Iluka to spin off iron ore royalty following loss

Iluka shares have surged after it finally moved to spin off its iron ore royalty stream, simplifying a business that’s swung to a loss.

Iluka Resources shares jumped on Thursday after the company finally made a call to divest a lucrative iron ore royalty over a key BHP mining hub, saying it intends to spin its Mining Area C royalty out into a separate company.

The fate of the royalty has been the subject of investor pressure and debate for the better part of a decade, since the mining boom turned the MAC royalty into a serious earner for the mineral sands company.

Iluka collects a 1.232 per cent royalty from sales of iron ore from tenements within BHP’s Mining Area C hub, as well as a so-called annual capacity payment of $1m for every million tonne increase in exports from the area.

The move has the potential to unlock billions for Iluka shareholders, according to activist investors such as Sandon Capital, which have been campaigning for years for Iluka to separate the royalty from its mineral sands business.

Before-tax earnings on the royalty were worth $85m to Iluka last year, more than 60 per cent of its $140m free cash flow. Over the past six years Iluka has collected $380m from the royalty, according to its annual report, and close to $881m since mining began at MAC in 2003.

And payments will steadily mount in coming years as BHP builds its massive new South Flank mine to a planned 145 million tonne a year mining hub by 2023.

Iluka boss Tom O’Leary said a review of the future of the royalty had found a demerger of the royalty was the best way to unlock value for shareholders, with the company expected to complete the process of an in-specie distribution of shares in the new company to existing Iluka holders by the end of the year.

The tax office’s view of the spin-out has previously been seen as a potentially significant barrier to separating the royalty from the rest of Iluka’s operations, on the grounds a single royalty may not meet the Australian Taxation Office definition of a royalty company and could attract a substantial capital gains hit.

But Mr O’Leary said Iluka had done significant amount of work on that issue in the last few months, and was confident of a favourable ruling from the ATO.

“We’ve engaged with the ATO, together with our advisers, and that’s culminated this week in submitting a formal ruling application. We’re confident that the usual demerger relief will be granted. We expect to get a draft ruling prior to circulating a demerger booklet, so we’ve got plenty of time,” he said.

The spinout represents a major win for big shareholders on Iluka’s register who have been pushing for the separation, and particularly for activist holder Sandon Capital, which has been a major force agitating for the move since 2016.

As well as unlocking value for Iluka shareholders, Sandon has argued the MAC royalty offers a “crutch” to Iluka’s management, with the cash influx helping to hide weakness in its minerals sands businesses.

Sandon managing director Gabriel Radzyminski said the fund manager was “very pleased” with Iluka’s decision, saying it could help establish a new asset class on the stock exchange as similar vehicles — such as Franco-Nevada and Wheaton Precious Metals — have done in the US and Canadian markets.

“We’re very excited for prospects that RoyaltyCo offers as a separately listed entity. We’re also really excited for the prospects of mineral sands — Iluka is the pre-eminent in the mineral sands industry with all of its derivative products, and that shouldn’t be forgotten either,” he said.

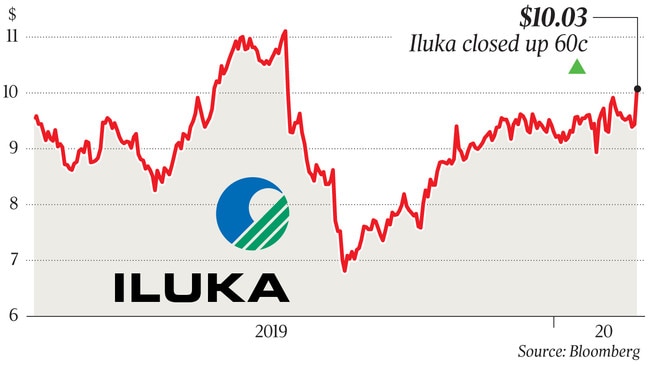

The market reacted well to Iluka’s announcement, sending shares in the miner up 60c or 6.4 per cent to a $10.03 close, despite issues elsewhere in the company’s business.

Iluka booked a statutory loss of $300m for the 2019 full-year, after a $414m writedown of its Sierra Rutile mineral sands mine, and a $162m writedown of associated deferred tax assets.

Iluka also told the market it faced further issues with community unrest around the mine, which forced another short-term halt to its operations on Thursday night.

Leaving aside the asset impairments, Mr O’Leary said the company had delivered an underlying after-tax profit of $279m, $22m short of the 2018 result.

Underlying earnings before interest, tax, depreciation and amortisation of $616m were up 2 per cent on 2018.

Mr O’Leary said the outlook for Iluka’s mineral sands business was solid, despite uncertainty around the impact of the coronavirus crisis in China.

“We very pleased with the first stage of the US-China trade deal and some clarity around Brexit, but we’re all confronted with uncertain spectre of what the impact of the virus will be,” he said.

He said inventory levels of Iluka customers in China and elsewhere were running very low, however, suggesting the end of the crisis would lead to a quick rebound in Iluka’s key markets.

“So when we are getting orders customers are wanting them filled quickly. So to the extent there’s some stimulus that some have speculated about at the back of this issue, then it may have pretty significant pick-up for us in zircon,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout