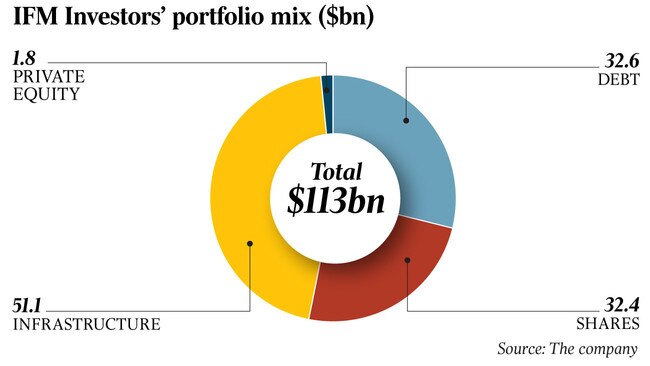

Michael Hanna, who helps oversee more than $50 billion of infrastructure assets at IFM, including a half-share of the NSW electricity distribution company Ausgrid, said demands for further cuts to network charges failed to take account of the significant cuts already made and the contribution of higher wholesale prices.

Mr Hanna’s comments come as The Australian this week revealed a group of six Queensland Nationals MPs had ignited energy tensions in the Coalition’s ranks, urging the Morrison government to revive legislation that would allow Canberra to seek orders divesting an energy company of its power generation assets — the so-called ‘‘big stick’’ rules.

Still, Scott Morrison made clear the big stick laws were not a priority for the final sitting week of parliament.

Ausgrid is attempting to finalise a five-year capital and operating expenditure agreement with the Australian Energy Regulator and has been battling a series of industry-wide moves including the loss of appeal rights and pressures to lower return on capital.

The federal government has also abandoned the National Energy Guarantee that was planned to guide industry-wide investment, floated and then shelved legislation allowing the Treasurer to break up energy companies that did not lower prices and adopted regulation to create a default price for household and business electricity bills.

“It is one of the most volatile countries for energy policy anywhere that we invest around the world,” Mr Hanna, the head of Australian infrastructure, told The Australian.

“It is fair to say that we have seen an increase in volatility, more uncertainty and it has been a distraction over the past nine to 12 months.” IFM Investors has been “short” electricity generators since 2014 when it sold the coveted Pacific Hydro business for a reported $3bn amid concern about the volatility of prices caused by a government review aimed at slashing the Renewable Energy Target.

But it has increased its exposure to distribution business, joining forces with AustralianSuper to pay $16.2bn for a controlling interest in the long-term lease for Ausgrid from the NSW government in 2016 after Chinese buyers were blocked.

While networks had been seen as a source of predictable, steadily rising returns, the industry has been under pressure since 2013 when the AER sought to slash the amount they could recover as a share of household and business electricity bills.

The AER ordered Ausgrid to slash its recoveries from customers by $3bn over five years — from $12.1bn it had proposed to $9.1bn that was agreed after court appeals.

Mr Hanna said Ausgrid was under pressure for further cuts from the middle of this year after already delivering a $237 saving in real terms to customers over its 2014-2018 agreement with the AER.

But he said the company also needed to undertake “careful investment” to maintain and upgrade the grid to accommodate a shift to decentralised generation — including a boom in rooftop solar installations — and a move to two-way flows of electricity as households pushed surplus generation into the grid in off-peak times and sucked it back out in the evening.

Under a revised proposal for 2019-24 Ausgrid had proposed cuts of 8.7 per cent but was being pressed by the AER for even more reductions.

The Australian Competition & Consumer Commission also proposed writing down the value of network assets, which would reduce the base on which network returns are calculated and feed through to lower household electricity prices.

“Of course it puts pressure on investment returns,” Mr Hanna said. “We would have wished for a better outcome or a more reasonable outcome.”

The regulatory crackdown is being felt across the sector, including listed companies AusNet and Spark Infrastructure, and the consortia of local and international funds that paid the former Baird NSW government more than $30bn for controlling interests in the TransGrid transmission network and the Ausgrid and Endeavour distribution networks.

Transmission networks are also facing demands for new investment such as interconnectors between the four mainland states and Tasmania and new infrastructure to support the Snowy 2.0 project that will add two gigawatts of pumped hydro generation to the national electricity market.

Mr Hanna said that he understood the pressure for cuts to electricity bills, but most of the recent increases in electricity bills had come from increased wholesale prices. Prices jumped in 2017 following the exit of old coal-fired generators such as Hazelwood and Northern and a trebling of prices for gas used to pick up the slack in generation capacity.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout