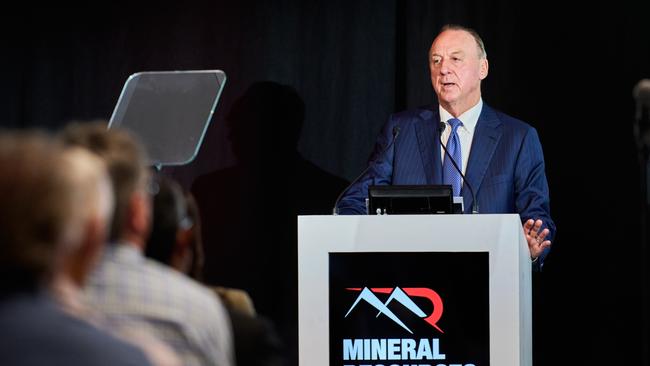

Hesta superannuation fund sells out of MinRes after Chris Ellison scandal and board exits

Industry superannuation fund Hesta has sold its remaining shares in Mineral Resources and cast doubt on the scandal-plagued company’s capacity to clean up its act.

Industry superannuation fund Hesta has sold its remaining shares in Mineral Resources and cast doubt on the scandal-plagued company’s capacity to clean up its act as it closes in on the appointment of a new chairman and board members.

Hesta said it had concerns MinRes might be unable to make the changes it believes are necessary to restore investor confidence.

The $90bn fund’s move follows the exit of three MinRes directors who were part of the ethics and governance committee set up by the company last November.

MinRes non-executive director Denise McComish quit the board late last month, a week after Jacqueline McGill and Susie Corlett resigned.

The three women formed the ethics and governance committee assembled as MinRes grappled with an investigation by the Australian Securities & Investments Commission over a tax evasion scheme, disclosure standards, related party transactions and other scandals involving managing director Chris Ellison.

Their departures have left the board light on for mining experience and suggest division within its ranks.

It also reduces the board to just six directors, including departing chair James McClements and Mr Ellison.

MinRes has said it will name a new chair from outside the company to replace Mr McClements before June 30. Mr Ellison has agreed to exit as managing director by April next year despite a rearguard campaign from some shareholders appealing for the company’s co-founder to stay.

It is understood an announcement on the new chair is imminent.

Hesta wants Mr Ellison out the door sooner rather than later, and said any re-inclusion of the stock in its portfolio would be contingent on “demonstrated pathway to address our serious governance concerns, an effective mechanism to prevent similar issues occurring in future, and a timely and orderly succession of the managing director”.

Hesta placed MinRes on its watchlist last October and sold part of its then 0.8 per cent stake after deciding it wasn’t taking appropriate action to tackle demonstrated governance issues.

Its statement comes after it sold its remaining $14m of MinRes stock.

Hesta chief executive Debby Blakey said the departure of the three directors last month was a big step backwards for the diversified mining services provider and iron ore and lithium producer.

“Last year we outlined our concerns that the managing director’s succession timeframe did not reflect the seriousness of the issues, and the issues indicated a systemic failure of governance,” she said.

“We have since regularly engaged with senior leaders and directors at the business to encourage action we believe necessary to restore investor confidence.

“The departures of the directors on the ethics and governance committee last month in our view represented a significant step backwards in seeking to address the serious governance concerns. Given these departures and the forthcoming succession of the chair, we don’t currently see a path to our concerns being addressed.”

Ms Blakey said selling the remaining holding was in their best interests of members.

In mid-February, MinRes released a statement saying the ethics and governance committee had reviewed governance issues and the board did not intend to take any further action against Mr Ellison.

“Mr Ellison has given assurances to the board that he never intended to obtain personal gain at the expense of the company and its shareholders. Mr Ellison has now paid the financial penalty of $3,790,607 announced previously,” MinRes said at the time.

The Australian revealed last month that the company was at war with oil and gas giant Chevron and the WA government over shipping levies on every tonne of iron ore it exports from the Port of Ashburton in WA.

MinRes said it opted to not disclose the levies or a legal dispute over payment to the market because it considered the charges invalid. It has launched legal action against the WA government’s Pilbara Ports, which is pursuing MinRes for non-payment of the levies.

Hesta’s watchlist includes WiseTech and oil and gas producers Woodside Energy and Santos.

The fund last week voted against two out of four resolutions and abstained on another at a protest-plagued Woodside annual general meeting in Perth.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout